GET INSTANT ACCESS

JOIN THE DISCUSSION

Overview

One of the highest-rated stock trading courses in the penny stock community, Tim Grittani’s Trading Tickers is an in-depth video training course that details the day trading system Timothy Sykes’ #1 student used to turn $1,500 into 10 million dollars in just a few short years.

Chock-full of high-level content that requires a commitment of study time to fully absorb and put into practice, Trading Tickers includes 8 DVDs (the course is delivered digitally though) and a total of 28 hours and 12 minutes of teaching:

- Disc 1 (4 hours, 1 min)

- Disc 2 (8 hours, 33 mins)

- Disc 3 (3 hours, 47 mins)

- Disc 4 (1 hour, 53 mins)

- Disc 5 (2 hours, 15 mins)

- Disc 6 (2 hours, 25 mins)

- Disc 7 (2 hours, 30 mins)

- Disc 8 (2 hours, 45 mins)

This course is well-organized and neatly broken down into chapters. In addition to learning the ins and outs of the trading method that’s made Grittani a millionaire, you’ll also have an opportunity to watch over his shoulder with the several hours of live trading footage that are included.

UPDATE: In 2021, Tim also released a second installment of Trading Tickers. Read our in-depth Trading Tickers 2 review for more info.

Trading Tickers Course Details

| Creator | Tim Grittani |

| Publisher | Grittani Trading Education Corp. |

| Formats | Digital (streaming video) |

| Discs | 8 |

| Runtime | 28 hours, 12 mins |

| Price | Click Here |

About Tim Grittani

Born into a middle-class Chicago family, Tim Grittani has always possessed an entrepreneurial spirit. Over the years, he’s been a student of statistics and probabilities, gaining some experience in the world of poker and sports betting before finally discovering the world of trading.

In his final year of college at Marquette University, Grittani began to learn about stock trading. In 2010, he opened his first $500 brokerage account at Sharebuilder and officially began his trading journey. Shortly thereafter in February of 2011, Grittani stumbled onto an ad for one of Tim Sykes’ trading courses and began to learn how to trade penny stocks.

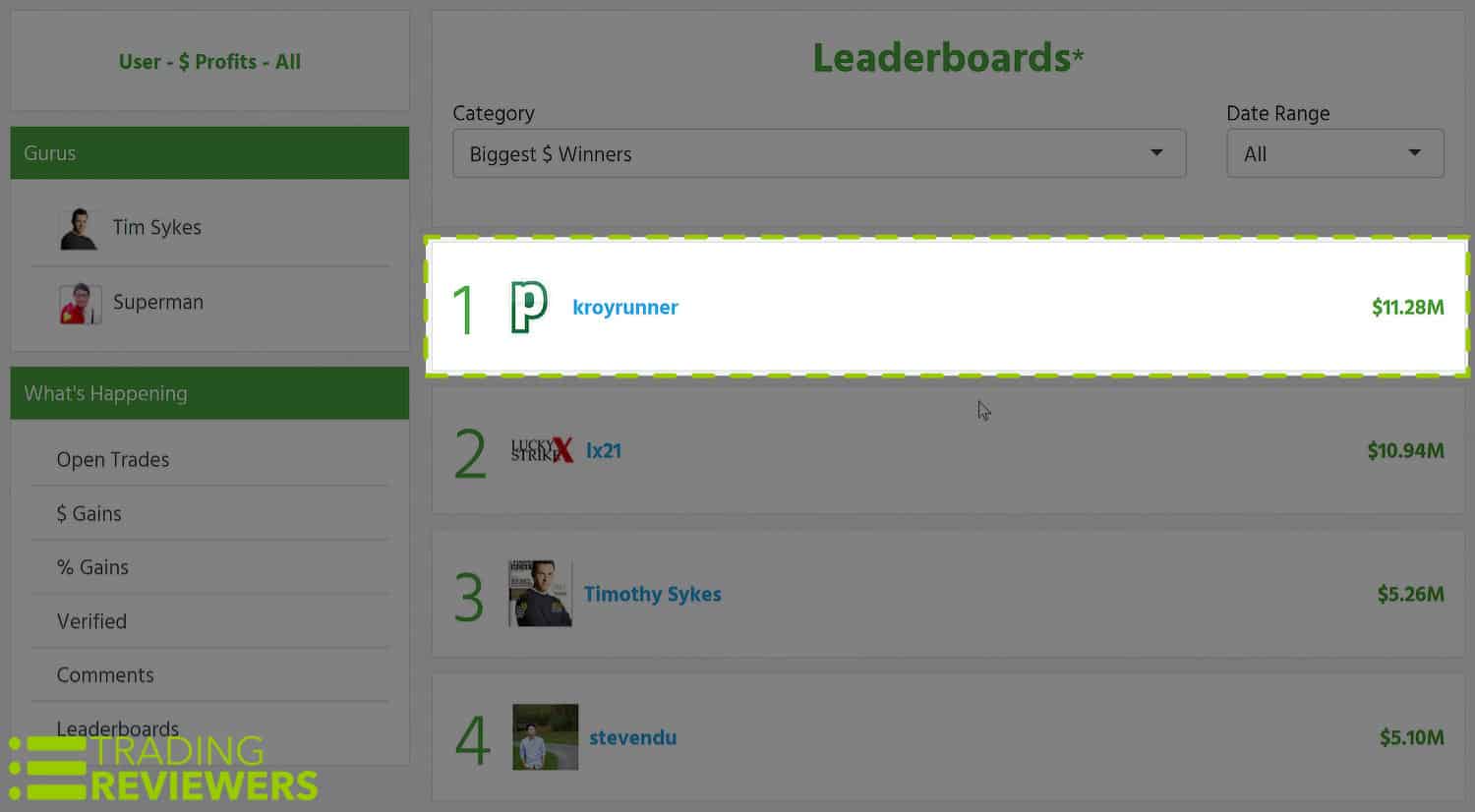

After several months of study, Grittani opened a Thinkorswim account with $1,500 and began to trade live. To date, he has turned that initial $1,500 brokerage deposit into more than 11 million dollars and has been featured on CNN, Fox News, CNBC, and other high-profile media outlets as one of today’s top traders. Grittani is also the #1 ranked trader on Profitly (username kroyrunner).

What You'll Learn in Trading Tickers

In Trading Tickers, Tim Grittani explains his highly-profitable penny stock trading system in great detail, revealing exactly how he scans the market each day to find the best penny stocks to trade, his entry and exit rules for both long and short positions, his favorite chart setups, and more.

Below is a breakdown of all the chapters included in the course along with a basic overview of what you’ll learn in each one…

Chapter 1 (Disc 1): Introduction and History

In this first chapter of Trading Tickers, Grittani gives an introduction to the course and provides some basic background on his personal life and trading journey.

Chapter 2 (Disc 1): Important Beginner Basics

Chapter 2 provides a brief overview of some basics such as how to read a stock quote, terms like bid/ask/spread, market hours, premarket trading basics, order types, basic trader lingo, how Grittani locates shares to short, computer setups, account building 101, and brokerage commissions. Grittani advises that it’s best to stick to volatile setups and focus on only one or two in the beginning until you find success and consistency. Scale up size only on the very best setups. He also discusses some of the emotional struggles experienced by traders and how to overcome them, day trading rules and regulations, tips for opening a brokerage account, recommended broker platforms, and the best desktop applications.

Chapter 3 (Disc 1): Basics to My Trading Strategies

In this chapter, Tim dives into the basics of his trading strategies. He covers general technical analysis information, why volatility is critical, risk management, level 2, OTC vs. listed stocks, and more.

Chapter 4 (Disc 1): Educational Services and Daily Preparation

Chapter 4 discusses useful chat rooms and services, different methods used to find stocks, how to scan for trades with stock scanners, watchlists, intraday scanning, stock promotion emails, and Excel spreadsheet tracking. In this chapter, there are also interviews with mentor Tim Sykes as well as Nathan Michaud and Cam from Investors Underground. IU is one of the largest day trading communities online and Grittani has been a member for several years — for more details on the community, check out our in-depth Investors Underground review (we also share a special promo code that’ll save you a ton of money on your membership).

Chapter 5 (Disc 2): Buying New Stock Promotions

Grittani lays out his strategy overview for buying stocks that are being promoted. The goal is to trade profitably off of a predictable spike. Also covered are some great tips on how to find stock promoter email lists and there are several trade examples included. (tickers covered: $AMMG, $PGLO, $TGRO, $WPWR, $PGFY, $ALKM, $ECRY, $TLPY, $COLV, $GLRKF, $MEDA, $AMLH)

Chapter 6 (Disc 2): Buying OTC Multi-day Breakouts

In chapter 6, Tim teaches his strategy for buying multi-day OTC stock breakouts. Covered in this section of the course are his rules, how to properly handle missed breakouts, the importance of being patient and sitting tight while allowing a breakout to develop, and overnight halts. (penny stocks covered: $COCP, $ECRY, $HEMP, $MJNA, $PGLO, $PVCT, $TGRO, $BIZM, $FNMA, $AERN, $POTG, $CRWV, $AEMD, $NVIV, $ECIG)

Chapter 7 (Disc 2): OTC Short Setups

In this chapter, you’ll learn about profitable short OTC chart setups. Tim covers overextended daily charts, momentum shifts, green to red breakdowns, how to short bounces, picking spots to risk off of, identifying support levels, and more. In this section, he includes examples of where things didn’t go as planned and the importance of not being stubborn. (OTC stocks covered: $HEMP, $PVCT, $MDBX, $GRNH, $WSTI, $FNMA, $THCZ, $ECRY, $GTATQ, $AEMD, $AXMM, $CTIX)

Chapter 8 (Disc 2): Buying Major Daily Breakouts

For this trading strategy, Grittani focuses on buying daily breakouts for listed stocks. He looks to identify major resistance levels that have held for two or more days while avoiding big overhead resistance. Volume is also a major indicator that he watches when buying breakouts. Ideally, you want to see big moves on good news, a couple days of consolidation, and a subsequent breakout resulting in a second leg up. Tim recommends buying dips and warns against chasing, risking off of previous support levels, not the breakout level. (tickers covered: $CANF, $RADA, $DGLY, $ROSG, $CUBA, $VGGL, $ARRY, $CYTX, $GENE, $VLTC)

Chapter 9 (Disc 3): Shorting Lower Highs into Spikes

Being that stocks typically pullback and consolidate instead of running straight up, Grittani often puts on shorts into spikes and covers into pulls. In this chapter, he also provides specific rules for entries and exits. (tickers covered: $VLTC, $ARNA, $NDRM, $VGGL)

Chapter 10 (Disc 3): Shorting into Daily Resistance

This chapter lays out Tim’s strategy of putting on shorts into daily areas of resistance. After identifying areas of resistance, he scales in shorts and then covers into fades. (tickers covered: $RADA, $CANF, $DGLY, $ABIO, $MCP, $VGGL, $GENE, $NYMX, $BIOC)

Chapter 11 (Disc 3): Shorting Overextended Gap Downs

In chapter 11 of the DVD, you’ll learn how to short stocks that are overextended and have gone for several consecutive green days without red. Tim focuses on names that are up a lot from where the run initially began and once things turn red, there’s a major momentum shift that really brings out the sellers. He also warns against the notion that the first red day necessarily means that the move is over. It’s critical to stick to your risk levels and cut quickly if things move against you. The major focus in this section is on playing gap down days, putting on shorts into an early morning push and risking off of the previous day’s close (r/g). (tickers covered: $CDTI, $FRO, $CUBA, $IBIO, $YOD, $LAKE, $FXCM, $BCLI, $GENE, $NYMX, $RADA, $ANV)

Chapter 12 (Disc 3): Shorting into Bounces

Another favorite trading strategy of Tim is strategically shorting bounces into previously established resistance levels on red days. It’s important to strictly enforce risk levels and be disciplined when it comes to cutting losses as short squeezes can result in powerful moves to the upside. Unfortunately, many new traders make the fatal mistake of refusing to cut a loss and they blow up their trading account in the process. (tickers covered: $FRO, $ANV, $ARNA)

Chapters 4-13: Live Trading Sessions

In the remaining lessons, Tim shares several live trading sessions that allow you to look over his shoulder in real-time as he trades. Lots of great knowledge and helpful commentary during these videos and they give great insight into his thought process throughout the day as he’s taking and managing positions.

Reader Reviews

The best…

The best.

Exceptional DVD…

Exceptional DVD. I just started trading and was recommended to view this. Its 28 hours of content which is very well put together to ensure that you get a good understanding on trading. Thanks Tim.

Grittani has a proven track record and is…

This course thoroughly lays out Grittani’s trading system and provides plenty of insight into his mindset and decision making process. The numerous trade reviews and live trading examples are also incredibly helpful as they show you what he does right as well as mistakes made (which are critical lessons to learn from as they will save you a lot of money and headaches). Grittani has a proven track record and is extremely talented at what he does – this course is highly recommended for the trader who has a similar approach and the time to fully digest and implement what is presented.

Submit a Review

Have you gone through Tim Grittani’s Trading Tickers DVD course? If so, please let other traders know what you think about it…

Tim Grittani Video Interview

Trading Tickers FAQs

While Trading Tickers isn't cheap, this course packs an incredible amount of value and the price is well worth it if you invest the time needed to learn Tim's patterns, rules, and trading mindset. This is a top-shelf stock trading course that shares everything you need to know, however people still need to realize that it takes work and dedication to learn and apply the strategies shared.

Tim is well-known in the day trader community and he has posted his account performance publicly for all to follow. When it comes to trading gurus, Tim is the real deal.

Since getting his start several years ago with a few of Timothy Sykes' DVD courses and $1,500, Grittani has racked up over 10 million dollars in returns.

Final Thoughts

Pros

Well-organized, very high-level content, nothing held back, helpful trade examples and live trading videos, instant access

Cons

Expensive, requires significant time commitment to complete (28+ hours)

Best For?

New traders who are just getting started as well as more experienced traders who are looking for more edge