CHECK PRICE OR BUY NOW

JOIN THE DISCUSSION

Overview

One of the very best books available on the topic of stock trading, How to Make Money in Stocks: A Winning System in Good Times or Bad by IBD’s William J. O’Neil should be mandatory reading for any serious trader or investor. This book lays out the author’s high-performance CAN SLIM system in great detail, providing readers with all of the essentials needed to achieve above-average gains in the stock market. If you’re in search of a proven methodology that has the potential to produce big gains, this book is a must-own.

Book Details

| Author | William J. O’Neil |

| Publisher | McGraw-Hill |

| Formats | Paperback, Kindle |

| Pages | 464 |

| Dimensions | 5.6″ x 0.9″ x 8.9″ |

| Published | 2009 (Fourth Edition) |

| ISBN-10 | 0071614133 |

| ISBN-13 | 978-0071614139 |

| Price | Click Here |

About William J. O'Neil

Founder of Investor’s Business Daily, William J. O’Neil is the creator of the popular CAN SLIM investment strategy and author of several best-sellers, including How to Make Money in Stocks, The Successful Investor, and 24 Essential Lessons for Investment Success. Born on March 25, 1933 in Oklahoma City, OK, O’Neil was raised in Texas and eventually went on to receive a bachelor’s degree in business from Southern Methodist University. In the early days of his financial career, he worked as a retail broker and then purchased a seat on the NYSE at the age of 30. After many years of using computers to compile investment research databases, he started IBD as a competitor to The Wall Street Journal.

What You'll Learn

How to Make Money in Stocks provides a detailed, step-by-step breakdown of O’Neil’s well-known CAN SLIM investment system. O’Neil’s methodology has influenced some of today’s top traders, including Mark Minervini, David Ryan, and many more.

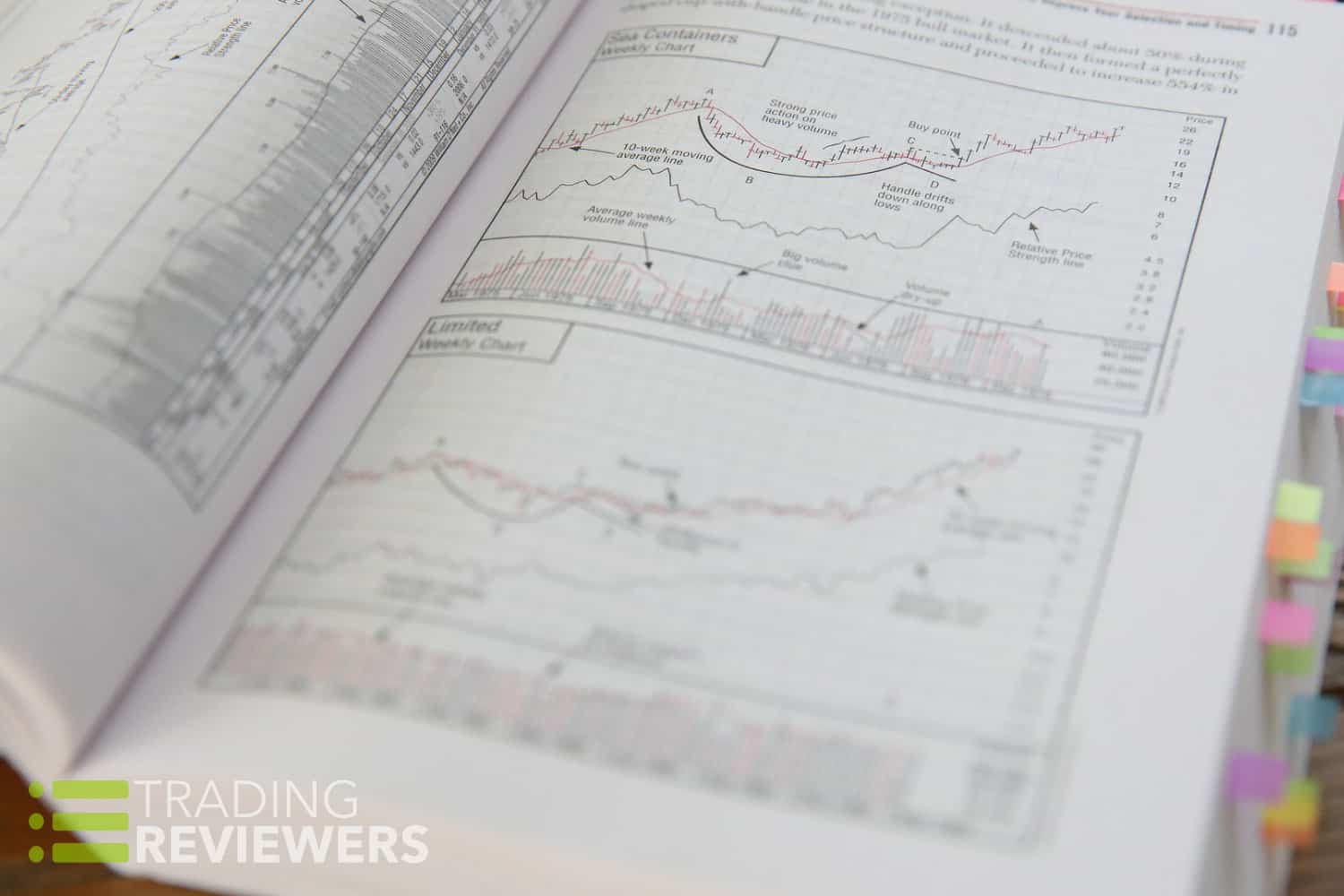

In addition to learning the ins and outs of O’Neil’s CAN SLIM strategy, we also love the fact that there are well over 100 charts in the book with detailed notes which provide valuable insight into price and volume action, basing patterns, and identifying market tops.

Chapter 1: "America's Greatest Stock-Picking Secrets"

“It is the unique combination of your finding stocks with big increases in sales, earnings and return on equity plus strong chart patterns revealing institutional buying that together will materially improve your stock selection and timing.” (page 9)

In the opening chapter of How to Make Money in Stocks, William J. O’Neil provides the reader with 100 charts of the best-performing stocks from 1880 to 2009. These charts are incredibly helpful and should be studied over and over again if you truly want to become better at both buying and selling stocks.

Chapter 2: "How to Read Charts Like a Pro and Improve Your Selection and Timing"

“Fortunes are made every year by those who take the time to learn to interpret charts properly.” (page 111)

In chapter two, O’Neil discusses the importance of charting stocks because history often repeats itself. He also outlines key price patterns to look for including:

- Cup patterns

- Saucer-with-handle

- Double bottoms

- Basing patterns

You’ll also learn several faulty setup warning signs to be on the lookout for.

Chapter 3: "C = Current Big or Accelerating Quarterly Earnings and Sales per Share"

“Following the CAN SLIM strategy’s emphasis on earnings ensures that an investor will always be led to the strongest stocks in any market cycle, regardless of any temporary, highly speculative ‘bubbles’ or euphoria.” (page 154)

In chapter three, you’ll begin to dive into the CAN SLIM strategy. In addition to technicals, this method places a strong emphasis on company fundamentals and O’Neil breaks down the most important things to watch for including EPS (Earnings Per Share) increases, outstanding management, and sales growth.

Chapter 4: "A = Annual Earnings Increases: Look for Big Growth"

“It’s the combination of strong earnings in the last several quarters plus a record of solid growth in recent years that creates a superb stock.” (page 162)

If your goal is to correctly spot stocks capable of delivering superperformance, it’s vital to take note of a company’s annual earnings growth rate. Also discussed in this chapter is the fact that P/E ratios are overrated and misused.

Chapter 5: "N = Newer Companies, New Products, New Management, New Highs Off Properly Formed Chart Bases"

“It takes something new to produce a startling advance in the price of a stock.” (page 171)

In chapter five, you’ll learn about the various catalysts needed for big returns. O’Neil also explains the importance of looking beyond the traditional “buy low, sell high” mentality and focusing instead on “buying high and selling higher” after a stock has completed a healthy basing pattern.

Chapter 6: "S = Supply and Demand: Big Volume Demand at Key Points"

“…if you’re choosing between two stocks to buy, one with 5 billion shares outstanding and the other with 50 million, the smaller one will usually be the better performer, if other factors are equal.” (page 180)

Chapter six covers the importance of supply and demand as well as insider buying, low corporate debt-to-equity ratios, and the potential danger of stock splits.

Chapter 7: "L = Leader or Laggard: Which is Your Stock?"

“If you own a portfolio of stocks, you must learn to sell the worst performers first and keep the best a little longer.” (page 188)

In chapter 7, William J. O’Neil explains why it is critical to focus on buying the strongest stocks in the best performing industries. He only buys stocks that have a high Investor’s Business Daily Relative Price Strength rating (RS) and describes how he identifies the market’s next wave of super stocks after a correction.

Chapter 8: "I = Institutional Sponsorship"

“…buy only those stocks that have at least a few institutional sponsors with better-than-average recent performance records and that have added institutional owners in recent quarters.” (page 198)

Institutional support is a major key when it comes to price appreciation in a name and chapter nine explains the specific criteria that O’Neil looks for when it comes to mutual fund, hedge fund, and other institutional buying. Also discussed is why too much institutional interest can be a negative for a stock.

Chapter 9: "M = Market Direction: How You Can Determine It"

“…in your analytical tool kit, you absolutely must have a proven, reliable method to accurately determine whether you’re in a bull (uptrending) market or a bear (downtrending) market.” (page 199)

In chapter nine, you’ll learn about O’Neil’s method for anticipating market direction and why it is so important to master if you want to reduce your amount of losing trades. He discusses how to protect yourself from major market downturns, stop-loss orders, identifying major tops in the market, and how to spot bottoms for a correctly timed reentry.

Chapter 10: "When You Must Sell and Cut Every Loss... Without Exception"

“The whole secret to winning big in the stock market is not to be right all the time, but to lose the least amount possible when you’re wrong.” (page 240)

Cutting losses short is a huge part of becoming consistently profitable. In chapter 10, you’ll learn exactly when to take a loss and why it is critical to maintain strict discipline in this area.

Chapter 11: "When to Sell and Take Your Worthwhile Profits"

“If you don’t sell early, you’ll be late. Your object is to make and take significant gains and not get excited, optimistic, greedy, or emotionally carried away as your stock’s advance gets stronger.” (page 254)

Knowing when to book profits is one of the most important aspects of trading, yet it is one that many traders seldom handle correctly. In this chapter, you’ll discover why it’s vital to develop a profit-and-loss plan, whether pyramiding is something that you should implement, major technical sell signs to be on the lookout for as your stock is going higher, and the importance of being patient.

Chapter 12: "Money Management: Should You Diversify, Invest for the Long Haul, Use Margin, Sell Short, or Buy Options, IPOs, Tax Shelters, Nasdaq Stocks, Foreign Stocks, Bonds, or Other Assets?"

“…diversification is good, but don’t overdiversify. Concentrate on a smaller list of well-selected stocks, and let the market help you determine how long each of them should be held.” (page 301)

In chapter twelve, a wide variety of topics are discussed including diversification, buy-and-hold strategies, day trading, IPOs, options, and other popular asset classes.

Chapter 13: "Twenty-One Costly Common Mistakes Investors Make"

“By far the greatest mistake 98% of all investors make is never spending time trying to learn where they made their mistakes in buying and selling (or not selling) stock and what they must stop doing and start doing to become more successful.” (page 302)

Trading is a skill that is developed over time and requires one to weed out bad habits to be consistently profitable. In chapter thirteen, O’Neil dives into twenty-one of the biggest mistakes he’s seen traders make over the years.

Chapter 14: "More Models of Great Stock Market Winners"

“If you think you’re just looking at a bunch of charts, think again. What you are seeing are pictures of the price accumulation patterns of the greatest winning stocks—just before their enormous price moves began.” (page 315)

Chapter fourteen presents more CAN SLIM success stories as well as profitable chart patterns to study. This is a very helpful chapter that should be carefully studied as it provides key price patterns to be aware of.

Chapter 15: "Picking the Best Market Themes, Sectors, and Industry Groups"

“The majority of leading stocks are usually in leading industries. Studies show that 37% of a stock’s price movement is directly tied to the performance of the industry group the stock is in. Another 12% is due to strength in its over-all sector. Therefore, roughly half of a stock’s move is driven by the strength of its respective group.” (page 323)

Investor’s Business Daily gives you access to an incredible amount of useful data, and in chapter fifteen, you’ll learn how to use IBD to quickly identify the strongest market sectors, industry groups, and individual names.

Chapter 16: "How I Use IBD to Find Potential Winning Stocks"

“IBD’s entire focus is on solid database research and extensive historical model building to serve as examples—facts, not personal opinions.” (page 341)

Chapter sixteen continues to focus on Investor’s Business Daily and provides more compelling reasons to consider subscribing. O’Neil walks you through a number of the newspaper’s features and also provides a detailed outline of how he uses it daily. Investors.com, the online companion to IBD, is also highlighted in this chapter.

Chapter 17: "Watching the Market and Reacting to News"

“Bernard Baruch stressed the importance of separating the facts of a situation from tips, ‘inside dope’, and wishful thinking. One of his rules was to beware of barbers, beauticians, waiters, or anyone else bearing such gifts.” (page 383)

In chapter seventeen, O’Neil discusses the dangers of listening to financial television networks, stock tips, and the rumor mill. The best traders stay the course and avoid getting sidetracked by noise and emotional traps. Also covered is the importance of keeping a journal detailing the market’s reactions to various news events.

Chapter 18: "How You Could Make Your Million Owning Mutual Funds"

“Mutual funds are outstanding investment vehicles if you learn how to use them correctly. However, many investors don’t understand how to manage them to their advantage.” (page 393)

In this chapter, mutual funds are discussed and O’Neil shares his thoughts on the best time to buy them, how many to own, open- vs closed-end funds, loads, fees, and more. He also breaks down the five most common pitfalls that mutual fund investors fall into and wraps the chapter up with some brief info on ETFs.

Chapter 19: "Institutional Portfolio Ideas"

“…I believe it’s a mistake for institutions to restrict their investments solely to large-cap companies. In the first place, there definitely aren’t enough outstanding ones to invest in at any given time. Why buy a slow-performing stock just because you can easily acquire a lot of it? Whey buy big-caps with earnings growing only 10% to 12% a year?” (page 411)

In chapter nineteen, O’Neil covers the topic of institutional investing and some of the challenges that are typically encountered.

Chapter 20: "Important Time-Tested Proven Rules and Guidelines to Remember"

“You can definitely become financially independent once you learn to save and invest properly. But you first have to get serious and make up your mind to work at it and never let yourself get discouraged, regardless of circumstances.” (page 427)

In this final chapter, you’re provided with a helpful list of bullet points that are quick and easy to review. This is a great chapter to regularly go over as it provides important trading rules and guidelines that will help you to maintain proper focus and discipline.

Reader Reviews

If you’re tired of lackluster returns…

A must-read book for any serious trader or investor. William J. O’Neil lays out an incredibly powerful system for achieving above-average market returns while minimizing drawdowns and it’s an easily duplicatable method with a proven track record. If you’re tired of lackluster returns and aren’t afraid to roll up your sleeves and do some work, How to Make Money in Stocks will provide you with a solid blueprint for success.

Submit a Review

Have you read William J. O’Neil’s How to Make Money in Stocks? If so, let other traders know what you think about it…

How to Make Money in Stocks PDF & Audiobook

Currently, William J. O'Neil's How to Make Money in Stocks is not available in PDF or audiobook format. However, there is a Kindle version of the book available for instant download here.

Video

Final Thoughts

Pros

Incredible value, proven system for making large returns, well-defined rules

Cons

Will take several reads to fully digest and internalize the concepts laid out

Best For?

Beginning to advanced investors/traders, those in search of higher returns