CHECK PRICE OR BUY NOW

JOIN THE DISCUSSION

Overview

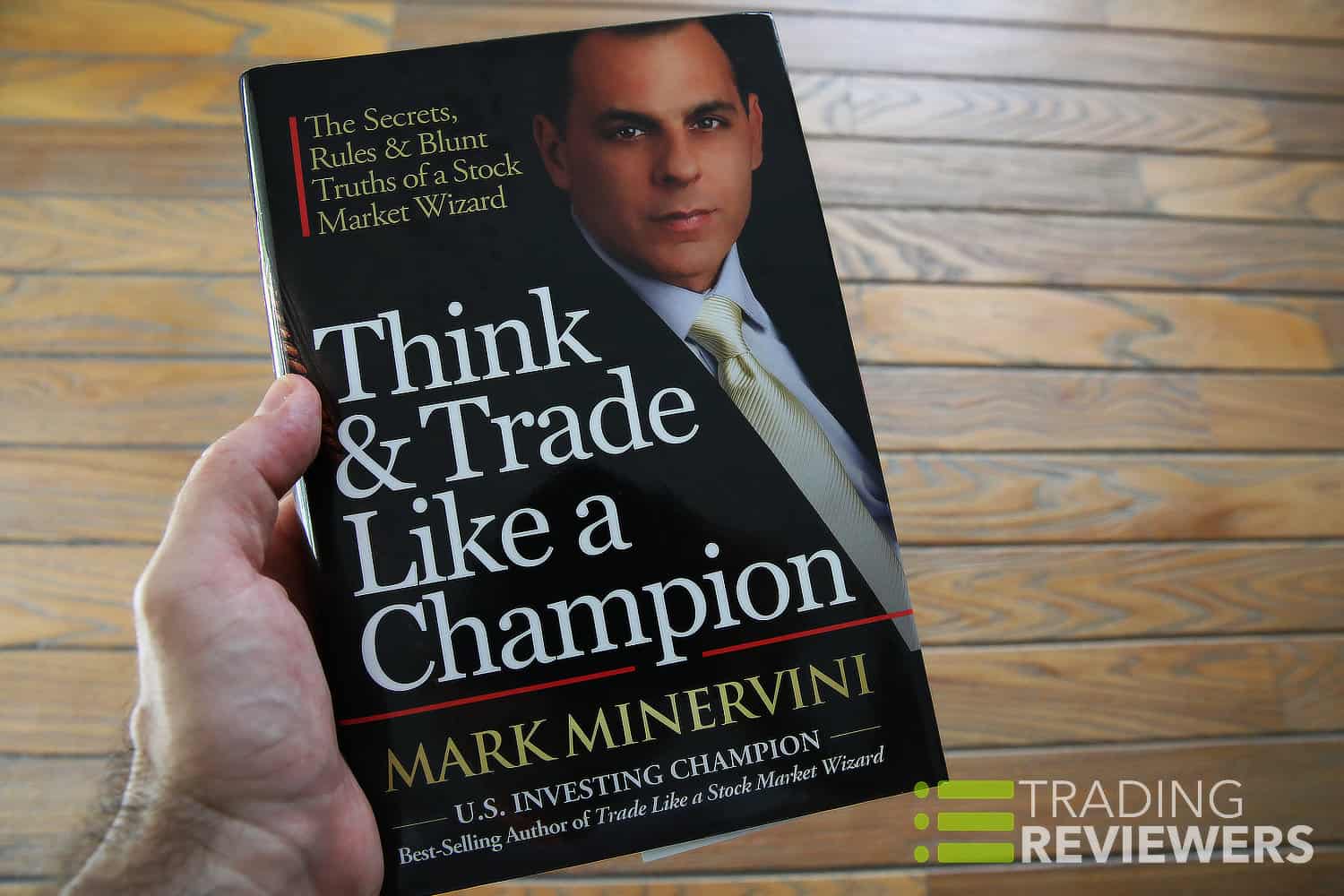

A follow-up to Mark Minervini’s popular Trade Like a Stock Market Wizard, Think & Trade Like a Champion takes a deeper dive into the author’s SEPA trading strategy that’s been responsible for year after year of triple-digit returns. Chock-full of valuable trading advice that Minervini has picked up during his 30+ years of trading, Think & Trade Like a Champion is one of the best stock trading books available and highly recommended for new and experienced traders alike.

Book Details

| Author | Mark Minervini |

| Publisher | Access Publishing Group, LLC |

| Formats | Hardcover, Kindle |

| Pages | 256 |

| Dimensions | 10.6″ x 7.6″ x 1.2″ |

| Published | 2017 (Third Edition) |

| ISBN-10 | 0996307931 |

| ISBN-13 | 978-0996307932 |

| Price | Click Here |

About Mark Minervini

Well-known as one of today’s most successful stock traders and a seasoned Wall Street veteran with more than 30 years of experience, Mark Minervini is truly a trader’s trader. Winner of the 1997 U.S. Investing Championship with a 155% annual return, Minervini has rightfully earned a reputation for being one of the industry’s top trading educators.

In addition to authoring several best-selling books, Minervini also runs Minervini Private Access which provides ongoing training, support, and trading education. For more details on this exclusive private trading community, read our in-depth Minervini Private Access review.

What You'll Learn

Well-deserving of a spot on every serious trader’s bookshelf, Think & Trade Like a Champion is an invaluable resource on everything from trading psychology, risk management, stock selection, and much more. Inside, Minervini details his proven methodology for uncovering some of the market’s biggest winners as well as his secrets for avoiding big drawdowns.

Listed below is an outline of the book’s chapters, a summary of what’s covered in them, and some of our favorite quotes.

Chapter 1: "Always Go In With a Plan"

“You won’t be able to manage your strategy—buy here, sell there, hold for a larger profit—unless you have a detailed blueprint that includes confirmation signals that a trade is working as expected, and violations you will heed as warnings and act accordingly.” (page 42)

In the opening chapter of Think & Trade Like a Champion, Mark Minervini discusses the importance of executing a well-though-out trading plan and details the key elements needed for being consistently profitable.

Chapter 2: "Approach Every Trade Risk-First"

“Taking a ‘risk-first’ approach means I understand the risk inherent in every trade and I prepare for the unthinkable. If you want big stock returns, you must consider the amount of risk you’re willing to take, and have a predetermined exit plan to protect your account from a large loss.” (page 44)

In chapter two, Minervini drives home the importance of risk-management and discusses optimal stop loss placement, properly managing the things you have control over, and the reason why all undisciplined traders eventually wash out.

Chapter 3: "Never Risk More Than You Expect to Gain"

“Most people are surprised when I tell them I would rather be able to maintain profitability at a 25 percent batting average than a 75 percent batting average. Why? Because it allows me to be wrong many times and still make money; it builds ‘failure’ into the system. I try to build as much failure as possible into my trading in the areas that I don’t have direct control over.” (page 57)

In the third chapter of Think & Trade Like a Champion, you’ll learn more about stop loss placement, how your batting average works together with your gain/loss ratio, the importance of building failure into your trading plan, and the compounding (and devastating) effect of large losses.

Chapter 4: "Know the Truth About Your Trading"

“Your spreadsheet is more than just a record of past performance to tuck away or glance at every now and then. It is the precise guide for handling your next trades.” (page 76)

In chapter four, Minervini discusses the importance of proper trade documentation and exactly how to use the data you collect to maximize future returns. Diligently maintaining a trade journal is an often overlooked detail that separates winning traders from losers and it will give you a massive advantage when the time comes to put on new trades.

Chapter 5: "Compound Money, Not Mistakes"

“In the stock market, when bad habits get rewarded it leads to ruin. If ‘just this one time’ works out, then heaven help you, because you’ll convince yourself that the end justifies the means, and you should do it again. Then my friend, you are doomed.” (page 92)

Chapter five details the dangers of averaging down on losing positions and why it’s so critical to stay disciplined by taking small losses along the way. All major market declines begin as seemingly minor pullbacks. Maintaining strict damage control preserves precious trading capital, allowing you to stay in the game while other traders are blowing their accounts up. Minervini also discusses how he handles a swing trade going into earnings, the importance of maintaining focus, and why it’s often best to remain in cash on the sidelines.

Chapter 6: "How and When to Buy Stocks - Part 1"

“My starting point is always to have the ‘wind at my back.’ That means that I only buy stocks that are in long-term uptrends.” (page 115)

Mark Minervini’s trading style is momentum-based and his aim is to buy high and sell higher. Not one to bottom fish, he times his entries while stocks are in the Stage 2 phase, a time of accumulation and rapid price advances. In chapter six, Minervini also shares his “Trend Template” criteria and the details of his VCP setup (“Volatility Contraction Pattern”).

Chapter 7: "How and When to Buy Stocks - Part 2"

“Just because a stock is trading down 50 to 60 percent off its high, don’t give in to the temptation of thinking this is a bargain. First, such a decline could indicate a serious fundamental problem is undermining the share price—a problem that may not be evident in reported or ‘surface’ fundamentals. Second, even if the fundamentals are not yet problematic, a stock that experiences a deep sell-off must contend with a large number of potential sellers or overhead supply. The more a stock drops, the more it is burdened by this overhang.” (page 137)

In chapter seven, Minervini continues to point out what to look for when preparing to put on a trade. During periods of correction, market leaders are the first to bottom and these are the stocks that you want to be in as things rebound. Also covered is knowing which positions to put on first and several powerful chart patterns to watch out for.

Chapter 8: "Position Sizing for Optimal Results"

“Ideally, I like to concentrate my capital in the best names, for example, devoting 20 to 25 percent of my portfolio in each of my top four or five stock picks.” (page 171)

Minervini warns against excessive diversification and argues that your focus should instead be on maintaining optimal position size. Listed in this chapter are his position sizing guidelines which are designed to achieve above average performance without taking on too much risk.

Chapter 9: "When to Sell and Nail Down Profits"

“You need to have some perspective, starting with the big picture. From an aerial view, you begin to understand the context of the current price action. Without this perspective, you run a high risk of becoming victim of your fears and emotions.” (page 179)

One of the topics which could have been discussed a bit more in Minervini’s Trade Like a Stock Market Wizard, chapter nine lays out a number of powerful strategies and indicators that you can effectively use to lock in gains. Knowing when to sell is one of the most challenging aspects of trading and the approaches presented in this chapter will help you to keep emotions at bay while timing exits.

Chapter 10: "Eight Keys to Unlocking Superperformance"

“If you want big returns in the stock market, you have to learn how to accomplish two things: 1. Make big money when you’re correct, and 2. Avoid big drawdowns when you’re wrong.” (page 203)

In chapter ten, you’ll learn about several key things that are essential for generating massive gains. What Minervini shares is not what would be considered to be “conventional wisdom” and it certainly goes against the grain of what is typically taught.

Chapter 11: "The Champion Trader Mindset"

“Over the years, I’ve come to realize that fear is the number one emotion that causes traders to sabotage their discipline. Fear of missing out causes them to chase stocks and buy past the point at which they know then should. Fear of loss causes them to sell too soon and take small profits in stocks that show no real reason for concern. And fear of making a mistake keeps traders from being able to pull the trigger descisively.” (page 218)

In the eleventh and final chapter of Think & Trade Like a Champion, Mark Minervini teams up with performance coach Jairek Robbins to address the emotional traps that keep traders from achieving superperformance.

Reader Reviews

A must-have trading book…

A must-have trading book that belongs on the bookshelf of every serious trader. Suitable for new traders and experienced veterans alike, Minervini lays out the fundamentals for becoming a disciplined and consistently profitable trader.

Submit a Review

Have you read Mark Minervini’s Think & Trade Like a Champion? If so, let other traders know what you think about it…

Think & Trade Like a Champion PDF & Audiobook

At the moment, this book is not being sold in PDF format but there is a Kindle version available for instant download (click here). Audiobook fans will be disappointed to know that there's no audio version available at this time.

Mark Minervini Trading Strategy Video

Final Thoughts

Pros

Great follow-up to Minervini's Trade Like a Stock Market Wizard, excellent insights on entries/exits/risk management, lots of charts

Cons

Additional examples would make it easier for new traders to understand and apply certain concepts within the book

Best For?

Beginner through advanced traders, CAN SLIM adherents, swing traders, those who have already read Trade Like a Stock Market Wizard