BUY THE COURSE

JOIN THE DISCUSSION

What is “The Strat”?

Known simply as “The Strat” (short for “The Strategy”), Rob Smith’s innovative trading system continues to grow in popularity as more traders discover this unique way of viewing price action. Devoid of widely-used indicators such as moving averages, stochastics, MACD, and RSI, The Strat is purely focused on price action, broadening formations, and time frame continuity.

Rob Smith has brilliantly condensed price action down to three possible scenarios, with candles labeled as either “1” (inside bar), “2” (took out one side of the previous range), or “3” (took out both sides of the previous range). The Strat is a trading system that can be utilized in any market and time frame, and once you begin to see things from this perspective, it will forever change the way you trade.

The Strat is a breath of fresh air in the world of trading education and I’ve yet to encounter a community with so much freely offered knowledge. The Strat community is passionate, diverse (scalpers, swing traders, etc.), and incredibly helpful to newcomers. While this review is for Rob’s paid course, he has also produced an overwhelming amount of free content in the form of videos and articles (be sure to subscribe to his YouTube channel, free Ticker Tocker newsletters, and follow him on Twitter).

Course Details

| Creator | Rob Smith |

| Publisher | Smith’s In the Black |

| Released | 2020 |

| Formats | Digital (streaming video) |

| Price | $599 or FREE with annual room subscription |

About Rob Smith (Smith's In The Black)

What You'll Learn in The Strat Course

Rob is the most unselfish trading educator I’ve personally come across and as mentioned, he has produced an extensive catalog of free content over the past few years that will teach you how to effectively trade The Strat.

So with all of the free videos and articles that Rob has created, what’s the point of a paid course? In my opinion, Rob does a great job of condensing his knowledge in this course, slowing things down a bit, and ultimately laying everything out in a methodical, easy-to-follow format. The Strat course doesn’t really teach students anything new that Rob hasn’t previously covered in his free content, but it does provide you with a neatly organized, well-structured package that takes far less time to digest.

The Strat course is a growing, continually updated project, and at the time of this review, there are a total of 15 modules included.

Module 1: "What is The Strat?"

Module Duration: 6:37

In this opening module of The Strat course, Rob provides a concise introduction to his trading system and briefly shows how it is unique from other approaches. He begins this section of the course by discussing the universal principles that The Strat is based off of:

- Time frame continuity

- The three scenarios

- How price reverses

Module 2: "Smith's In The Black Channel Users Guide"

Module Duration: 9:52

Module two is another introductory section that explains how to navigate through the Ticker Tocker member’s area. Rob introduces each of The Strat resource areas, including The Strat Time Report, The Strat Attack Show, The Strat Power Hour, and more.

Module 3: "What We Look For Part 1"

Module Duration: 16:44

In module three, Rob begins to lay out his trading system setups and the criteria he looks for to identify price continuation and reversals. He also discusses the concept of “in force”, coming back through previous ranges, magnitude, multiple time frame analysis, and goes into greater detail regarding the three price action scenarios.

Module 4: "Getting Started"

Module Duration: 6:00

In this section of the course, Rob gives some basic recommendations to traders of all experience levels on how to get started with The Strat.

Module 5: "Introduction to the 3 Scenarios and The Time Frame Continuity Principle"

Module Duration: 10:03

Module five is focused on a deeper dive into “1”, “2”, and “3” bars as well as the importance of continuity across multiple time frames. Multiple time frame analysis can assist in identifying market participants by price and time. Rob also points out why it’s important to know when the major time frames reset.

Module 6: "How Price Reverses"

Module Duration: 9:34

In module six, Rob breaks down his approach for trading reversals and how you can combine multiple factors to accurately identify the point that a trend reversal takes place as well as the objective price target (magnitude).

Module 7: "How Price Continues"

Module Duration: 6:03

If price is not consolidating, it’s either reversing or continuing. In module seven, you’ll learn about price continuation patterns and how you can use them to stay in a trade and add to winners.

Module 8: "What We Look For Part 2"

Module Duration: 13:29

In module eight, Rob reiterates the main principles that have already been covered and drives these concepts home with additional details and chart examples. He also touches on “pivot machine gun” setups and how to effectively use areas of known stop-loss orders to your advantage. Rob also talks about exhaustion risk and why it’s important to be aware of that whenever going into new highs or lows. Another key concept to understand when trading The Strat is something that Rob refers to as “mother bar risk” and he goes into detail on that in this module. Lastly, you’ll learn about “triangle they out” and how you can benefit from stop runs when taking reversal trades.

Module 9: "Getting to know your ETF's"

Module Duration: 24:41

Rob includes an in-depth discussion of ETFs in module nine, covering the main sectors and sub-sectors that traders should be aware of as well as an overview of each one’s top holdings. Monitoring major sector ETFs can improve edge as it allows you to identify both confluence and divergences.

Module 10: "Refining Your Universe"

Module Duration: 8:48

In module ten, Rob talks about narrowing your focus. For Strat newcomers, it’s easy to get overwhelmed, and to combat this, he recommends focusing on one particular setup in the beginning and mastering that before moving on. Another good idea for anyone who is just getting started with The Strat is to avoid jumping around and simply stick with the 60m and 30m time frames. Rob’s newsletters and regular videos are also an excellent resource and he makes mention of them in this section.

Module 11: "Guide to Set Ups and Magnitude"

This learning module simply consists of an infographic that lays out the various Strat setups. If you’re just getting started, it’s a great idea to print this graphic off and keep it next to your computer for easy reference.

Module 12: "The Importance of The Flip and Simultaneous Breaks"

Module Duration: 16:06

In module twelve, Rob spends some more time discussing time frame continuity and why it’s critical to be aware of the flip (the bottom of the hour) and simultaneous breaks. With The Strat, when things occur is important, and becoming aware of these core principles will completely transform the way that you trade.

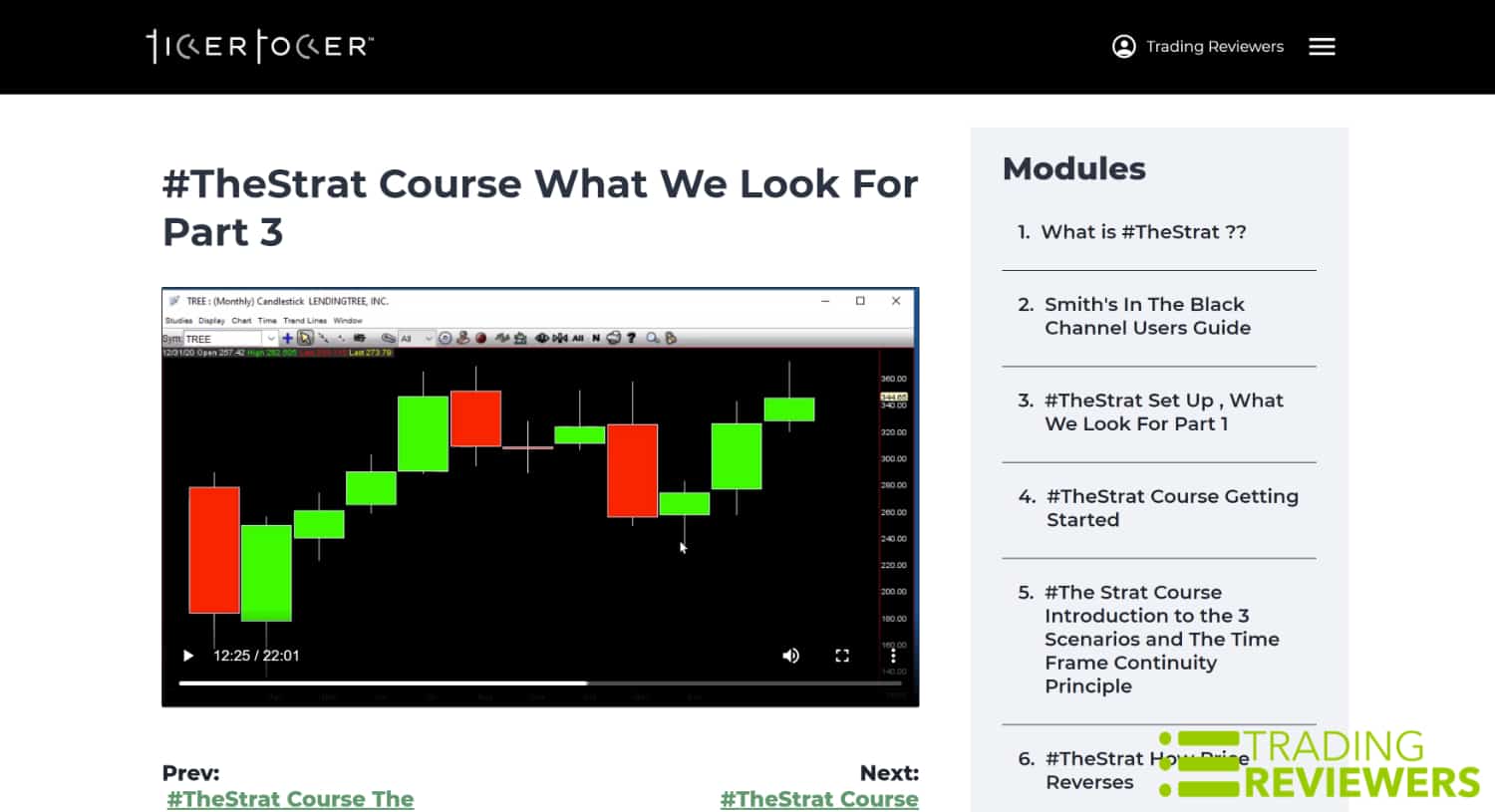

Module 13: "What We Look For Part 3"

Module Duration: 22:01

Model thirteen continues to dive deeper into The Strat methodology and Rob talks about how important it is to train the mind to see things differently than you always have. Another thing that he stresses in this video is why it is helpful to look for full-time frame continuity, even when trading on lower time frames such as 5m, 3m, or 1m. When all time frames line up, you’re tapping into a larger group of market participants, resulting in more exaggerated moves. Rob also spends some time discussing hammers and shooting stars.

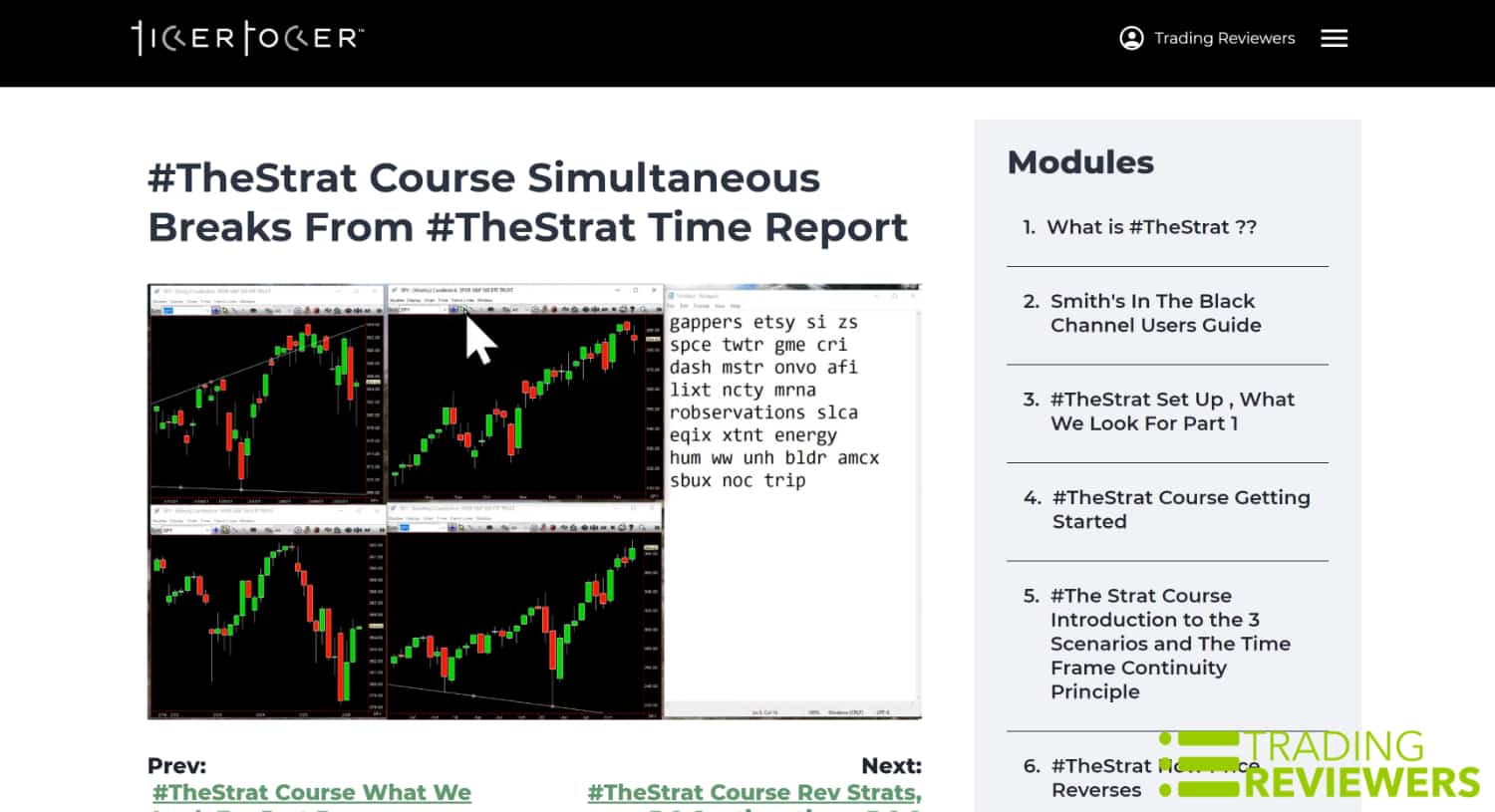

Module 14: "Simultaneous Breaks From The Strat Time Report"

Module Duration: 15:09

Module fourteen is a recording of The Strat Time Report from February 26th, 2021. In this section, Rob looks at a number of charts and provides helpful commentary on how things are setting up across multiple time frames. This video is extremely helpful in reinforcing the concepts that have been presented in the course thus far.

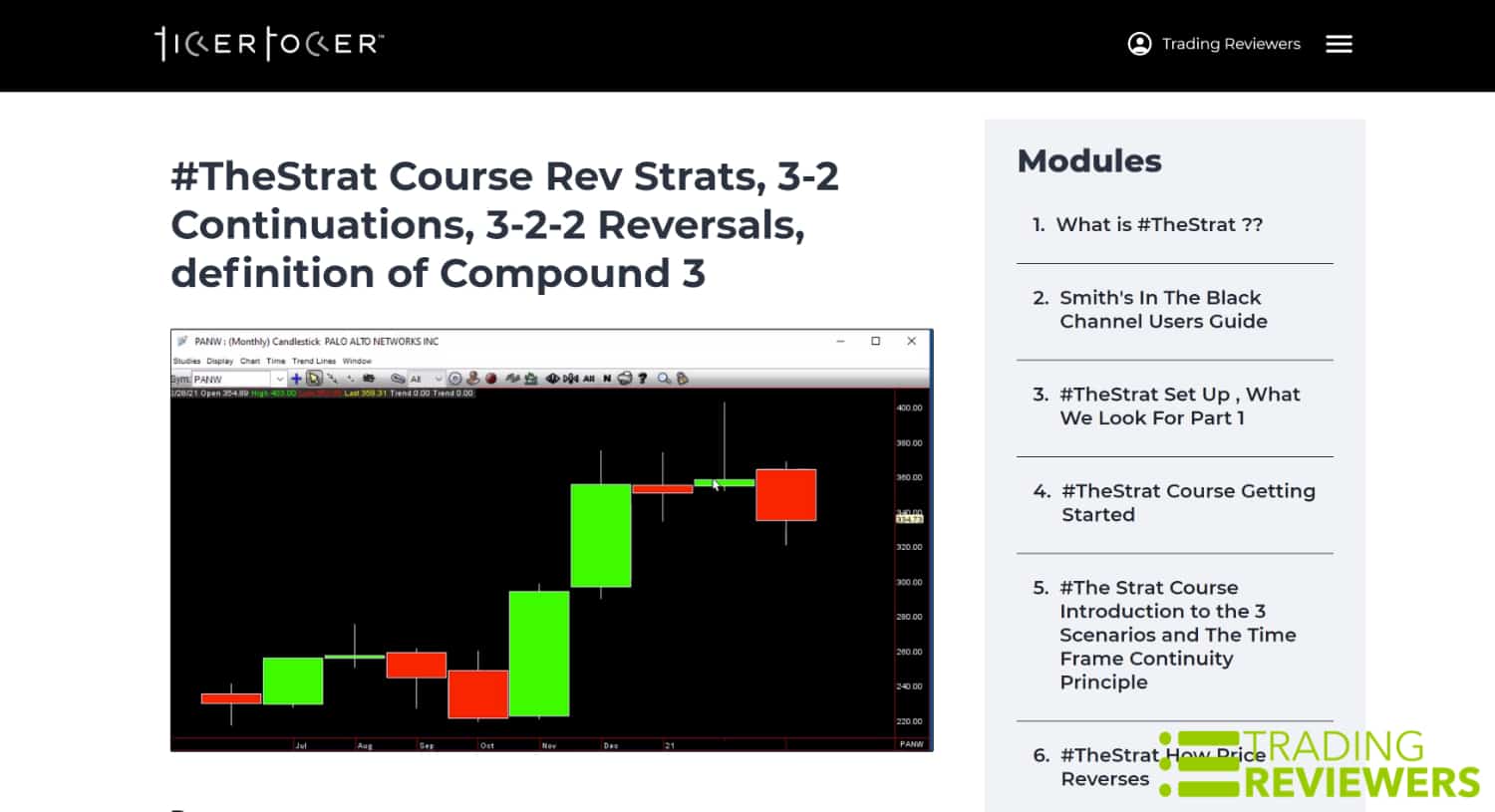

Module 15: "Rev Strats, 3-2 Continuations, 3-2-2 Reversals, definition of Compound 3"

Module Duration: 11:01

In module fifteen, one of the main areas of focus is on rev strat setups which is my personal favorite. A rev strat is a type of reversal setup that involves the reversal of an inside bar equilibrium, and this can often result in a violent reversal move. Rob goes through a lot of examples in this section which is helpful and he also discusses continuations and compound “3” bars.

Reader Reviews

Should be learned by anyone who…

The easiest, most straightforward, and concise price action strategy. The strat should be learned by anyone who wants to be consistent in the stock market.

Teaching you how to fail…

This is the suckiest thing ever stolen. This is teaching you how to fail. No one is successful. Only cheerleading a few dollars.

Best…

Best course ever.

Rob is a true asset to the trading community…

Rob Smith is unique in the world of trading educators in both his trading system and generosity. Always willing to answer questions and help newcomers, Rob is a true asset to the trading community and The Strat is an approach that anyone can learn. Once you learn the setups taught in this course, you will be able to effectively apply them to any trading vehicle or time frame.

Submit a Review

Have you gone through Rob Smith’s The Strat course? If so, please let other traders know what you think about it.

Pricing

At the moment, the price of The Strat course is $599. Alternatively, you can get access to the course for free if you purchase an annual subscription to the Smith’s in the Black Live Room through Ticker Tocker.

FAQs

Absolutely. As mentioned, you can use The Strat to trade anything imaginable and there are many traders who are successfully using this strategy to trade options.

No specialized trading software is required to trade The Strat. Having said that, certain charting platforms are better than others (we highly recommend TrendSpider, which has scans and set ups for The Strat built right in to the software). We'd also recommend Benzinga Pro which is a great browser-based platform for news and stock screening. It even features a chat channel specifically set up for discussion and education on The Strat.

Pros and Cons

Pros

Cons

- Well-organized modules

- Manageable course length doesn't require massive time commitment to complete

- The Strat is incredibly versatile and can be applied to any market or time frame

- System provides a non-emotional, objective way to trade any market

- Strong focus on risk management

- The Strat community is the best we've encountered in terms of idea sharing, helpfulness, and overall kindness

- Course access is free with annual subscription to Rob's Ticker Tocker community

- $599 price tag is a bit pricey, especially for new traders (although access is completely free with annual membership to Rob's Live Room, as mentioned)

Best for?

The Strat course is ideal for newcomers to Rob Smith’s popular trading strategy and anyone who finds his vast selection of free content to be a bit overwhelming. Rob did a nice job of organizing this course and condensing the most important details into a manageable number of modules. If you want to learn The Strat in the most efficient way possible, studying this course is the best option in our opinion. While you can certainly learn The Strat by watching Rob’s free videos, it’s a far more time-consuming approach in our experience. This is by far the most versatile trading system we’ve ever come across, and regardless of your experience or trading style, The Strat’s universal truths can be successfully used to trade any market and time frame.

I’m curious about when you say strong focus on risk management. I havent seen course yet but there aren’t any modules about risk management.