Hey, this is Jason, with TradingReviewers.com and today we're joined by Sean Dekmar of TradeCaster.com. Sean, welcome!

Hey, thank you so much for having me and you know, being able to speak with each other. You've been so nice in helping me out and I really look forward to this interview. So, thank you so much again.

Hey, thank you. Hey Sean, can you tell us a little bit about your trading background. How did you originally become interested in trading?

Yeah, so this goes back to the very start of college. Currently, right now, I'm 26 years old and I started getting involved in trading, probably around when I was 19. I always had an interest in stock trading when I was 17 or 18, going through high school, but I really never thought it was something that I could do or something that I could really pursue.

As I started getting older, I started realizing that this wasn't what I wanted to do. When I was in college, I was a criminal justice major — a little heads up for you. So, of course, I respect police officers and everything they do. Just for me, that just wasn't what I wanted to do. I wasn't going to be happy waking up, you know, for the next 20 years of my life doing that. Especially having a boss, having a salary, doing that day after day and I just knew from the very start of who I am that I know I can do more. I know I can go after anything I wanted and really achieve that. I just never really knew what I wanted, and that was kind of the biggest question kind of growing up is, you know, what can I do? What is something that I can start? What is something I can find that is going to lead to being able to make money and be successful?

Now, the thing is, you know, money's not the most important thing in the world to me, but I do want to be able to have that financial freedom to be able to supply for myself, supply for my family, and not be underneath restrictions of let's say a 9 to 5 I'm not happy with. So, throughout college, I realized a lot of things. And one of the big things I realized was, one day I was sitting down on a bench in my campus and the bell would ring, you know, at 9:30 when people would start moving from class to class, and I didn't go to class that day.

I sat there and I saw everyone move from one building to the other building. Ten minutes later everyone is absolutely gone, learning from their professors. 45 minutes, 50 minutes go by — same exact thing. Next class, next class, everyone moves around and goes, you know, and does their thing. And I'm sitting there, and I think to myself, where do we be different? Where do we break away from the norm? Because when I think about the norm, I think about every single one of my friends. My friends that did that normal route who are now underneath the 9 to 5, underneath a job that they're not happy with, stuck into debt, saying to themselves, you know, is this all I have? You know, for the rest of the next twenty years.

And that was a really big eye-opening day for me, because I said to myself, if I'm learning the same thing that every other kid is learning at this time, where am I going to be different? And I always like to use the example, if I look out my window right now and I look down the street, I'm going to see every single person, probably driving, you know, a car lets say that's going to be between $10,000 to let's say $30,000 to $40,000. There's only a very exceptional amount of people who are driving cars that are maybe $100,000, $120,000, $200,000 — something along those lines. Now materialistic items, this is just an example, obviously aren't the most important things in the world. But it just gives you a little bit of visualization, how do people again, afford that? Because going the normal route, learning what everyone else is learning, we're not going to be able to break out.

So, at some point in our lives if we want to be able to have that next step, that financial freedom, to be able to get free of that 9 to 5, we have to at some point in our lives be able to do something different that no one else is doing. But the hardest part is, of course, doing that. Because when you're first starting, guess what? People are going to look down upon you. When you're first starting, people are going to talk behind your back and say, why's he doing this? But the thing is, why not try to go do something? Why not try to be someone? Why not try to go ahead and make something of yourself? Because the worst-case scenario, you fail, you're right back down to where everyone else is. That's the worst-case scenario. That you fail and you're back down to your 9 to 5, you're back to where everyone else currently is.

So, the thing is, why not go try to be someone and go try to do something and try to make something of yourself? And that's something that really hit me, especially sitting on that bench that one day and seeing every kid do the same exact thing, class to class, professor to professor, learn the same exact material. I said to myself, if I want to be someone and be able to have this freedom, I need to at some point break away from the norm. And I can't care what other people think about it, I can't care about the judgment or what people may say. I need to know that I am not, you know, part of this norm and if I want to be able to live an exceptional life, I need to do exceptional things.

So, I started trading back in around sophomore year, is when I started really taking is serious. And then sophomore year is where I started paper trading and just learning about the market. Now, you need to understand, I was just a broke college kid. I didn't have thousands of dollars to start stock trading. But the thing I always say is, being a broke college kid was one of the best things that ever happened to me.

And why was being a broke college kid one of the best things that ever happened to me? Well, it didn't allow me to start stock trading right away. If I started stock trading right away, I would have lost everything right away. So, the best thing was it allowed me to paper trade for about a year straight before I was actually even able to open up an account. I had to save up for about a year before I even started stock trading. I saved up about $1,400 and my one friend, actually loaned me $1,400, and I was able to start up an account with just around $2,500, a little bit over that area to start pursuing my stock trading. And that was very awesome and I was very happy, but the thing was I had over a year of paper trading, a year of learning, a year of making mistakes, a year of finding what's right and finding what's wrong before I actually started stock trading.

So, starting off with about $2,400, $2,500 as a sophomore, that was one of the best things that happened to me, because it was after a whole entire year. But how did I really find stock trading? That's like another funny story as well, as when I was, after the day that I was sitting on the bench, and I said to myself, you know, what can I do differently? I didn't really know where to start. You know, everyone wants to make money but where do you start when you say I want to make money? So, what did I do, just being very naive, I went straight to Google and I typed in, how to make money. And one of the big articles I read, was the big three things that came on up. Three things that came on up that's changed the course of who I am today which is number one, get involved with real estate. Real estate's a great way to be able to financially free, but of course, you know, I always think getting involved with real estate you're going to have to have large amounts of money, buying houses, renting them out, flipping them, doing everything along these lines.

Number two, you can start some sort of business if you want to. You know, business is something that I've always loved. I actually remember when I was a freshman in college that's actually where I kind of had my first hit of business life. We actually sold homecoming t-shirts. I actually saved up my whole entire money that I had over the summer, about $1,000, sold homecoming t-shirts, and was able to make $3,000 in profit just from selling homecoming t-shirts. And that was kind of like my first big business expense I ever did and that was absolutely awesome, and that definitely has helped me carry over and everything I am now.

And the third thing, of course, was getting invested in the stock market. Now, getting invested in the stock market, that's something that intrigued me. You know, the whole business side, you know that wasn't even here yet whatsoever. Everything now was just about getting involved in the stock market. Learning how to trade and that was something that I wanted to say to myself, alright well how do I do this? You know, right away when you hear about stock trading you're going to hear about, you know, options trading. You're going to hear about the SQY. You're going to hear about blue chips and of course, you know, if you dive deeper into it you're going to learn more about penny stocks and day trading.

Now, the first thing of course, when you read about on the internet of day trading and penny stocks, and all this different stuff, is that it's extremely high risk. But people with small accounts, of course, can get involved because you're trading stocks that are not costing as much. So, if we can play these stocks and we can find some sort of strategy that is allowing us to make a large amount of money, that limits our risk, then you know, that would be the perfect strategy. And that's what I've been trying to perfect, you know, year after year, after year and it took me a whole year of paper trading before I found something that started to work.

Because you hear about these stories of kids in their dorm rooms, you hear about these stories of people holding overnight, stores about people within a day making $10,000, $20,000, $100,000, and you say, why can't that be me? Now a lot of times these people do get lucky, you know, maybe they're holding some sort of large amount of shares and a press release comes out or some sort of crazy news comes out, or some sort of big momentum push goes flying on in and these people make money. But I say to myself, if someone can make, you know, $50,000 in a day, how can we predict this? How can we say, okay, I want to limit my risk and I want to maximize reward? Is there a way that we can do that?

And over the past few years, you know, I've been able to definitely work out some kinks and be able to be a successful trader. I've been full-time stock trading now for the past 5 years of my life. And every single year profits are getting bigger and bigger, because the account's growing more and more. On top of that, every single day is a day to learn. Even though I've been trading now for, I would say 6 years, because that first year I was also paper trading, you know, there's no ceiling on education. Every day, even at my level, I'm going to learn something, I'm going to subconsciously even, pick up new material every single day.

So, starting off with my stock trading, I know again kind of going a little long right there, but it really started back in college. Just wanting to be someone, wanting to be something different, wanting to make something of myself and realizing that if I just follow the norm, follow the every single person path, I'm going to end up like everyone else, and where is that going to leave me? You know, so I always wanted to break off. And I encourage everyone who's listening to this, to take that chance because what do you have to lose? Be someone, that you guys can definitely make something of yourself.

That's awesome that you had that epiphany at such an early age, and you had the courage to do what you felt you had to do. Regardless of what, you know, your friends and your family were telling you in the background as you're pursuing your dream. So, that's really awesome that you were able to discover that, like I said, at such an early age. Because a lot of people it takes them many years of trial and error to find, you know, where they really fit and what they want to do. Can you tell us a little bit about your trading education? For instance, what resources did you use when you were getting started in the beginning to learn? Who did you learn from? Who inspired you? Who mentored you along the way?

That was another big thing, you know, me of course not having too much money as a college student when I was learning everything, I didn't have a mentor, I didn't have a chat room that I used, I didn't have anyone to guide me. So, you know, being paper trading was my number one resource. Trial and error, right. So, if I lose enough times on a stock, I'm going to eventually figure out the right way that's going to work. And that's why it took me so long to be successful in the stock market, because I never had someone to actually show me the ropes and guide me.

A lot of my education was straight off of Google and straight off of YouTube. Just typing in on YouTube, how to start stock trading. Go over to Google, reading Investopedia. Investopedia is like all of my education right there. If you click one link on Investopedia, how to day trade, it's going to give you different terms, you click that term it's going to take you to a different page. You read a little bit, halfway down you got a new term, it's going to take you to a different page. Next thing you know, you're just diving into the rabbit hole of Investopedia and you have 2 hours down, 3 hours down and you're just gaining up all this knowledge.

But I always say there's a big difference of course between knowledge and experience. The number one way I like to always put this is, imagine if you want to be a professional quarterback in the NFL. You could study every single play, you could study how to throw a football in a spiral, you can study the different way that blitz's happen and all these different, you know, ways that you need to read the defense. But if that's all you do, and you never go out on the field and actually play a game, you can't be shocked and say why I am not good? You can study of course all the film you want, but until you actually get experience and get yourself out there, it's a completely different world.

So, you know, that's what a lot of new traders I see also have the biggest problem with. We study, study, study and once we put ourselves actually in the field and actually start stock trading, we end up losing, and we say to ourselves, I put in all this work, why am I not successful now? I put in all these hours of, you know, reading. I put in these hours of watching videos. Why am I not successful? Because the knowledge is there, but the experience is not. How to control your emotions are not, how to actually read the charts not, especially when there's money on the line and something in value that you're trying to get, it's not going to be simple. It's not going to be easy.

So, the thing was, when I first started stock trading the paper trading was an extremely helpful way for me to be successful because it allowed me to figure out what to do right and what to do wrong. Every little right thing I wrote down. Every single day I would go over to finviz.com there's a list of the top gainers, top losers, and all I would do every single day is look at every single top gainer. Say what made the stock spike? What made the stock drop? Go through every top gainer, figure out why it became the top gainer. If I can figure out why it became a top gainer, I can find future top gainers. Oh, this stock spiked because there was a press release towards it. Oh, this stock spiked because there's a chart pattern towards it. Oh, there's an agreement towards it, there was a buy out towards it, there was a rumor on it.

And the thing is, you're going to start to collectively picking up little hints on each one of these plays. So, if you do this day after day, after day, you're going to see some very common characteristics of what makes a stock spike. It could be a low float, it could be a certain chart pattern, it could be a certain news press release that comes out, and there's going to be ones that are going to lead to top losers as well. And the thing is, you do this every day and commit yourself to doing it every single day, you're going to realize, okay this is what makes a stock spike, this is what makes a stock dump, and you start realizing what you should be getting involved with and what you should be getting away from. And I believe, it was like Thomas Edison as well, who said, oh I found, you know, a million different ways not to invent the light bulb before I did invent the light bulb, right.

Same exact thing with my stock trading. It's like I could lose, lose, lose, lose, that's not saying I'm a bad trader, I'm just figuring out ways how not to make money in the stock market. Now I know those aren't going to work, so now I can keep progressing to find ways that are going to make money in the stock market. And as someone who didn't have a mentor, having someone that didn't have anyone in my family that was involved in the stock market, it was one of those things that, you know, I just had to figure out on my own. And that's why it took me so long.

Now, people who are new that are listening of course, it's not going to take you maybe a whole year before you start making any sort of money. We just want to make sure that you're guided on the right path, and it just took me that long because I never had anyone to tell me yes or no, and just had to figure everything out myself. But a lot of experience and of course, just using free resources, such as YouTube, Investopedia, finviz.com, and you know, any other videos I could find out there.

That's awesome that you bootstrapped it from the very beginning...

Yeah.

Obviously, it makes it a lot easier when you do have some capital in the beginning, that you can invest towards resources, different websites and we'll talk a little bit more about your new project here in a little bit, that certainly can go a long way in helping a new trader kind of cut down on that learning curve. How long would you say it took you in the very beginning to become consistently profitable?

Consistently profitable, you know, for me just because I never had a mentor, but probably after, you know, 7.5 to 8 months, that's when I actually started seeing profits day after day start building up. That's when I started feeling confident. But, as I say, you know, stock trading is no different than anything else we do in life. And a lot of things I give analogies towards, I always do it towards sports, because I was growing up playing a lot of sports. And the thing is, you know, if you've never picked up a basketball, don't expect to play in the NBA right away. You know, if you've never picked up a football, don't expect to play in the NFL right away. If you've never stock traded, don't expect to become a millionaire right away.

The people that you see out, you know, making millions of dollars in the NBA, they've been playing basketball since they were a kid, all the way till they are now. NFL, they've been playing since, you know, high school, middle school, you know, college, all the way up through until now. The people that are the big dogs on Wall Street, they didn't just randomly say, hey I want to be a stock trader a week ago and start doing that. They've been putting in years and year, and years of work. And that's what a lot of people kind of get lost in in the social media. A lot of people get lost in that kind of faze of, you know, fantasy trading. Now, trading, of course can lead to a million amazing things. It's changed my life, it's made me who I am today of course, but at the same time you can't get lost in, okay I want to go do these things and travel the world, and buy this, and buy that, and you know, not work for anyone and just be lazy all day. That's not the way trading works.

You can have a lot of those things, but it's all through hard work. I always say if you want to be a full-time trader, you got to act like this is a full-time job. Yes, we can maybe some days work for a few minutes, make a great profit, but that doesn't mean we want to go back to bed, we still want to be here, we still want to soak up education, we still want to learn. So, if you want to have it as a full-time job you need to treat it as a full-time job. And that's you know, something that a lot of traders don't understand when first starting off.

Very true. Do you recall the details of your biggest trade? Do you remember what that was like?

Yeah, one of my biggest trades that I've ever had was $27,000 and that was within a 30-hour span. So, I actually bought it around lunch hour one day and sold it the following afternoon the next day. So, I was actually holding the stock overnight. I had, I believe, around fifteen thousand shares on the play. The stock was able to go a little bit over a dollar and I was able to make around $27,000. I actually have it on my YouTube page. It was back in 2018, one of my biggest trades.

A lot of the times I don't, you know, shoot after those huge $27,000 days just because it's so much risk. You know, the worst thing I hate seeing happen is I'll be up let’s say $8,000, and I'm saying oh let me keep holding, holding, holding. At the end of the day, I'm down to $500. You know, as time progresses, I become a lot more of a conservative trader. You know, I like to have my money, I like to lock it in. The last thing I ever want to do is be up let’s say a huge amount, and then end up losing absolutely everything just because I let greed take over.

So, a lot of like my big-time gains were a little bit earlier in my career, just because that was when I was a little bit more risky and said, hey, you know, let's try to let this big thing run on out. And that was about 2.5 years ago I was able to make that big-time profit. That was on shipping stock $PXS. Over the past 2.5. 3 years, every single November and any day trader will probably back this up as well, shipping stocks would go a little crazy. We had $DRYS about 3 years ago, the stock went from around $5.00 to about $105. It was an amazing spike. We had stocks such $DCIX, $TOPS, $GLBS, if you want to look up those tickers, about a couple years ago, back in November, those all went on about $20 spikes. And then the other year we had, I would just remember these patterns, because a lot of times stock trades fall into patterns.

The way I like to trade is the past chart history is going to tell you what to do in the present. If that's on how high stocks have run or what months that they run, and sometimes we see these very common themes. And November with shippers had been a very common theme. So, I remembered that from the past two years, that we usually see this happen every time, loaded up on $PXS, stock shot on up right on queue and was able to wake up the next day and be able to make a $27,000 gain. So, obviously that's a huge day, it's a huge feeling, you're extremely happy with that, being able to make that amount of money in 24 hours, a little over that. And when some people work, you know, an whole entire year to make something just above that and you know, it's definitely life-changing. You want to stay humbled with yourself, you don't want to get overconfident because you know, the next day you're right back at work and going through the whole thing all over again.

Yeah, that's so important. You know, you got to take every day fresh. You know, you put a big winner behind you and you got to start the next day off fresh because the minute you think you can outsmart the market, it will crush you. You have to stay humble, it's key. What about your worst trade? And what type of impact did that have on your trading going forward?

Worst trades are the worst days. Those are the ones you try to avoid. The thing is, you know, about when you have those bad trades, everyone wants to ignore them. Everyone wants to throw them out the window and forget them, but honestly, the worst trades you make or the biggest red days you have are actually the biggest lessons. You know, everyone wants to talk about their wins, everyone wants to show off their wins, everyone wants to say, oh look how much I made. But the thing that actually makes you a better trader, every single day, is of course your losses.

The biggest loss, I believe I've had was around $18,000 within a morning. That one was also about 2.5, 3 years ago, that's when, as I said, I was getting a little bit crazy on both sides just letting a lot of my wins go and a lot of my losses go. And when you take a loss like that you say to yourself, you know, why? Like what was my reasoning behind that? And that's why every single day, you know, I record a lot of my trading and that's either because I put them on YouTube or for myself as well where I watch it. You know, I always like to watch myself trade. Because I like to re-watch the stock and see if I have the same thought process when I don't have money on the line. Would I do the same things? What am I doing right? What am I doing wrong? What can I correct here? It's basically just like watching film, you know, after you have a game and you stay to yourself, okay, why did I make the moves that I did here?

So, being able to recap every single trade is so important. So, if I have one of these giant losses and like 2.5 years ago, when I had this big $18,000 trade going on, I said to myself, you know, what was the point of that? Why not just rip off the band-aid? When I'm down $3,000 is it fun? If I'm down $2,000, is that fun? No. But why would I just want to keep holding and losing, and losing, and losing, and losing? So, it really teaches you a huge lesson, because it gives you that big hit in the gut, saying, you know if you keep holding, you're going to end up losing. And that's the reason why so many new traders end up losing, and why so many people can't find success, is because they let one trade destroy their whole entire account. Now, obviously, you know, with me trading for a while, I have an account that is very sustainable and if I take a loss like that, obviously it's never fun, obviously it's never great, but I'm able to bounce back.

Most people if they take a, let’s say starting off at $2,000, $3,000, $4,000 hit, that's going to end their career. That's going to end their confidence, they're not going to enjoy trading ever again. And the most important thing I can say is every single day is different. Every single day we're going to wake up, and every single morning we could see a bigger spike than the day previous. Why sit on a play that's not working? A lot of the times I talk about, you know, stock trading is like being in a relationship. Sometimes you're going to be in an awesome play, sometimes you're going to be super happy with the stock, feel great about it and sometimes, you know, it's going to break your heart and you know what you got to do, you can't just sit there and take it, you move on. Rip off the band-aid, there's a million other fish in the sea.

So, yes, every single trade that you get into, is of course going to have its own variables. Those losses are going to sting, but it's all about limiting those losses as quickly as you can, and that's a big thing I always try to do, especially now with my trading. I always try to make sure that every stock I get into, A- I have reward then I do have risk, and top of that if things are not going my way, rip it off, move on. You know, I've been trading now for the past six years, one of the biggest lessons I know is if a trade's not working out for me, I know I can I do this whole time, I've made, you know, over six figures in the stock market, I'm going to be able to do it in the future. Why sit on a loser? But, yes, those losing days definitely hurt and you know, you always just want to limit them as much as you can.

Yeah, it's so important to cut losses. It's a key to becoming a profitable trader for sure.

Oh, one hundred percent.

How many hours a day, Sean, do you work on average? And what does your typical day look like?

For me, just because, you know, I live stream my trading throughout the whole entire day. I'm a little bit different than the typical trader where you kind of make your trade and wrap up. Personally for me, I wake up starting around 6:45, I start live streaming right around 7:00 am. 7:00 am is where hot news starts coming on out, you know, hot press releases usually come out from 7:00 am, 7:30, 8:00, 8:30, 9:00, 9:30. I'm on the eastern seaboard, New York time, so that's the time schedule that I'm always going to follow. And throughout these thirty minutes, we usually see these very hot press releases.

Now, a press release is one of the main key things that make stocks go on giant spikes and go on giant rips. So, if I know, hey every thirty minutes we're going to see these press releases drop, I'm going to be watching my news stream, or I'm going to be watching for these hot press releases to come out. And if I see one right away, I'm going to jump in it right there and then as people wake up, they start seeing the news. I always say sacrifice sleep for profit. If I was, you know, in your bedroom and I said, hey, wake up, you could be making $500 right now. You'd be jumping out of your bed and running over there.

But the thing is, you know, day after day, a lot of people may see a press release or not see a press release and they're saying to themselves, oh, why I am awake right now? Let me go to back to sleep. The thing is, those big press releases are going to come, you just want to be ready for them. And the thing is, I've made thousands of dollars waking up early and seeing these hot press releases. So, seeing these hot press releases, I jump in, be able to make some nice profit right there. So, it's so important, sacrifice sleep because you could be making some big-time money.

As we get closer towards around 9:30, that's where I always like to put together by game plan. I always write out a morning watch list that I send out to all our members, but the morning watch list is also for me as well. Writing out every single top gainer, every single stock with hot news, every single hot chart stock, you know, every single previous top gainer, every stock that I think has potential today, it's getting embedded in my brain and I'm saying, oh this is one I definitely want to focus on for this price, or this price, or this price. So, when I'm looking at these stocks right at 9:30, I'm keeping my eyes on the scanners and seeing what's going to be getting their biggest rips and best runs.

Now, between 9:30 to 11:00, this is like my prime-time hour. The first hour and a half, or the first two hours of the market are always going to be the best. Because people are excited, it's a new day, we have all these hot press releases, the bell is open and the most volume is here. So, when we have very big volume or big (volatility 00:25:19) in the stocks, we're going to be seeing the most activity. I always say volume equals activity, activity equals profit. As long as the stock is moving up or down, we're going to be able to make some sort of money, if that's on the long side or if that's on the short side. If that's again, buying a stock for a break out, getting a dip buy or shorting the stock back on down, we're able to make money. And the morning is when we're going to see the most.

Now, as we get closer to lunch hour, 12:00 to 2:00, that's where I usually, you know, take a little bit of step back. That's also a very dangerous time that most traders don't realize. A lot of people that are new, they start trading at 12:00 to 2:00, but that's a time that a lot of traders are not around their computers, that's a lot of times that we're not seeing stock move up and down, because at the end of the day I know sometimes we kind of get lost in it, but we see a lot of stocks slow down. And we need to understand that stocks really only spike, why? Because people buy them. Stocks drop because people sell them. And if we have a period of the day, the middle of the day, where no one's really buying or selling, you shouldn't be buying or selling because you're not going to be able to get anywhere. It's just going to be sitting.

Again, going back to another sports example, imagine the first quarter of a game. It's exciting, people are happy to be there, the tip-off just happened, everyone's jumping up and down. But then you get to half time, what happens? Half-time people go to the bathroom, grab a hot dog, do whatever they got to do, things are really slow, nothing's really happening on the field, nothing's happening on the court. Then as you come down to the last little bit of the day, the end of the day, that's where things start getting hot. That's the fourth quarter. People are trying to make their final trades before the market closes. Day traders coming in, swing traders trying to hop in before the end of the day. Everyone's trying to get their last little profit before the end of the day and then after hours start up where we kind of a few hot press releases here and there from 4:00 to 6:00.

But really for me, I start trading right around 7:00 am. My day usually ends up right around 4:00 pm, but I always again, keep my eyes on the scanners every now and then until about 6:00 pm at night, just in case anything starts popping at all. So, usually around my computer looking for some trades for about 11 hours a day, but again, you know, that's just me. Not every trader has to do that.

Sean, you've been working really hard to launch a new project that has a ton of potential to help new traders, I briefly alluded to that a few minutes ago. For our listeners who aren't yet familiar with TradeCaster, can you give us a brief overview of the platform, and what it was designed to do?

Yeah, so TradeCaster is where I live stream my trading every single day. You know, there are a lot of people out there that of course, have chat rooms but what I wanted to do was make a platform that is going to help, not only new traders, but also give a place for traders that are experienced to be able to strive as a trader. I always thought when creating of course, TradeCaster.com, is what did I need when I didn't have anyone? What did I need when I first started stock trading? I want to give you of course, straight, blunt answers, have everything set up. I don't want to say, okay, hey how do I find how a stock is going to be great and lead you to one video that didn't really have much, to go to another video that didn't have much, to just like purchase something at the end. That's not what we want here.

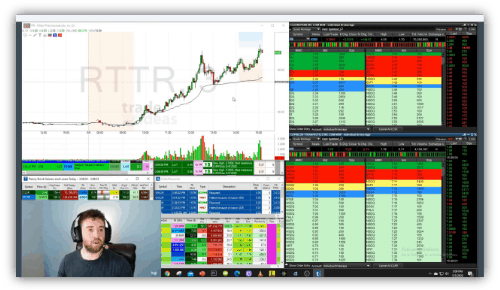

Every single day I am on the mic talking from 7:00 am all the way up towards around 6:00 pm, and just showing you exactly what I'm doing. So, on tradecaster.com we have a 250-hour video library, if you are a new trader and need to get started on your trading. We have a chat room with over 500 traders in it, with all different levels. We have an alerts chat where I alert every single day. And on top of that, I live stream my trading every single day. Where I live stream my professional scanners, I show all my trades, I talk you and walk you through every single play, and I just try to make the best overall community where I say, hey if I had this when I first started off I could strive and excel in my trading career, at such a quick and rapid pace. Because I know so many times there are so many different chats out there, that are just let’s say discord and not, you know, saying anything bad about that whatsoever. But you know, when you're sitting and just typing in a chat room, what kind of value are you getting from that? You know, just typing in a chat room and not having, first off any one speaking, and if there is anyone speaking not having a screenshare where you can actually get a visual out of it, is very hard to comprehend.

So, not only do I want to of course lead by example, but I always want to teach you and I want to show you. And even when I take a loss, you know, all our members see it. You know, I'm only a human of course, and I believe I am a great trader but at the same time losses will happen. TradeCaster also has the ability to expand, which means that we can allow many people to live stream at a time also. So, not only are there times that I'm live streaming, there's also other very successful traders live streaming. That could be me, other top traders in chat, other guests that I reach out to, and it always just gives people a platform to be able to visualize, see, and learn from other successful stock traders. So, we try to always think about anything we possibly can and whenever a member says, hey can you add this feature? The beautiful thing about it is we just hit up our program team and they add it within a week. So, any feature that people want we always add it right away. So, we're constantly growing and constantly adding new things as well.

Yeah, it's such a great concept for a trading platform. And I love the fact that there's so much transparency, you know. That's one of the things that you really don't see with most other trading chat rooms, you know. You just don't see the transparency. You don't know exactly what's going on behind the scenes. But the way that you've set TradeCaster up, as you mentioned, all of the traders that are in the room, they see every move you're making, and they get all of the ongoing commentary throughout the day which is incredibly helpful when it comes to cutting down that learning curve and to learning the process of trading, risk management, you know, where to take your profits at. All of that is happening real-time and everybody in the room can see that. So, I love the concept and the transparency of TradeCaster.

Oh, yeah, thank you so much for that. That was one of the most important things for me. And as I said, you know, the live stream is where you live trade in real-time, second by second, I bring over my P&L box from my broker and I show all my statements, every single time I trade. That's the most important thing of course. You know, being a new trader, you want to learn from someone whose been in your shoes and of course is successful. No one wants to sit behind a chat room and keyboard and hear, okay, buy now. Why? What's the reasoning? You know, this is what I want to show you, hey I'm selling now, why? You know, what's the reasoning? There's no learning behind that.

So, having the live stream — hey I'm buying this because of this reasoning, let's break down the press release, let's go over this chart set up, let's learn this together. Hey, okay, I'm going in at this area. Alright guys, I'm getting out at this area. Why is that? Volume is starting to fade, level two is starting to look a little bit weaker. So, we can break down every concept in real-time, so not only are you going to be making money, but on top of that you guys are also getting an education and getting confident in yourself. And that's the most beautiful thing about it.

Exactly. What would you say inspired you to develop TradeCaster?

Just the fact that, you know, as you've said before, there are many other chats out there and you know, I'm never a person to talk negative on another chat room whatsoever, but I do understand that there are chats out there that aren't very beneficial, whatsoever. It's just, you know, buy here, sell here. And people just sit around and say why are we buying here? I don't know, but that guy bought here. So, you know, you're not going to really get true value out of that. And I see so many people complain on that over the internet, every single day. And even, you know, people that aren't aware of TradeCaster, every single day I'll go through Twitter or Stocktwits and all they're doing is saying, oh, people are just following this guy, or following this guy and hiding behind a keyboard and that's not very helpful to their trading career.

There are of course people that may not be in it for the right reasons and there are traders that are trying to learn the right way to trade. And to have full transparency where you can say, hey, watch me trade, I'll walk you through every single trade and you have of course the decision if you want to buy in. If you don't want to buy in but on top of that you're also learning, and just saying, okay I get his reasoning behind it, that's the most important thing for me. And it all came down to, what did I need when I started off? Because I've been in your shoes, it's not like I just, you know, all of a sudden knew about stock trading. I didn't know anything about stock trading when I first started, you know, 6,7 years ago.

It all came through working hard day after day, and giving this my all, and I think back and I said okay, if I had this answer I could have been successful, or this answer I could have been successful, or if this person taught me how to find hot stocks, or if I knew how to read a press release or if I knew, just you know, what stocks to trade, you know that's what I want to break down for you. Also, on top of everything, you know, I have a one on one chat room where you guys can hit me up, or just ask me questions directly. And that's a huge thing as well. It's not like I'm hard to find or hard to get to. If you have a question, hit me up, I'll give you a straight answer for it. That's, you know, a beautiful thing as well. I don't want to be leading you down some crazy funnel path that's just going to lead to a DVD at the end. You know, you have a question, just let me know and again, I'll give you a straight answer no matter how long it takes.

Yeah, I think it's great for learning the mindset. Being there in the saddle with you every day, because you're not just taking trades. You know, you're explaining what levels you're looking at, why they're important to you, where you're cutting if the trade doesn't go as planned, all of that is so important for a new trader that's trying to learn. It's not just about having a crutch and following, you know, following a trade alert, it's about learning to be independent. It's about learning to think for yourself, learning to spot trends and to identify areas of interest and make decisive trades based on the information that you have. And that's really what becoming a trader is all about.

Exactly, it is.

And unfortunately, I agree with you, there are many communities, many chat rooms that don't really place an emphasis on that. It's more of a stock alert service where people are simply following the guru. And they're not really learning the mindset to be independent. So, I think TradeCaster is very unique in that regard and I think that's a huge positive. What have been some of your failures so far with TradeCaster and what have you learned from those failures thus far?

I mean, the biggest thing of course, you know, about having so many people watch you trade every single day is sometimes of course you may try to do a little bit more what you should. You know, as a stock trader and someone who's doing it full time every single day, you know, I have over 500 people watching me. And I know a lot of times, you know, I'm constantly trying to teach education, do lessons, I'm constantly trying to trade, I'm constantly trying to help out every single person. And when things get a little bit slow, sometimes you may hop into a trade that maybe you shouldn't have. Or maybe you do something that maybe you shouldn't have just because a lot of times you want to help out the community as best as you can, and you want them constantly engaged.

The last thing I ever want is maybe, you know, a slow or maybe a time that people are bored because stock trading is such an amazing thing, and it's such an amazing opportunity. And I just want people to constantly be able to see that. But you know, kind of some of the failures of course would just be starting off and you know, learning what makes a chat room really run the right way, and of course, you know, live streaming and how to be the best mentor you can be.

So, you know, that was all the way back when I started. The original site we had was Dekmar Trades and then we switched to over to TradeCaster about 2 years ago now and just have been, you know, slowly growing, growing, growing, nearly every single day. But, you know, as a mentor it's all about just helping out of course the members every single day and just making sure that they're enjoying it.

What do you enjoy the most about being an educator in the trading industry?

One of the best things is just seeing someone who is absolutely new, come in knowing nothing, and by week 2, week 3, they're making their first trades. By a month and a half in, you see them over in profits chat and they're the person saying hey, just made $400 on the day, thanks Dek. Hey, just made $600 on the day. Next thing you know, 2 months later they're making more money than me.

You know, I always find that extremely satisfying and one of my favorite parts of the day is going over to our profits section of our chat room and just, you know, seeing all the people that were new and the people who asked me such beginner questions a couple months ago, now saying, oh hey, I'm thinking about switching over to full time. Hey, I'm making this sort of money. Hey, I've never been able to see this type of cash before. So, that's always, you know, such the most satisfying thing in my eyes as a mentor. Especially when they've been bouncing around maybe from this room, to this room, to this room, and finally have found some sort of success.

So, you know, that's my favorite thing. I find it extremely rewarding and I absolutely love what I do every single day. As you can tell, you know, I'm extremely energetic, it doesn't seem like I die down a lot of times and this is the momentum I usually keep up from 7:00 am to 7:00 pm, just because I got nothing in the world to complain about. You know, I do a job every single day I love. You know, I work with amazing members every single day and we're all out here just having a fun time, you know, stock trading. It's not much better than that.

In regards to TradeCaster, how frequently do you add new features and functionality to the platform?

We probably go every 2.5 weeks that we try to add something new. Especially when someone asks for something, I always send it right to our program team and they make it happen. You know, when we first started at Dekmar Trades, about 4.5 years ago, we started with just a simple chat. We had nothing but a chat room. And then someone said hey, you know, can you add a video library? Sure. Hey, can you add a live stream? Hey, got it. Hey, can we add, you know, this, that, this, that, you know, one on one chat, can we add tagging traders, can we add this, and then from here it's just been, you know, explosive ever since and we just, you know, non-stop now. Whenever someone wants something, we just add it towards it, because we just want to make this the best community you possibly could have.

Well, we're almost out of time for today, Sean, but there's one more thing I wanted to ask you. What can you tell us about your future plans for TradeCaster?

Future plans for TradeCaster, is just going to be, A- you know, continue what we're doing. 2020 has been my best year of stock trading so far. Month after month is getting bigger and bigger. Back in March, I was able to make over $20,000. April, last month, was $27,000, and right now in May, I'm currently up about $11,000. So, I'm averaging around $1,000 per day right now. Live streaming everything, we're going to have brand new lessons coming on out. We have also a brand-new textbook that we've never put out before. We're also, of course, adding or partnering with many different scanning companies, broker companies, Lightspeed is one of the companies that we actually just partnered with. All our members are able to get discounts on free trades.

And we constantly are just searching for different partnerships, and constantly always reaching out to different companies that you guys are going to be able to save money. Because the last thing we should be doing is spending money on things that we really don't need to be paying for and focusing on our stock trading accounts. If we put that into our accounts of course, we can trade and make more money. We don't need to spend $200 on scanners, we don't need to spend $200 on trading fee commissions, we don't need to spend $200 on educational stuff. Lets all again, be able to save our money, I'll get as many partnerships as we can, that's a huge thing I've been working on for you guys to be able to save your money and move it to your trading account, because that's what really matters.

That's awesome, it adds a lot of value to the membership for sure. Well, that does it for our interview today with Sean Dekmar. Sean, thanks so much for coming on and taking the time to tell us more about yourself and also about TradeCaster. We're certainly excited to see how the platform develops going forward. So, that's it for today everyone, until next time happy trading.

Hey, thank you so much.