JOIN THE DISCUSSION

Overview

Mark Minervini’s premium subscription-based membership website, Minervini Private Access (MPA) provides subscribers with a unique opportunity to trade with and learn from one of the best traders in the industry today. Far more than a run-of-the-mill stock newsletter, Minervini Private Access is a comprehensive trading education platform that includes real-time trading alerts, top-shelf market commentary, weekly study sessions, Q&A, and much more.

Most members of MPA were initially introduced to Mark’s high-performance SEPA trading strategy through his bestselling books. Trade Like a Stock Market Wizard and Think & Trade Like a Champion are two of our all-time favorites and they provide foundational information for Mark’s trading system. Minervini Private Access builds on what is taught in those books, providing the essential hands-on experience that’s necessary to truly learn Mark’s approach to buying and selling stocks.

Membership Details

| Service | Minervini Private Access (MPA) |

| Founded | 2006 |

| Subscribers | 1,000+ |

| Included | Live stream trade alerts and updates, virtual training room, video lesson archive, post archive, portfolio tracker, risk calculator, RBAF calculator, resource recommendations, weekly webinars with Q&A, mobile app |

| Subscriptions | Monthly, annual |

About Mark Minervini

A veteran stock trader with nearly four decades of trading experience, Mark Minervini is no stranger to above-average market returns. His SEPA (Specific Entry Point Analysis) strategy identifies stocks that are capable of delivering the superperformance that resulted in his U.S. Investing Championship win in 1997.

What's Included with Minervini Private Access

As mentioned, Minervini Private Access is a comprehensive educational package that includes many features and tools designed to take your trading to the next level. While many so-called trading gurus desire a following that’s fully dependent on them (and their products), Mark Minervini’s goal with both his MPA service and annual Master Traders Program is to train people to become completely independent traders. This is an important distinction, and Minervini Private Access provides a very unique opportunity to learn trading firsthand from one of the world’s finest.

After signing up for Minervini Private Access, your account will immediately be set up and Mark’s staff will email you the login information needed to access the member’s area. Once inside, you’ll have full access to all of the tools and features of MPA — before jumping into everything, though, we highly recommend that you take a few minutes to check out the User Guide as it explains more about the various sections in the site’s back-end and the terms used.

So without further ado, let’s take a look at all of the features and functionality included in Minervini’s MPA membership…

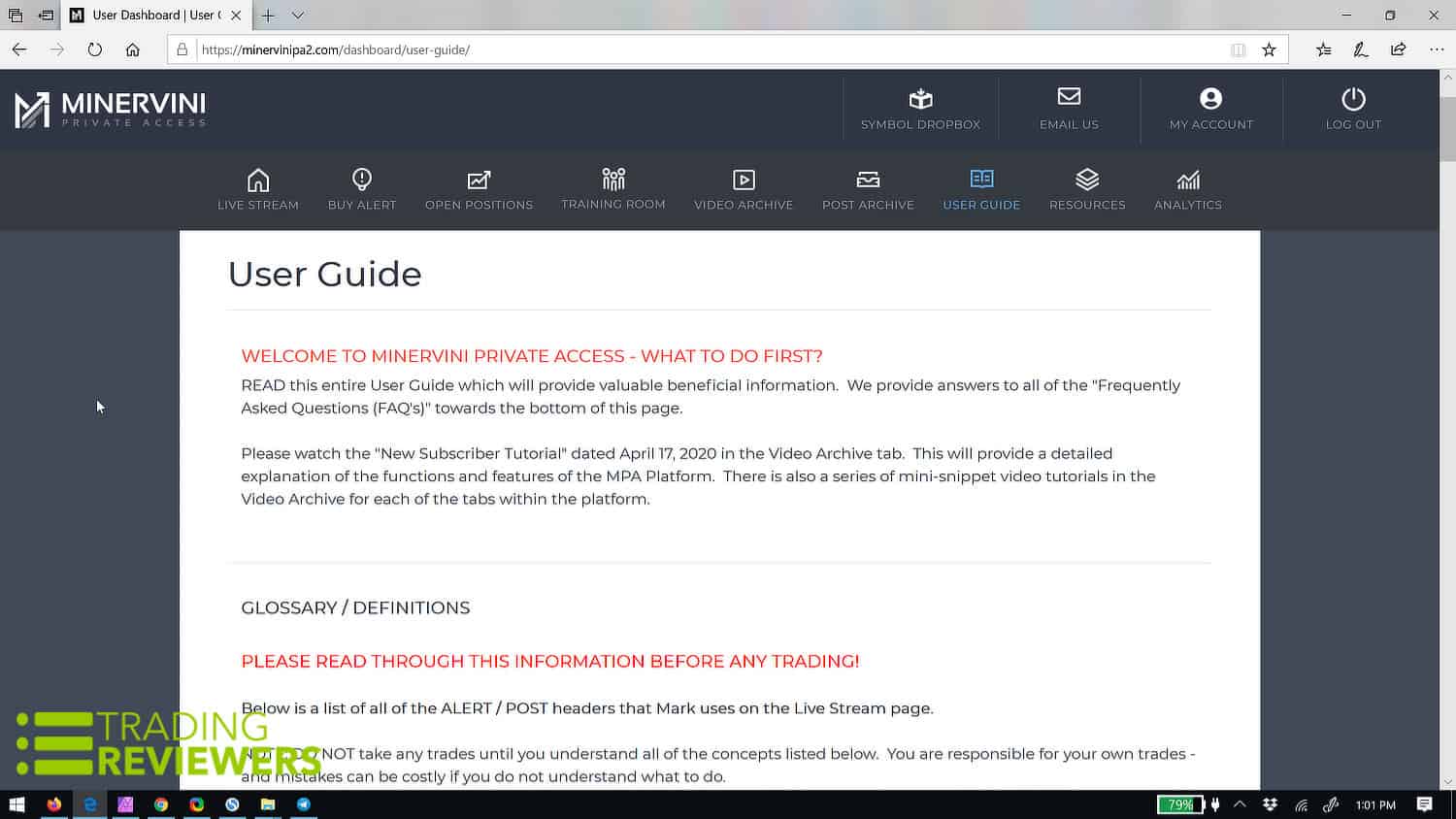

User Guide

As we mentioned, the User Guide is the very first place that new members should go after logging into the MPA members’ area. This section of the site provides you with an explanation of the terms you’ll see used in the community as well as the answers to some commonly asked questions. There’s also a New Subscriber Tutorial in the video archive area that is helpful to review.

Real-time Live Stream Trade Alerts & Updates

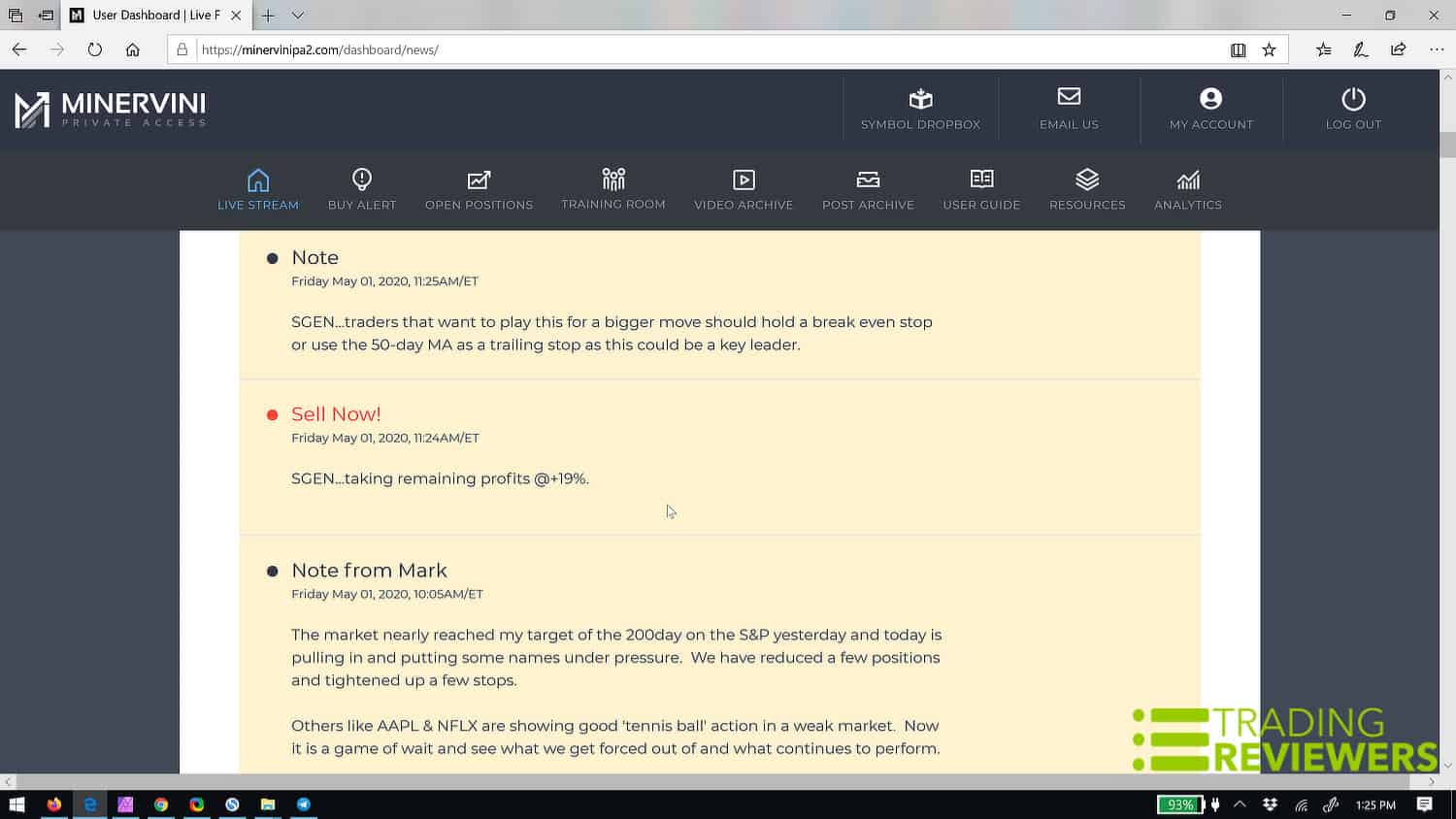

The MPA Live Stream page is one of the most important areas on the website and it’s something that you should keep open during the trading day. In the morning before the open, Mark always provides some general market commentary, updates the stops on all open positions, and notifies members of any names that are on close watch (“Buy Alert”/”Sell Alert”). Throughout the trading day, Mark also provides additional information and real-time updates whenever he buys and sells stocks.

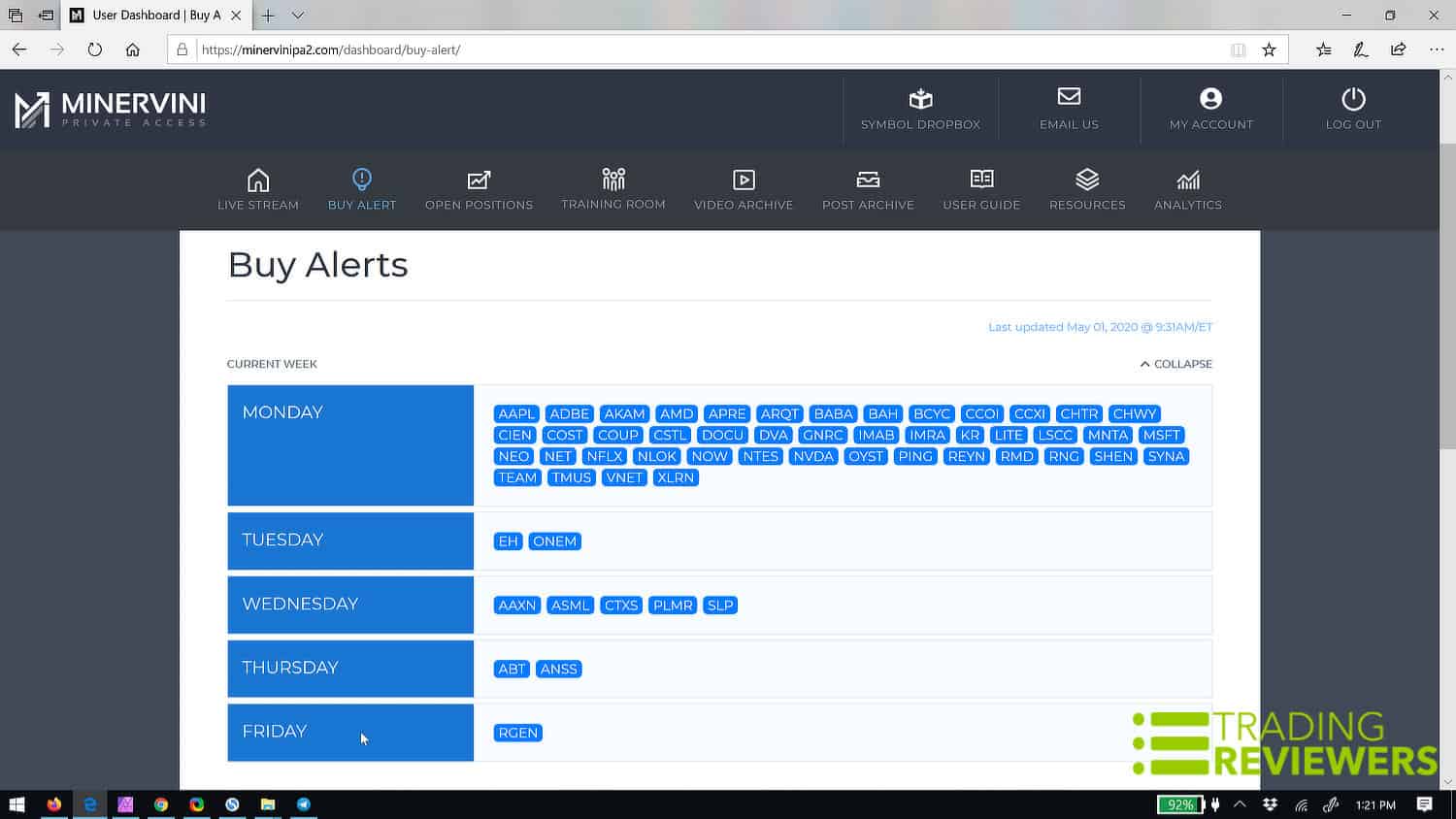

Updated Weekly Watch Lists

In the Buy Alerts area, you’ll get daily updates of stocks that are on Mark’s watch list. The phrase “Buy Alert” is slightly confusing as it is only stocks that are being closely monitored for potential buy (and sell) setups. This section is cleared out at the beginning of each week and updated with new names.

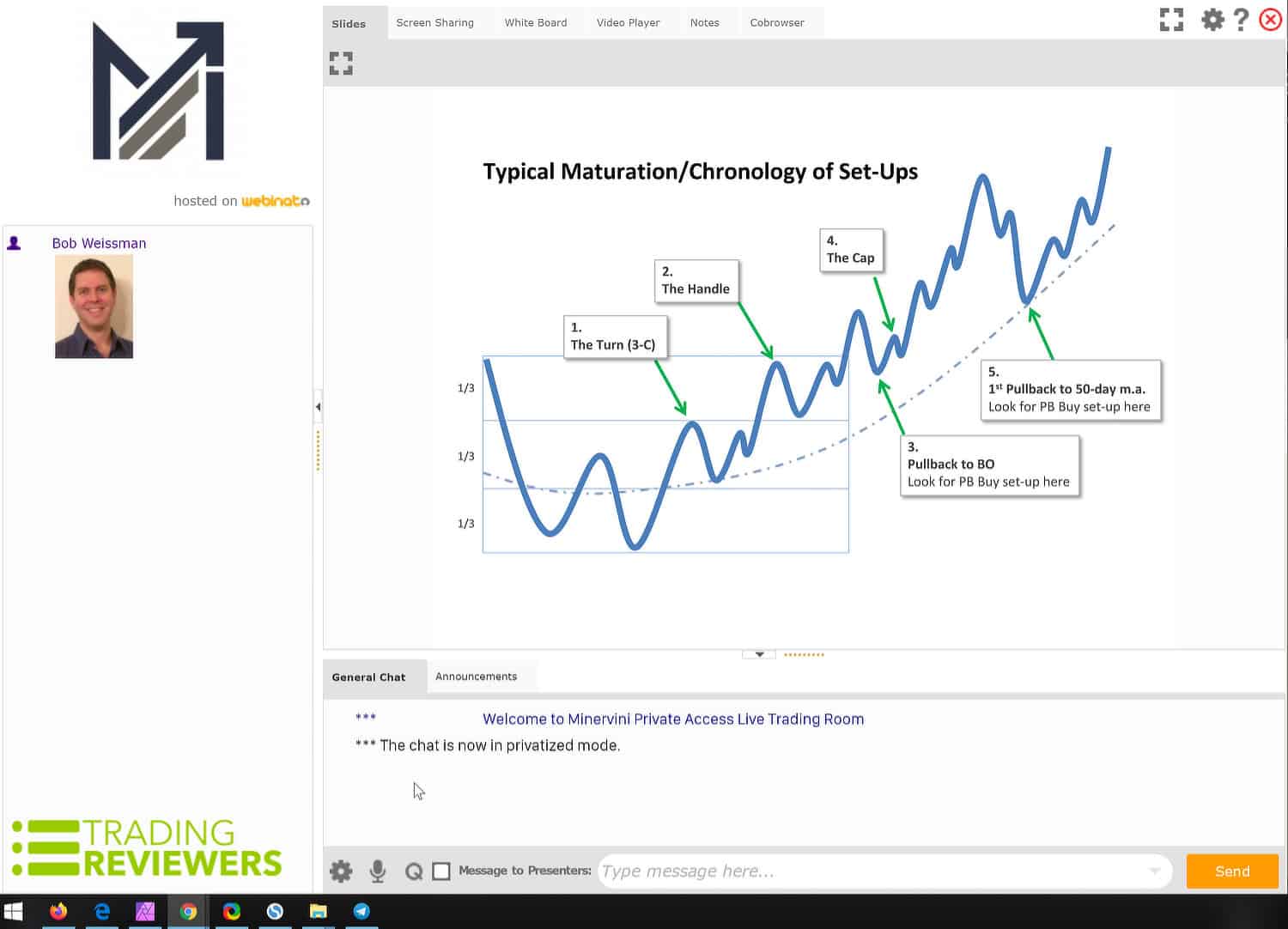

Interactive Training Room

The interactive training room is hosted on Webinato and it’s where the weekly study sessions take place. These are very valuable calls that provide you with great insight into Mark’s mindset as he reviews charts and teaches MPA members additional detail regarding his stock selection process. In addition to Mark, these live training webinars often feature David Ryan, Mark Ritchie II, and Minervini’s assistant, Bob Weissman. All of the sessions are recorded and conveniently made available in the video archives area for later reference.

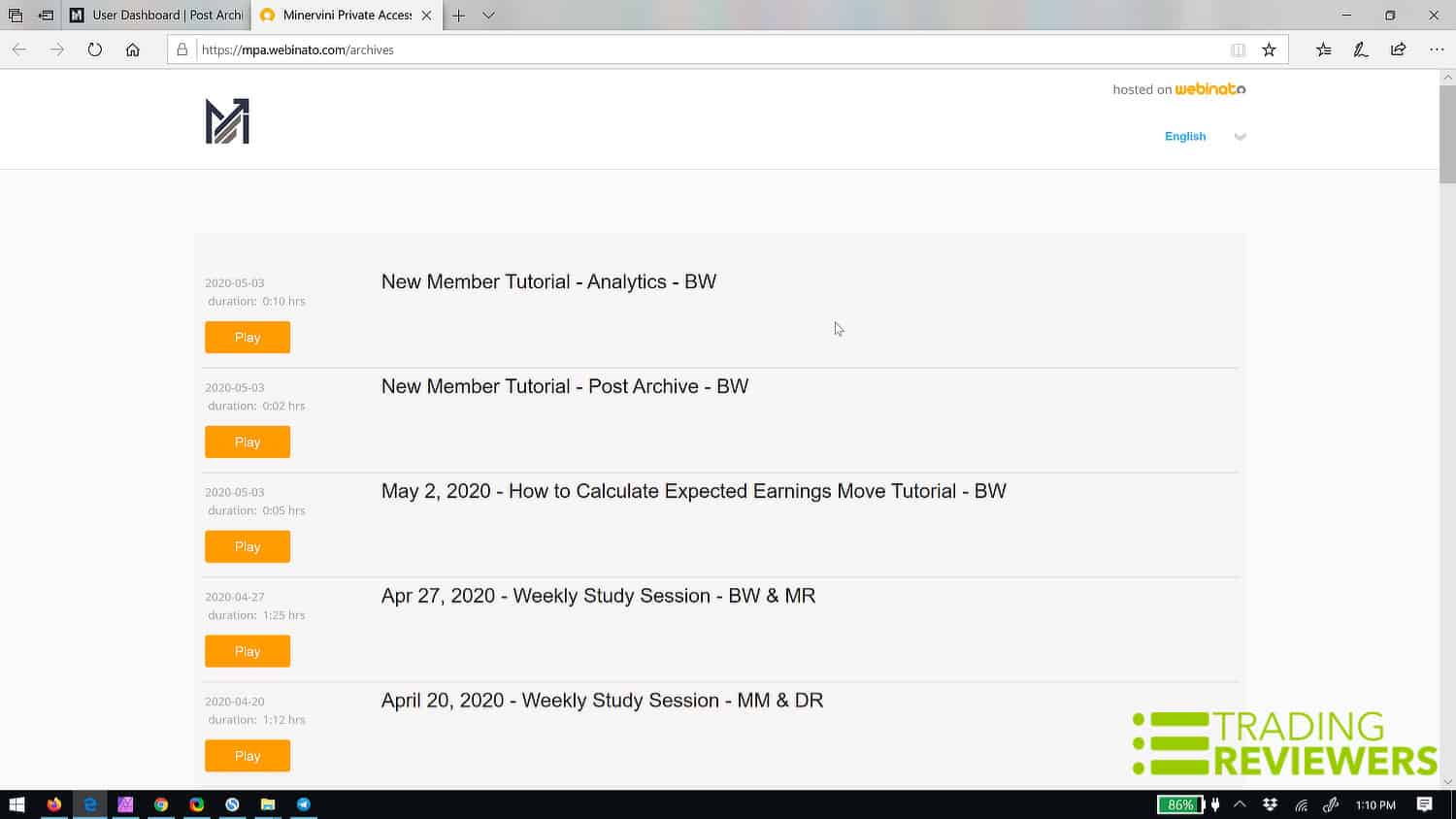

Video Lesson Archive

As mentioned, the video lesson archive contains all of the previously recorded study sessions. Currently, there are video lessons that go back to October of 2013, providing new members with a full library of high-level instructional videos to learn from. While you can play these videos through the website, we’d highly recommend downloading them for two reasons:

- Browser-based video playback doesn’t provide you with a way to speed things up. We prefer to download the video files and play them back through VLC Media Player which gives you the option to increase playback speed.

- If Mark decides to discontinue MPA at some point, having a downloaded copy of all video lessons will allow you to refer back to the information at any time in the future.

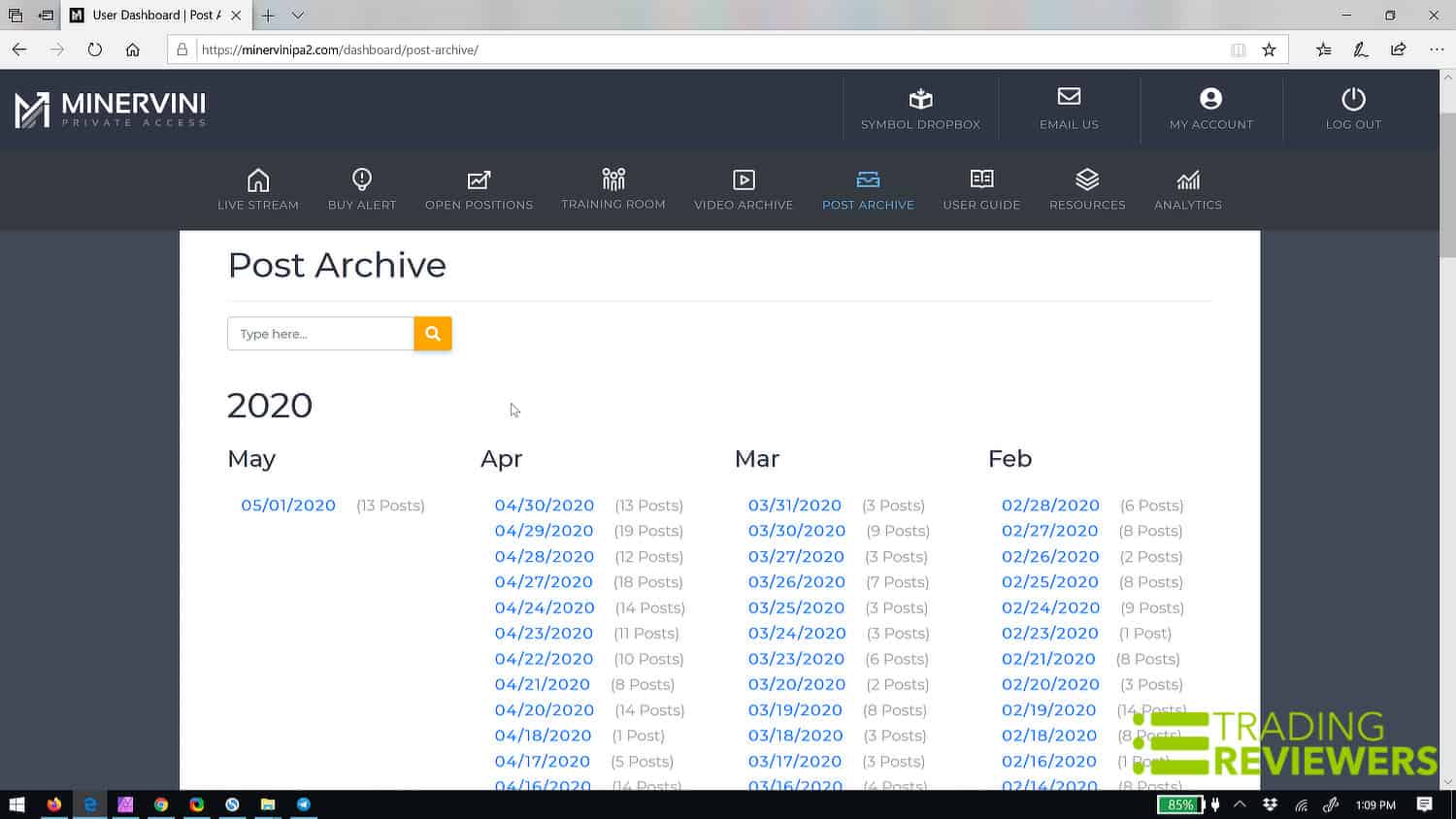

Post Archive

The Post Archive area allows you to review Mark’s daily posts that appeared previously on the Live Stream page. At the moment, the archive allows you to go back to August of 2019.

Portfolio Tracker

The MPA members’ area features a built-in portfolio tracker that allows you to log all of your trades. You can view your open trades, closed trades, and even export the information to a .CSV file. Additionally, there’s a handy monthly tracker that displays the following statistics:

- Average gain

- Average loss

- Net

- Ratio

- Win %

- Loss %

- # of wins

- # of losses

- Breakeven

- Total number of trades

- Largest gain

- Largest loss

- Net

- Ratio

- Average days gain

- Average days losses

- Trading commissions

Trade Calculators

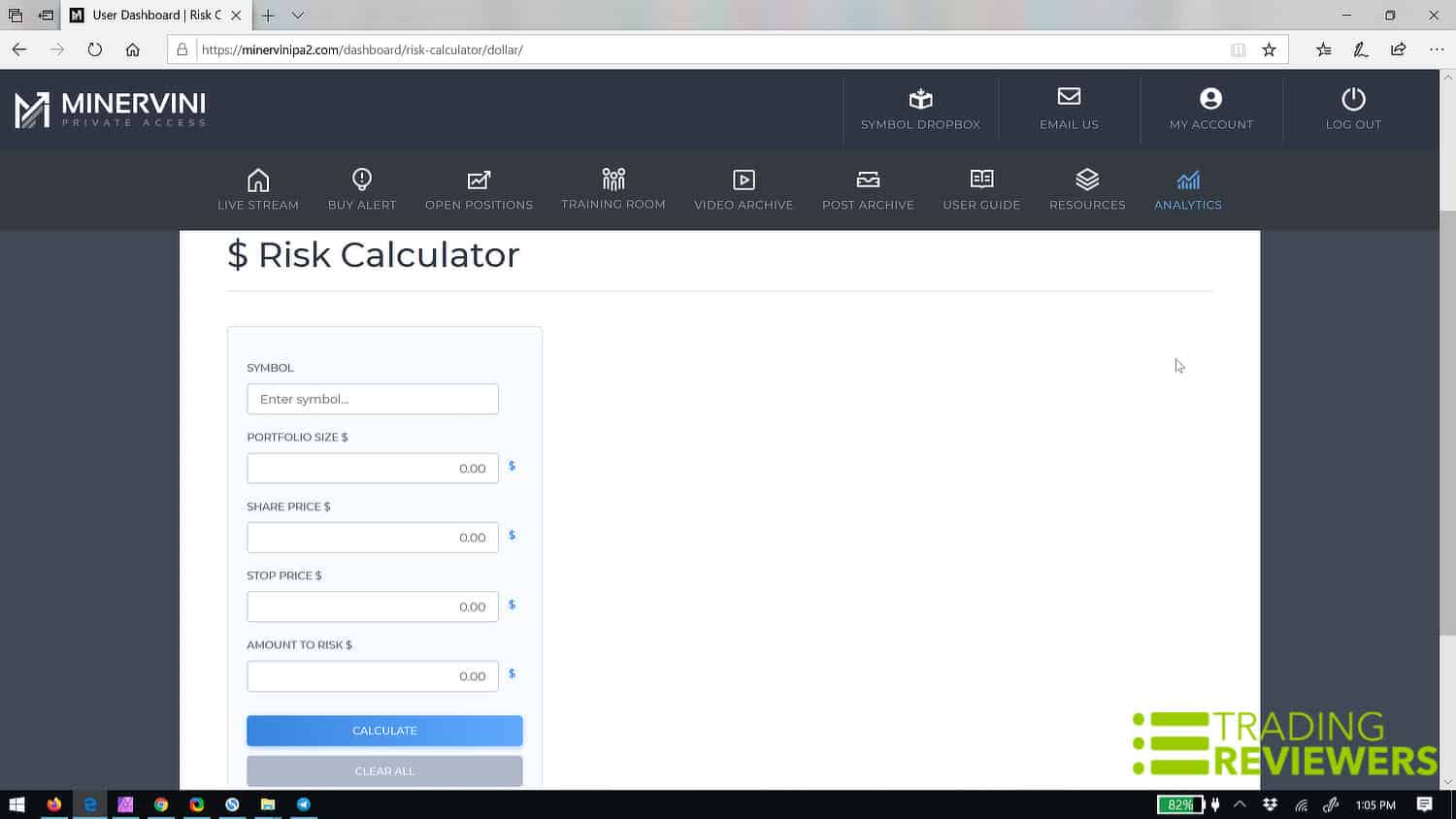

Mark also provides several trade calculator tools in the members’ area. Under the Analytics tab, you’ll find a DRMA tool, RBAF calculator, % risk calculator, and $ risk calculator.

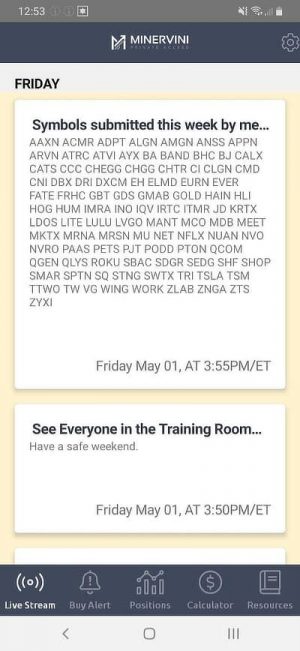

Mobile App

Minervini Private Access now provides subscribers with a convenient mobile app that makes it easy to access the site remotely and receive update notifications. The app is available for both iOS and Android users and you can log in to the app using your normal login credentials.

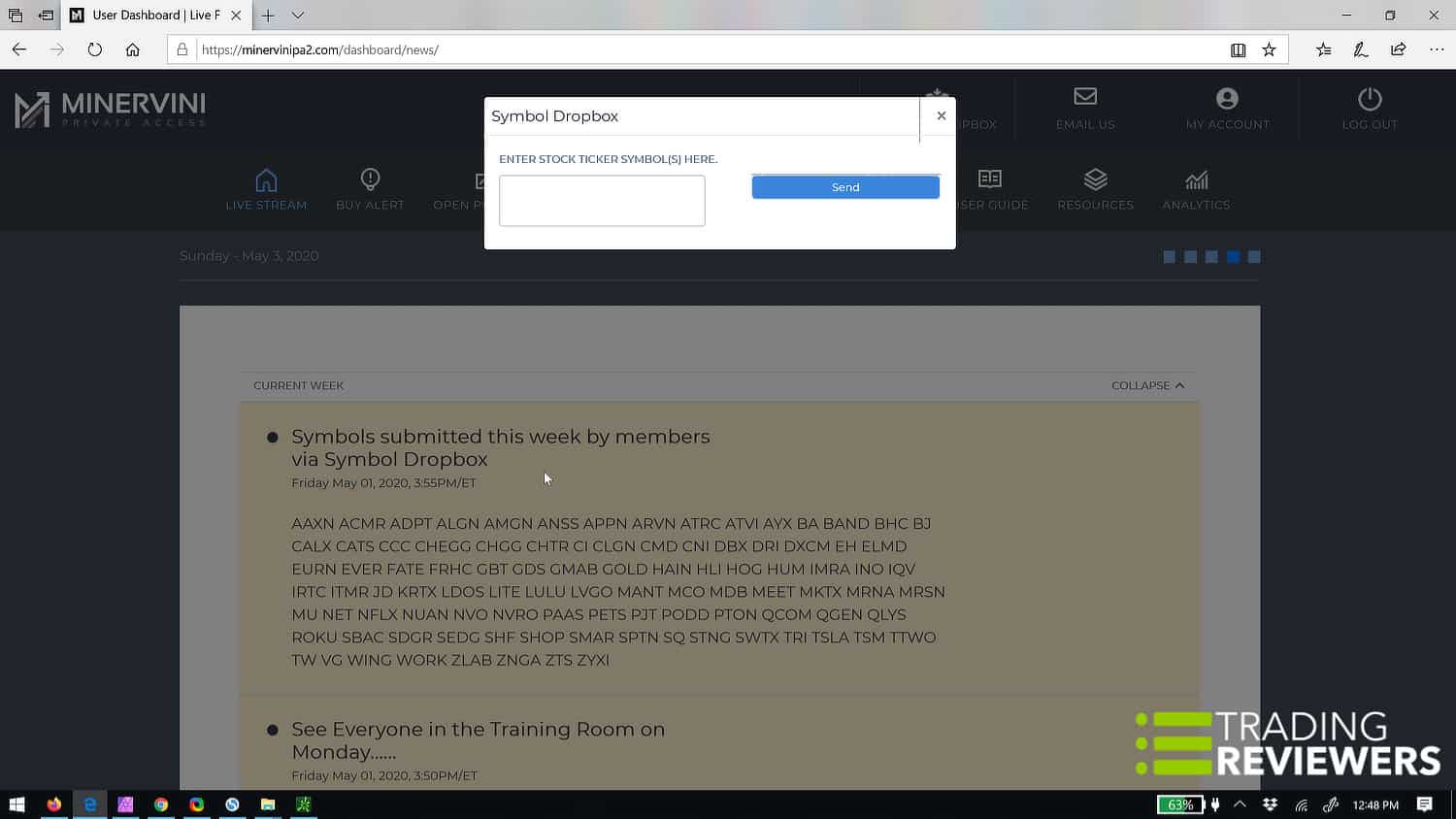

Symbol Dropbox

Last but not least, MPA offers a Symbol Dropbox feature that gives members a quick and easy way to directly submit tickers to Mark throughout the week. Mark reviews all member-submitted names and if they meet his criteria, they’re added to MPA’s Buy Alert list.

Reader Reviews

Frail…

Mark banned me from his twitter account because I made sarcastic remark. I did not expect his ego to be so frail. I apologized, but it made no difference. Mark has assembled a great team, identified in the one and two star reviews above.

Mark’s books are excellent, and contain everything he knows about trading the market, as long as it is a bull market. His course is a waste of money if you can read. I’m sure the course is a handsome supplement to his income.

I recommend reading his book, “Trade Like a Stock Market Wizard” and following his instructions on entries and exits. The other books are redundant, just as his “Master Class” is redundant. Mark discloses in his master class that he has not taken a vacation or left his desk for more than a few days in the last forty years. If you measure success by $ alone, he is successful. I kind of pity him.

Overpriced…

I was a member of Minervini Private Access for several years and attended his Master Trader Program. Minervini is very knowledgeable, and at times, Minervini posted sound stocks and excellent trades, and I would recommend his books. However, it seemed to me that he also used his knowledge and skill to exploit the hope and greed of his clients.

First, I think his service is overpriced at $6,000 a year, and his Master Trader Program is overpriced at $5,000. Also, I think Minervini is a terrible teacher. In the question-and-answer session, Minervini would commonly get irritated at his client’s questions and criticize their questions. I think that you can find better services and programs at a lower cost with more effective teachers.

Second, Minervini focuses on volatility contraction in stocks because when the stock moves to either the upside or downside, it can be explosive especially if the stock is thinly traded. However, the stock can also be manipulated especially if the stock has weak fundamentals. Each week, Minervini would post the stocks he was watching at the market open, so you did not have time to research them, and the stocks would commonly change from week to week. Thus, it would be a challenge to get a strong understanding of the stock’s fundamentals.

During market hours, Minervini would put out a “breakout alert” or “buy now” alerts on the stocks he was watching as the stocks were breaking out. At times, the breakout was a legitimate market induced breakout because the stock was heavily traded. However, commonly the stock was thinly traded with weak fundamentals, and the stock would surge in value, and then come crashing down. At times, I saw the service would put out a breakout or buy now alert on a stock. I looked at the stock on Market Smith, and it was not breaking out, but moments later, it broke out. It could have been a lag in my internet, but it happened several times, so it seemed as if Minervini or the service was creating the breakout, pumping it to their clients, and then selling into the manipulated demand. Also, Minervini would add stocks to the watch list during the trading session. At times, just after adding the stock, the stock would breakout and at times, eventually crash down. Minervini even admitted to “popping” stocks at times because his account size was so large.

Minervini said one of his tactics was to enter the trade with large size, sell a portion into strength, and then free roll the rest, which is a sound strategy, if the stock is breakout on fundamental reasons and not manipulation. Thus, it seemed his service was alerting their clients to a combination of both legitimate and manipulated stock breakouts.

Minervini also talked a lot about the compounding effect of small profits turned over frequently enough to accomplish your goal. This is a sound strategy, but the hard part is consistently doing it. Unless, let’s say you hypothetically pumped up a thinly traded stocks with weak fundamentals to your clients after you purchased large amount of the stock to create a breakout. Then, you sold your shares after your clients drove up the price. If you do that frequently enough, you might be able to win something like the US Investment Championship.

I lost a lot of respect for IBD because they give this guy a lot of airtime.

Value isn’t there…

The following is my own experience and personal opinion.

Mark’s service is overinflated bloatware marketed by a highly persuasive highly successful salesman; being Mark and his ego-driven Twitter account. Their new selling point is their analytical trade tracking software (built into the site). Investing in hiring a programmer to give you your own trade analytics so you’re not married to Mark’s $6,000.00 a year trade tracker. Bob reminds me of a used car salesman and his sole purpose is to extract your hard-earned money from your pocket… He’s trash.

Mark Ritchie is garbage as well and is riding off the coattails of Minervini. Ask Mark Ritchie about his RTM Capital firm… Their performance sucks and does not have super-performance gains. Furthermore, it’s interesting to see Mark R increase his Twitter exposure. His tweets sound exactly like Minervini and what he spews he’s just trying to sound smart.

I’ve read Minervini’s books, gone to the seminar, and done multiple years of MPA service and It’s not worth the time or money. There are far better options out there for far cheaper. I am more consistent and more profitable now than I ever was blindly following Mark and his methods.

So in a nutshell Mark’s books are great, his service and MPA regurgitate the books and are way too expensive. The value isn’t there and most importantly….. THEY DO NOT TEACH YOU HOW TO THINK FOR YOURSELF.

Front running…

I believe he was front running the overwhelming majority of the stocks he put on buy alert in 2021 because he was in the USIC. Almost every low volume stock he put on buy alert would jump 5-10% followed by crashing minutes after. Come to find out he had triple digit gains yet most of his buy alerts all crashed the same day. I can understand 20% of buy alerts squatting same day, but it was more like 90%. He either was front running or has a significant flaw in his buying criteria.

Save your money…

Minervini Private Access – MPA is basically a complete rip-off. Avoid!

For $1000 per month, or $6000 (seriously overpriced!) for an annual subscription you get a few lamer stock recommendations each week and so-called “training classes” each Monday. These classes are nothing but Mark Minervini, along with his deputy dog Mark Ritchie Jr. holding court and answering written questions with a snarky, egotistical and condescending attitude.

You can also subcribe to Minervini’s Twitter feed where he hawks his books and courses like carnival barker. He has thousand of adoring boot-lickers who tell him how great he is. Yuck.

Remember, you are trading to make money, not to give star power. If you are not trading to make money, then you should find something else to do with your money and time and just buy index funds.

If I could give this garbage a -10 stars, I would. It’s really that bad. Save your money. Learn to trade by reading William O’Neil’s books, and taking reasonably priced classes if you need to.

He is front-running…

Mark deserves credit. He overcame a great deal to be where he is today and no one can take that away from him. The thing to remember about his service and results is he is front-running. By the time the typical member is able to respond to a buy/sell alert, Mark has already made the trade. And, due to the # followers, and some low liquidity plays, his followers pump up a stock rapidly then he takes his profits. The investing competition would be more fair if they didn’t allow traders with troves of followers to compete. Just to repeat, Mark is very good and very wise. But don’t go into his service thinking you can just follow his trades and make money. That won’t happen.

Improved my trading…

I have been a member of MPA for about a year. The information given by Mark Minervini and Mark Ritchie are invaluable. I have learned a lot this last year, and have improved my trading considerably. However, YOU HAVE TO PUT IN the work. I now spend around 4-6 hours during the weekends, preparing for the trading week. Discipline is a must.

Most of the people complaining don’t want do do the work. They just want a signal service.

Worth consideration…

I Google these reviews a lot and on this one I feel I have enough experience to say something. I have been a subscriber now for 18 months, I did the MTP last year, and I have read his books twice.

Those who say you get what you put in are correct. Those who say it’s a huge amount of money for little guarantee of profits are also correct.

The difference is in how you look at trading. Successful trading is not a bunch of buy and sell alerts. Successful trading is a process of education and self development. You are paying for a semester with the two Marks, both proven traders. They are professors and class is in session. That’s how you need to think of it. You are not paying for anything more than education.

As a part of my personal path, I paid for a host of services. Ivan, Sam, Stewie, Leif, Florida, Gilmo, Al, if these names ring a bell than you get it – and a dozen others. In 2020 I spent $25k in services and programs. And made several times that in returns.

There are many ways to make money in the market. All of those paths require discipline, risk control, and development. This is not a game. The market can be all things to all people. If folks want to treat it like Vegas than it will be a casino for them. But there is also a very different path that leads to consistent “super-performance.”

Mark’s method is best understood as a development of the IBD base-breakout system, popularized by William O’Neil and practiced by many different traders with their own take on it. The IBD system also has the CANSLIM element which Mark desires but does not emphasize as much. The IBD “family” of methods is well-represented on the USIC leaderboard every year. It requires practice, development, and discretion – but there is substantial evidence of alpha when properly applied.

Be honest with yourself. If you are looking for buy and sell alerts with virtually guaranteed alpha, look elsewhere. Buy some MGK and play VIX games. If you are serious about developing the skill that is trading – and reaping a lifetime of success – and you have enough money to work with that this sort of investment makes sense, Mark’s service is worth consideration.

Be careful…

Be careful if you sign up for these services. I signed up for 3 months for a number of thousand dollars. I was shocked that they took the money from my account again for another 3 months and another few thousand dollars without telling me. Apparently unless you opt out, you are opted in for auto renewal. I hate that. I ended up having a massive row with his administrator, Bob and did get my money back.

The whole thing is really strange – if you are worth millions, why go to all this bother unless it is to get people to help you move thin stocks?

Ever see Jim Rogers selling subscriptions or Dalio or other big hedge fund names?

And his ego on twitter is something to behold. Yes maybe he is good but he has no modesty.

Not what he appears to be…

Mark is definitely not what he appears to be. He needs the money, that’s why he runs a service. This is what a good friend of told me.

Using members’ money to benefit himself…

Can’t agree. His “buy now” alerts on many of the thinly traded names are aimed to using members’ money to benefit himself. That’s how he is winning the USIC – not much competition in the 1M class also.

If you’re ready to put the work in…

I think people are using this service the wrong way. This isn’t a model portfolio where you would take every alert.

95% All ideas come off the buy alert list, you should be putting this in to a watchlist on Monday when it comes out and then screening them yourself, look for the set up, set your own alerts and then place the trade yourself. If there was 40 names on the WL there may only be 4 you feel comfortable with, then you wait for these to BO and know the risk prior to placing the trade.

Opposed to waiting for Mark to post it and then scrambling to get the trade on, not knowing the risk you’re taking and if it fits in with your risk. You then find you’ve bought a few % extended and messing up your risk reward on the trade.

Mark says every week do not buy extended, so if you’re buying a stock extended. That’s a you issue.

If there’s is 50% chance of losing as stated in one of the comments, meaning 50% work, that’s a 50% batting average. Thats a great batting average so congrats on that. Also Mark rarely uses an 8% stop loss, his average is much smaller.

He’s currently doing 3 training sessions a week. Two are just Mark Minervini, One on the market and one is on the stock WL for the week and open positions. Then there is over an hour long Q&A with Mark Ritchie and Bob Weissman, Mark Minervini sometimes comes in. Mark Ritchie is a great trader and capable of answering all the questions.

It’s also beneficial to get access to another great trader in my opinion.

If you go in to this service knowing you have to put the work in and you are responsible for your trading you will benefit from it. If you go in just buying every “buy now” on the feed you probably won’t make money, and be over exposed.

I’m only writing this review in case there’s someone on the fence, who’s struggling to decide. If you’re ready to put the work in, I wouldn’t pass up on the opportunity to learn from one of the greatest traders of our time.

For recent results, he’s number one in the USIC 1 million dollar + category, and many of the USIC 20K division are MPA candidates. Results speak for themselves.

P.S I Wouldn’t sign up just for a month, you wouldn’t go to the gym for a month and expect to look like Arnold Schwarzenegger LOL

Good luck!

Submit a Review

Are you (or have you been) a Minervini Private Access member? If so, please let other traders know what you think about it.

Mark Minervini Super Trader Tactics [VIDEO]

MPA FAQs

While MPA is an expensive investment, it's something that you can leverage if you treat it as more than a stock picks newsletter. For serious traders who take advantage of all the site has to offer (vs. simply following buy/sell recommendations from Mark), it's a tremendous opportunity to learn from the best and an investment that can set you up for life. As with anything else, you'll get out of MPA what you invest into it in terms of time and effort, and those who immerse themselves in the training and internalize Mark's system will find the cost of the membership to be well worthwhile.

Final Thoughts

Pros

Well-organized members' area, full access to Mark's video library of lessons going back to 2013, opportunity to learn Mark's process in real-time as he enters/exits positions, portfolio tracker and trade calculators are a nice addition

Cons

Expensive, entry/exits for some real-time trade alerts can be difficult if they're thinly traded names

Best For?

New stock traders who want to learn how to trade properly from the beginning, experienced traders looking to refine their process

What kind of results does Private Access generate? I was surprised Minervini does not offer some kind of trial at a reduced amount to see if his style is a good fit for me. And he does not post past trade recommendations to see how he has done.

Hi Mark, thanks for the comment.

Unfortunately, he does not provide a historical track record of his performance and the model portfolio holds far more positions than he actually recommends holding at one time. The reason for this is (1) because it’s impossible to take a position every time an alert is made as the names often get away from you and (2) he wants to provide new members with the ability to take trades shortly after signing up.

In reality, even if Mark did post performance numbers, members would not be able to replicate those results as he typically gets better fills (his positions are obviously put on prior to alerts being made).

Hope that helps, Mark.

Is it really worth it? I am planning to subscribe.

Hi Amit, thanks for your comment.

To answer your question, it honestly depends on the individual as this is a very expensive membership. If you’re 100% focused on learning Mark’s strategies, have already read his books, and started implementing what you’ve learned, it will help you to take things to the next level. If you’ve yet to complete those initial steps, I would hold off for the time being.

Hi there!

I have read Mark’s 1st book and enjoyed it a lot. Therefore, I am focused on learning Mark’s strategies more. However, I enjoy William O’Neil’s school of thought as well. When considering if I should join Mark’s service, what should I consider if I like both Mark and O’Neil’s method? Or how should I think about it?

2nd question: Are you familiar with Growth Stock Mentor by Jim Roppel? Can you please do a review on that service?!?

Thanks!!

Hey Mike, thanks for your comment. O’Neil’s teachings had a lot of influence on Minervini and when it comes to their individual approaches, there’s quite a bit of overlap.

As far as Jim Roppel’s service, I’m familiar with it but haven’t reviewed it at this point. I’ll put it on the list.

Happy trading…

IMHO, major difference between Mark and Bill is the role of fundamental analysis and holding period. CANSLIM is 75% fundamentals & 25% technicals while Mark seldom uses fundamentals to pick stocks. Because Bill believes in buying market leading fundamentally powerful stocks, he doesnt book profits for the first 4 weeks at least. On the other hand, Mark is a short term swing trader and nails down profits very fast and moves over to the next breakout. For him, portfolio turnover is a crucial variable for big returns.

IBD is supposed to follow O’Neil’s approach but they did not so well recently. O’Neil’s approach works pretty badly in choppy markets.

Not sure about Mark’s approach but I am interested to know a bit more.

How did you get in to MPA?

Did Mark allow you to write a review?

I will become a member in the near future, because its a once in a life time opportunity to be trading and learning from one of the very best best traders in this decade.

His books are amazing and i cant wait to teach more from him. Hopefully I will travel to US one day to participate in the Master Program.

Just look at his students and how well they have performed. 11 of top 20 in US investing Championship is MPA members.

Thanks for sharing this man!

Hi Allan, thanks for your comment. I joined MPA the same way everyone else does.

how would you compare his service vs yearly workshop ?

Hi Onder, I haven’t gone to his workshop so unfortunately I can’t help you with that…

Hello. I note the MPA website has some “testimonials” carefully chosen but no discretionary space for customer reviews e.g. the reviews here. That’s a red flag.

Secondly, the MPA website mentions Mark’s performance in the bull market of the 1990s dot-com era but there is no visibility on Mark’s portfolio performance e.g. in or since the 2007 crash. Do we have audited results of Mark’s portfolio performance that I may have overlooked?

Hi Tom, this is commonplace and is one of the reasons why we decided to develop TradingReviewers.com as it provides a non-biased platform for traders to share their personal experiences with services, software, courses, and more.

In regards to getting access to audited results of Mark’s performance, there is nothing that I am aware of. I would recommend reaching out to Minervini and requesting this.

If Mark had amazing audited results, he would publish them a thousand times over – he would not be able to stop himself.

Hi Jason,

Thanks for this post. It’s very hard to find any info about MPA and some, not me, might believe it’s a scam. I was on a call with MPA staff a few days ago and, amongst the questions i was asking for historical performances. The answer i got was that on average in the last 11 years per every dollar invested in each of the 150/200 yearly recommended trades the return was of 2,08 dollars per trade. Could you concur somehow on this figure?

Thanks a lot,

Marco

Hi Marco, I don’t have access to that data so I can’t confirm it, unfortunately.

Wondering if it’s worth signing up to a service like this if you live in a different country/timezone. The NYSE runs from 2.30am – 9am my time. If you aren’t actively trading during those hours and instead using stops would it work for you.

Hi Hannah, I wouldn’t recommend MPA to anyone who isn’t at their desk during market hours.

so I say I can only spend first 2 hours of market, do you think it is still not worth ? how about trading from my cell ?

Hi Onder, I wouldn’t feel comfortable recommending MPA to you if you’re not available during market hours.

Is this course good for a total beginner?

Hi Christine, MPA isn’t a course and I wouldn’t recommend it for beginners. If you’re just getting started and want to learn Minervini’s approach, I’d recommend his books first.

I paid 6k for one year. It was the worse experience I’ve ever had. It was just terrible, lost lots of money.

I found the sales pitch to be so highly promising & then after they have your money they verbally abuse you on the webinars. As Minervini has said, sic; “There is no such thing as a stupid question, just stupid people.”

Not surprised. I barely went anywhere, would have lost a lot except for jumping out quickly when things went wrong. Made good money trading my own stocks more or less with Minervini’s methods. Lately I’ve been hitting some High Tight Flags, which can really go. Evolutionary process.

hello EZ, could you please elaborate your experience? it will really help people who are now considering this service. thanks a lot!

I would recommend the following, in order:

1. Read all of Mark’s books. Several times.

2. Subscribe to MarketSmith and experiment with finding stocks using the method in Mark’s books. And, follow Mark on Twitter. He posts stock recommendations there.

3. Attend the next Master Trader Program. It will be sometime in the fall of 2021. This year it was virtual, so no travel or other expense. It costs $5,000.

4. After doing all of this, you will be pretty involved with Mark’s methods. You should be having some successes, some failures and learning a lot about yourself.

5. By then, you will know whether or not it is worth your while to subscribe to MPA.

It is not worth it. It takes several months to get the hang of his methods so subscribing to one month is a waste of time, especially at the end of the year when the markets are volatile. Just read his books, especially the 2 chapters on risk, & use MarketSmith from IBD to find your own early entries (He calls them cheats). I have been trading many years & have subscribed to other services that also have great results. Minervini’s “Specific Entry Point Analysis” is great when it works, however he recommends a lot of thinly traded volatile stocks that rise quickly. Usually the alerts come out too late while he buys ahead of sending the alerts for a lower price which gives him a higher percentage gain to report. He rarely gives Buy Points ahead of time like most services so if you don’t have a trigger finger, you’ll get in too late & lose money immediately during what he calls a “Natural Reaction”. I have heard him say he helped a stock a little, so by using his own huge account he can certainly manipulate a thinly traded stock which of course he denies. The majority of the stocks that are bought you probably have never heard of. They are short term swing trades, he doesn’t believe in holding long so it’s a full time job to keep up to date with the action. I would have done better this year buying leaders back in Feb-March & just held them than trading in and out. Minervini seems to be tired of teaching, prefers his long term subscribers & is very short with his newer subscribers as he comes off very arrogant & high strung on the webinars.

Agree. Mark is using members’ money to benefit himself. His methods are great and he is a great trader, but he is using the platform to manipulate stocks.

Dear All,

Minervini arrogantly giggles at your questions during the weekly training and Q&A sessions. He often not bothered to pay attention necessary to understand genuine questions, so misunderstands them and goes off on tangential rants and tirades. He has no patience or will to answer genuine scenario based conceptual questions intended to clarify trading concepts and lazily brushes them aside incorrectly calling them “hypotheticals”. He has doubtless lost his commitment to teaching and MPA is by now largely just a business to pay his monthly bills and in which his sales guy Bob keeps doing an overkill of “brand Minervini”.

Hope this helps,

Balaji

His email alerts suck. As someone mentioned, the tickers are thinly traded and the price action will surge a few %. Then it will crash or get stopped out.

Hi Jason,

Since 2017, I have read all his books multiple times, have attended all his free webinars and follow him religiously on Twitter. I have had a good run in Indian stock market (I don’t trade US stocks) using his methods. My 3 year CAGR is 26% while the Indian indices rose 13-14% CAGR during the same time. My max drawdown was 12% (during Covid crash).

Is it worthwhile to subscribe to his MPA for a month (999$) to gain access to his video archives. I am not concerned about trade ideas as I don’t trade us stocks. I just want to learn more. His MTP is way too expensive for me.

Hi Enem, that’s a significant investment to make if you’re only interested in accessing the video archives. Having said that, you may still find it worthwhile if you’re already having success with his approach and are willing to devote the time required to study all of his archived content.

Hi Jason

I have a question about the content. One of my biggest problems in trading is the daily and weekly routine. I would like to understand how I select stocks or how to definitely add a stock to my watchlist and when to remove it. In short, the process that I have to do daily or weekly. Is there a possibility that this occurs or is available in the subscription.

Thank you for your time.

Greetings Peter

Hi Peter, thanks for the comment. Yes, Mark covers all of that…

You cannot throw money at a problem. You have to have a through understanding of his system. Not just one read but 10 reads minimum. Bring up all the stocks he’s featured in his book and study what he is really looking for. You also have to have been in the market for many years to understand all the wiggles. You can find these stock yourself using Marketsmith if you know what you are looking for. I don’t use the MPA because it almost puts the responsibility for my trading on somebody else. I would only use this service for all the archived learning. Mark is brilliant and I am sure I will be making 200% year in year out because of his books and his teachings on Twitter. I have already made huge moves like Mark in individual stocks like $MVIS, $TAOP and $VERU last year like 50% gains in a matter of 3 to 7 days. I need to do more risk management to complete the whole system. I had been an O’Neil follower for 20 years. I found Mark’s system way more effective.

Does MPA provide any insight into developing mindset and routines to implement his strategy? Example like exercises to follow and prep work to be done when markets are closed. From my understanding Mark is only available during Q&A, not during market hours or after hours and most communications are trade alerts.

I have no interest in being a day trader and spending time in front of the computer during the day.

Can anyone answer this for me?

Thanks

hello Jason

I stumble on your site I see great reviews

my question about MPA is

did Mark list the stocks that about to break before the market open ?

so you can enter with the breakout and not to wait the buy alert

Does Mark go through Stocks Selection Process. Means how he filters stocks and add them to the buy alert list?

Lots of interesting comments. I am considering MPA and watched a youtube video of a guy who shows you the screens. I’ve read Mark’s book twice as well as many others. I’ve been actively trading for a year with mixed results, though mostly good. I’m tending to agree with the people who say it’s a tool not a solution. I recognize it as such and as such requires that four letter word WORK. I recommend getting a time block and reading The One Thing and get focus and goals mastered first. The hammer isn’t going to hit the nail by itself. Hope this 2 cents helps the thought process.

I was a member for several years and attended his master trader program. I would not recommended. Mark seemed to recommend a lot of thinly traded stocks. Mark would alert you or tell you to buy now, and then, the stocks commonly crashed down after breaking out. It seemed like he was entering into the trade before he was recommending it. His clients would bid up the price and then someone was crashing the stock, and I suspect it was Mark. It seemed like the old pump and dump approach. Also, it is very expensive, and he is not a horrible teacher. He is a good salesmen.