FREE 7-DAY TRIAL

JOIN THE DISCUSSION

What is GuruFocus?

GuruFocus.com offers you a window into the trading world of elite investors and stock market insiders. With the goal of helping value investors uncover the best bargain stock ideas, this financial news and research platform tracks over 250 value investing gurus and top corporate officers. You can use the platform’s potent research tools, real-time news, and value screeners to tap into top gurus’ winning investing strategies.

In this GuruFocus review, we’ll take a look at the platform’s features, pricing, pros and cons, and who it’s best for.

Platform Details

| Founder | Charlie Tian |

| Founded | 2004 |

| Platform | Browser-based |

| Users | 600,000+ |

| Included | Stock screener, backtesting, portfolio tracking, valuation tools, interactive charts, guru lists and trades, data export, mobile app, tutorials |

| Subscriptions | Premium, Premium Plus |

| Price | Click here |

| Coupon Code | No discount code currently available |

About GuruFocus

The GuruFocus.com founder and CEO, Charlie Tian, began his career working as a research scientist for a major telecommunications company, but he eventually developed an interest in investing. As a result, Tian began to study the investing methods of Warren Buffet and many of the best investors in the world.

During this period, Tian concluded that it was unnecessary to create his stock portfolio from scratch because the investing masters had already done the groundwork for him. With this idea in mind, in 2004, Tian launched GuruFocus.com as a platform that focuses on business news, research, and investment advice based on value investing strategies.

What's Included

To lay the groundwork, GuruFocus has a massive database with portfolio data on over 4,000 institutions and more than 92,000 companies. The website offers two membership levels, Premium and the Premium Plus subscription. Aside from institutional and international data, their premium memberships include:

- Stock screeners with customized filters

- Backtesting

- Interactive charts and portfolio tracking

- Valuation tools

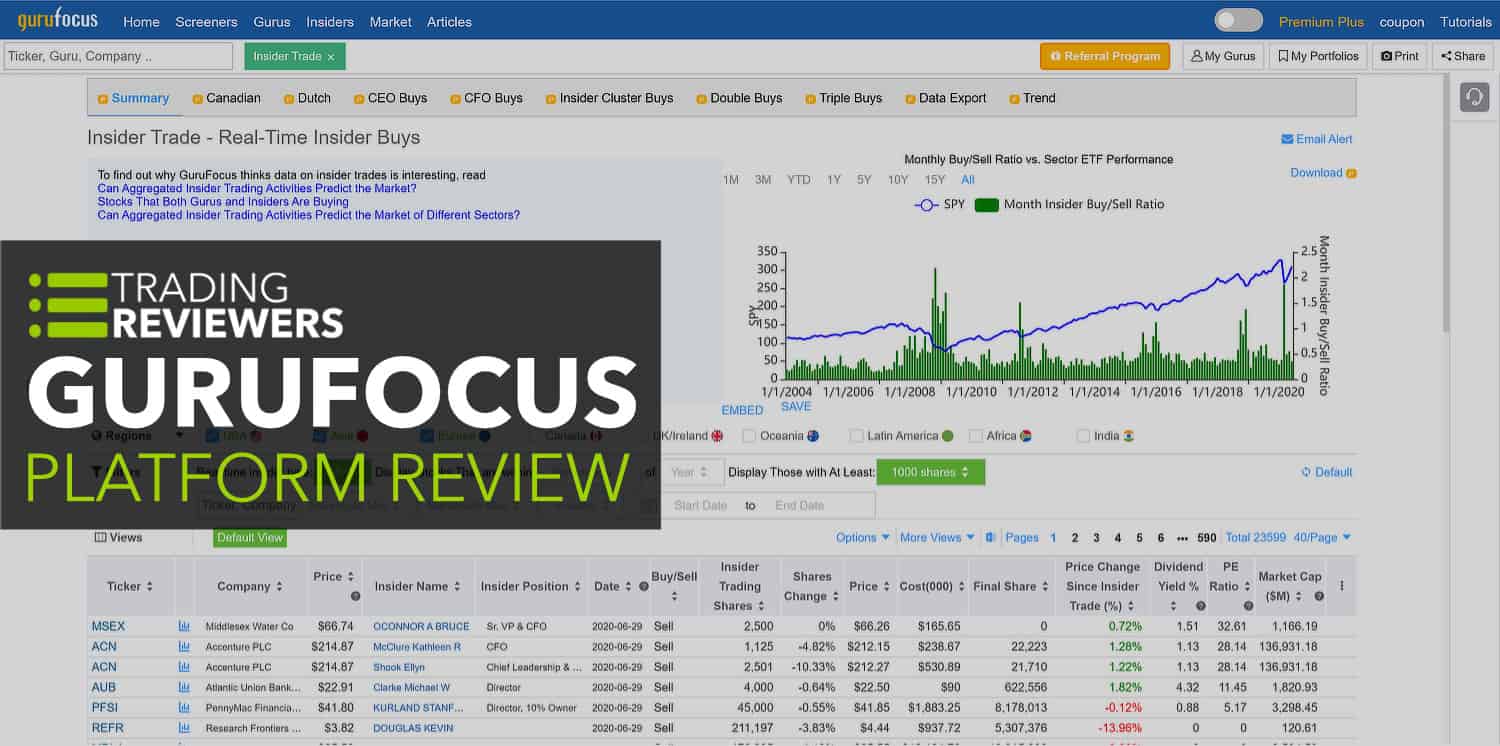

- Personalized guru, real-time guru trades, and insider buying and selling

- Indicators: Warning signs, good signs

- Underpriced investment ideas

- Excel/CSV and API support

- Mobile app

- Forum

- Tutorials (videos and articles)

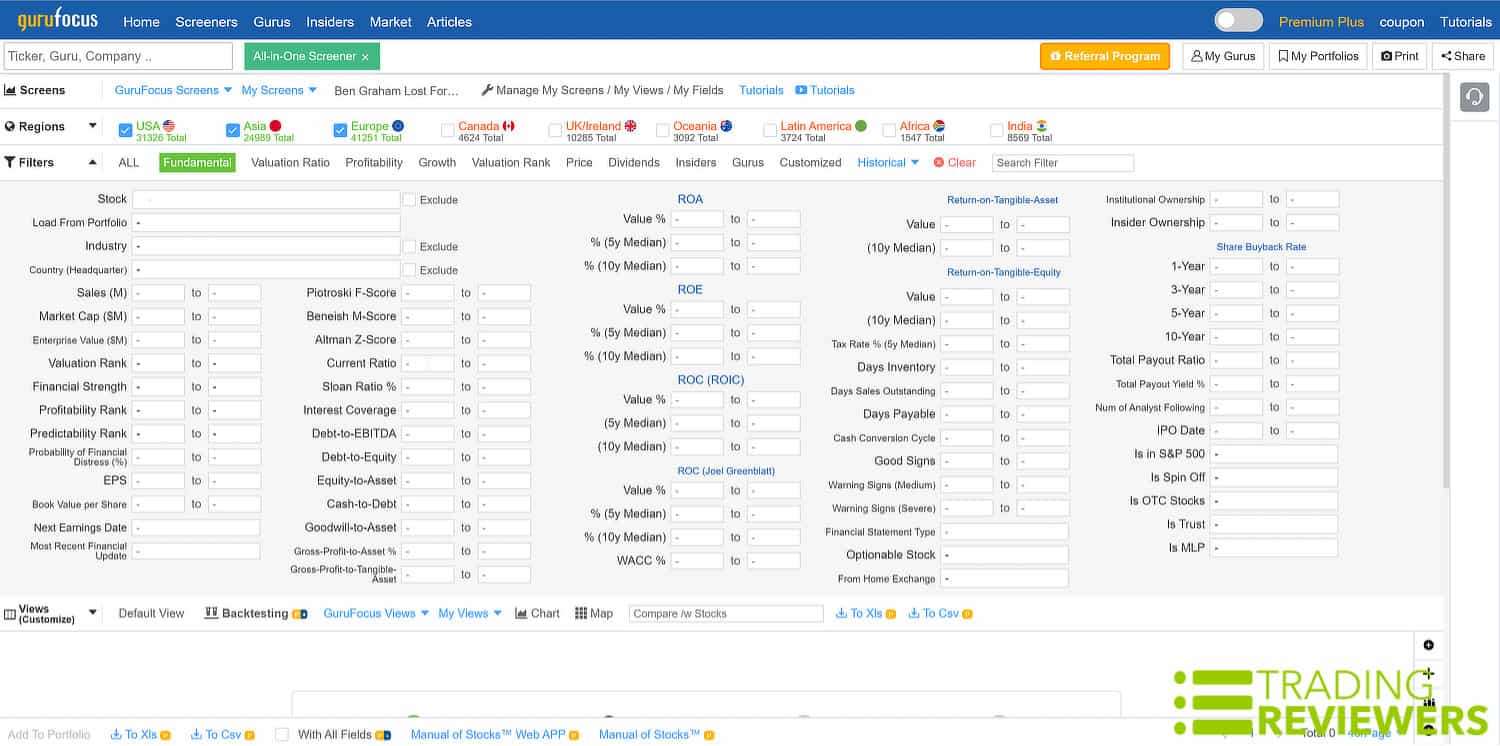

Stock Screener

To help you choose winning stocks, the GuruFocus All-in-One stock screener allows you to narrow down your choices with over 500 preexisting filters. This selection of screening criteria includes market cap, predictable rank, insider ownership, and profitability rank. GuruFocus organizes its screener by 9 regions and 10 categories, including fundamentals, valuation ratio, profitability, guru, insider stock purchases, dividends, and more. Plus, the GuruFocus stock screener provides historical trading data for backtesting.

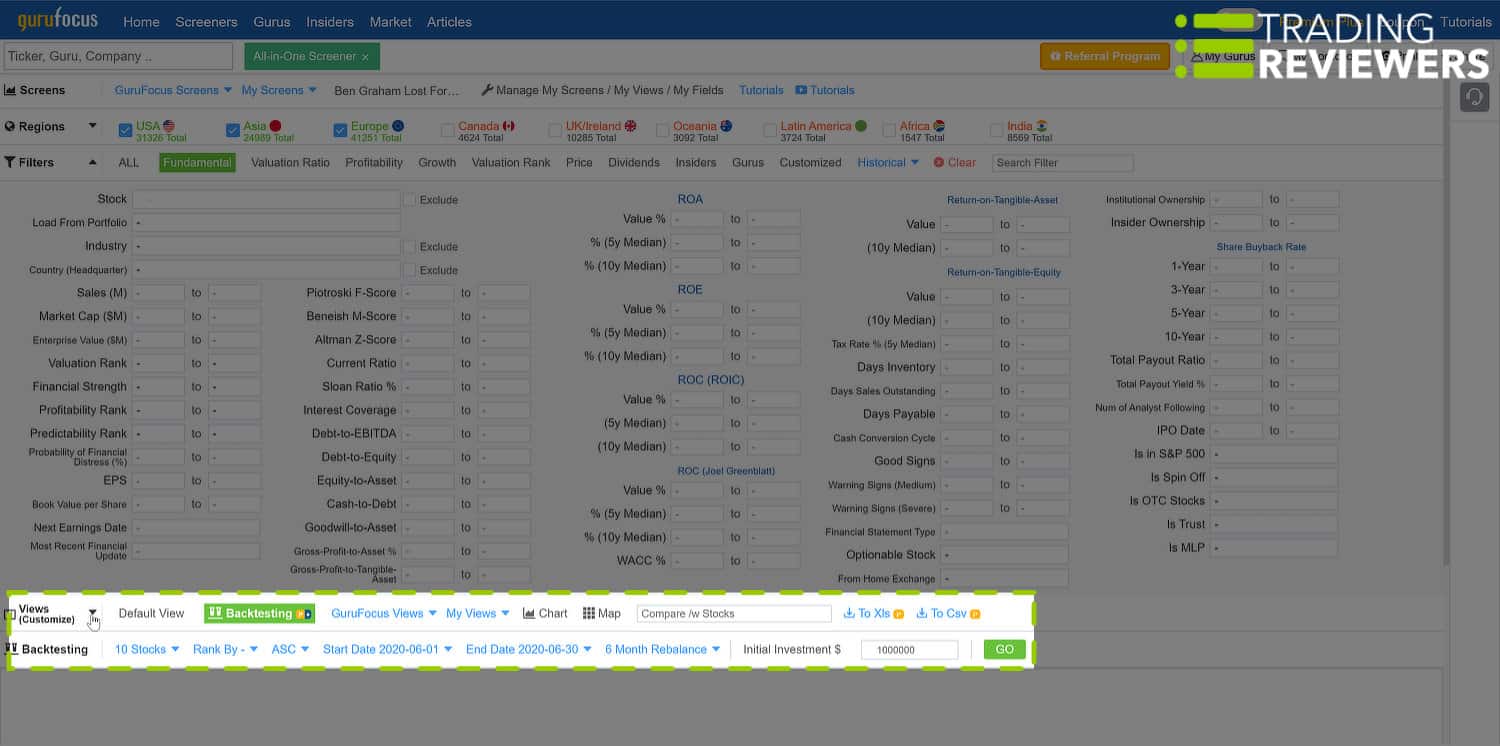

Backtesting

When it comes to testing strategies or potential trades, the GuruFocus backtesting feature is the most effective, user-friendly research tool on this platform. It’s easy to test your stock picking strategies with GuruFocus:

- In the All-in-One screener, set up your customized filters

- Click on the Backtesting tab at the bottom left-hand corner of the display

- Set the starting year for your test, your portfolio rebalancing interval (monthly/annually), ranking criteria, and the number of stocks in your model portfolio

- Enter your initial investment

The results will instantly appear in a test portfolio. Through line charts, the performance results will reveal how your strategy compared with the S&P 500, DJIA, and the NASDAQ.

Portfolio Tracking

The Individual Portfolio Tracker provides valuable real-time reports that will keep you current of market changes from a value perspective. To keep you up to date, the individual portfolio tracker provides Overview and Alerts tabs. The Overview tab gives you a rundown of your stock holdings and the Alert tab provides a list of active alerts. For a more detailed view, you can select “View/Edit Portfolio”.

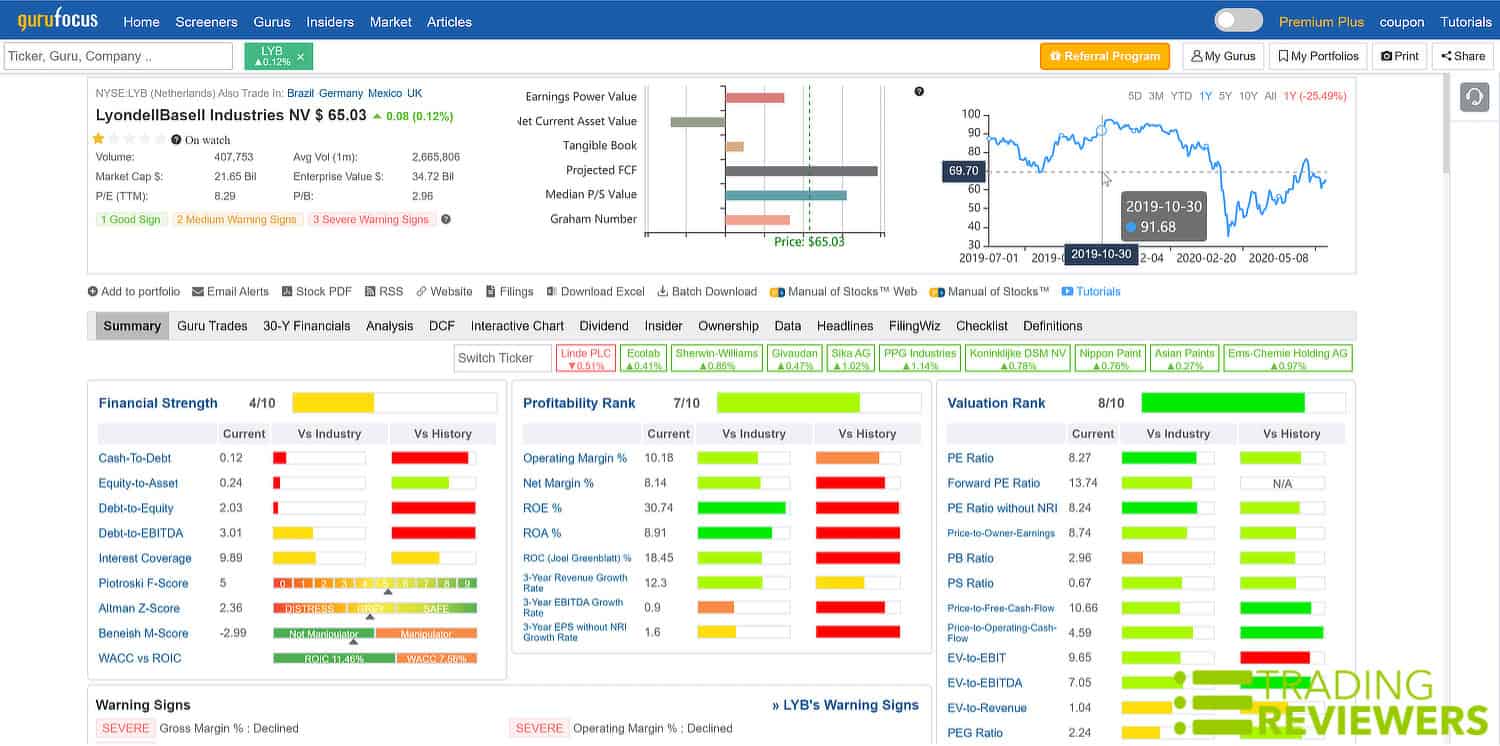

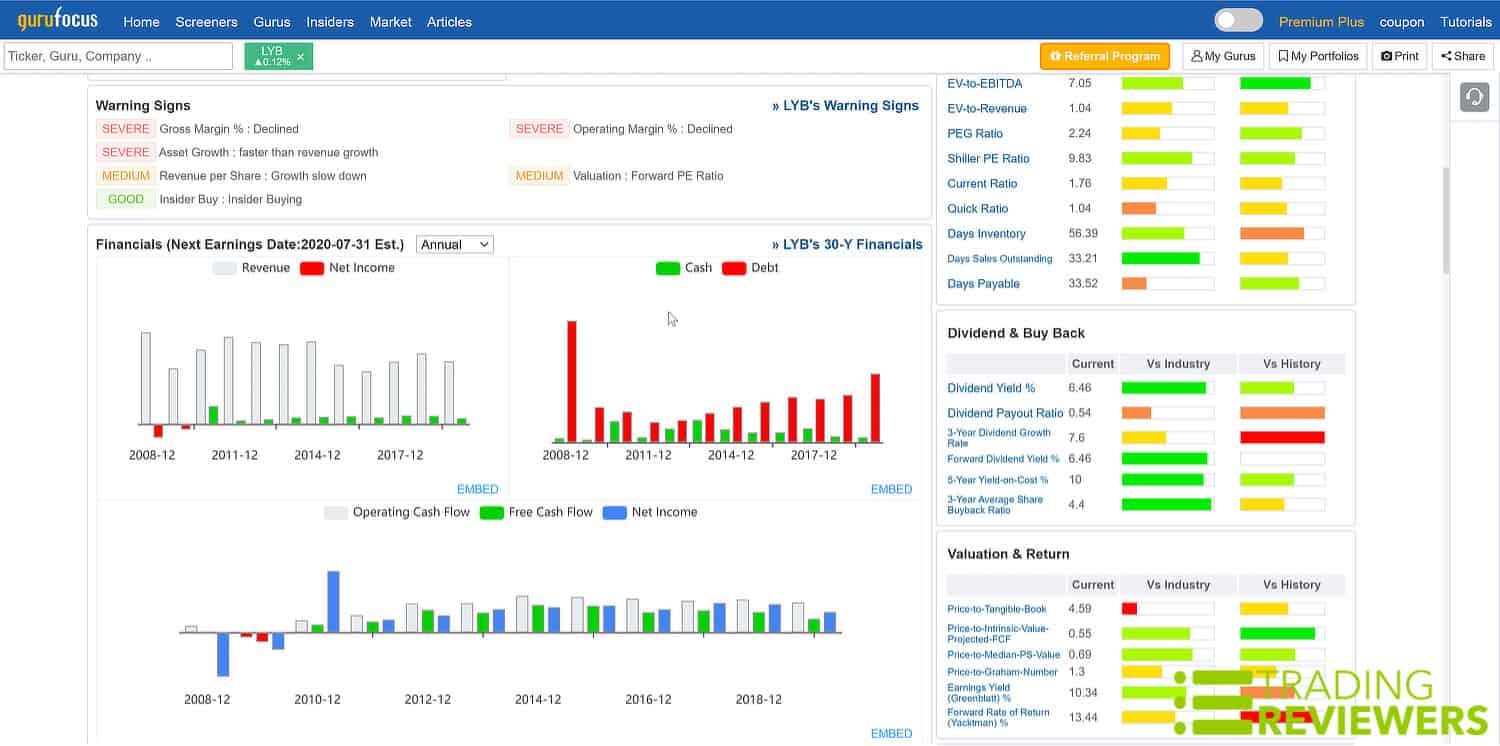

Valuation Tools

The key to finding undervalued stocks is getting an accurate valuation of the underlying companies. For that purpose, GuruFocus provides a built-in valuation tool and the DCF calculator. If you enter a ticker into the search box, you’ll see “Analysis” and “DCF” listed side-by-side on the main toolbar. Listed under the Analysis tab, the valuation tool uses a specific group of valuation methods for each stock. The Discount Cashflow Function (DCF) calculator lets you evaluate stocks with the discount cashflow evaluation method. It uses 6 default values to determine your stocks’ earnings growth rate over the previous 10 years.

On the home page, the Value Screens box lists stocks that are prescreened for valuation. It uses valuation screens from Bill Graham, Peter Lynch Fair Value, the Magic Formula, and 6 others. To refine the results, the feature uses net current asset value (NCAV), price/NCAV (%), and net-net working capital (NNWC).

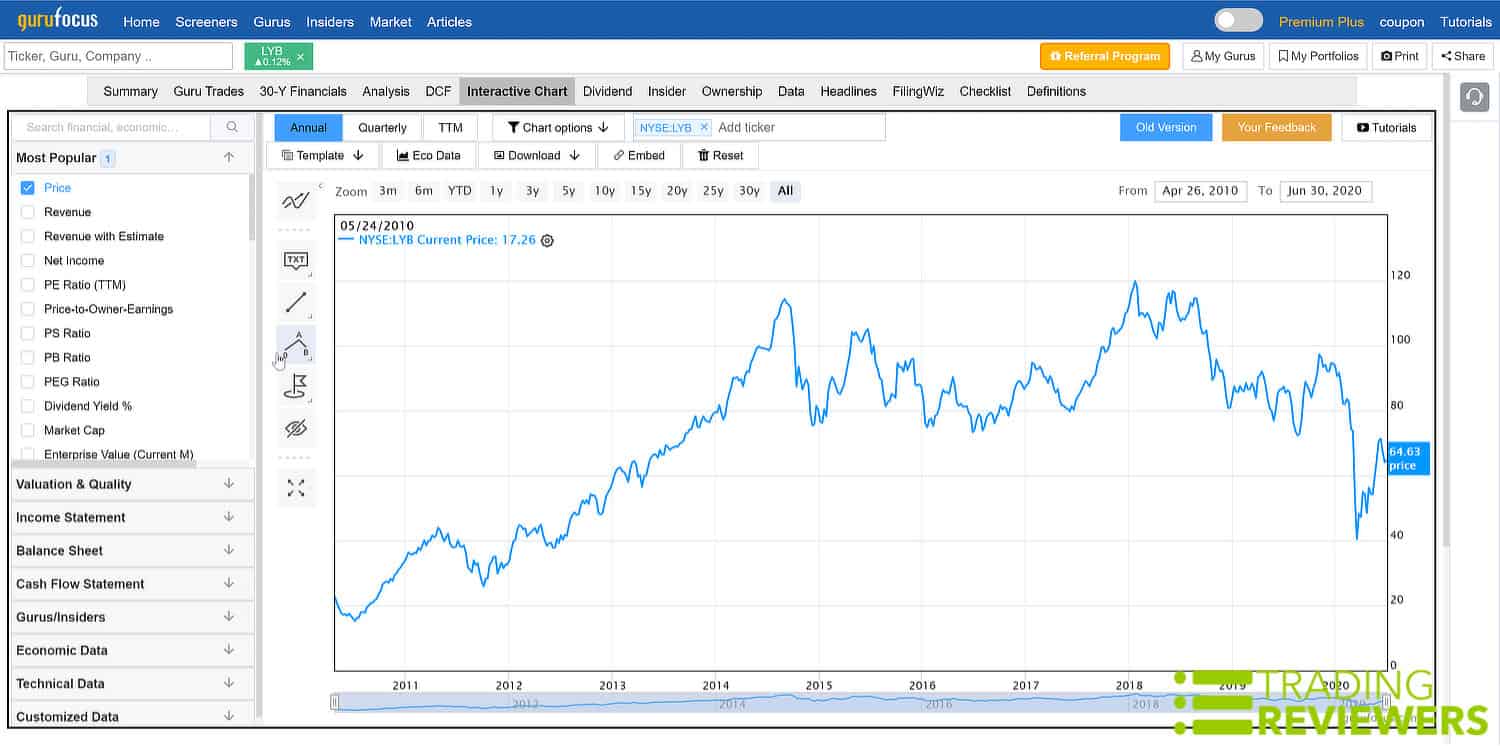

Interactive Charts

The interactive charts feature is another nice research tool in the GuruFocus premium membership package. With it, you can visualize your research findings by populating the chart with many fundamental data choices such as earnings per share and Min P/B ratio. On the charts, this tool will:

- Overlay your selected data over the price graph

- Allow you to customize the data series by selecting or deselecting the boxes

- Include technical data like Bollinger bands

- Designate recession periods with a gray vertical bar overlay

On the interactive charts, you can also plot financial metrics from the company’s financial statements, GuruFocus yield curve, valuation formulas, and economic indicators.

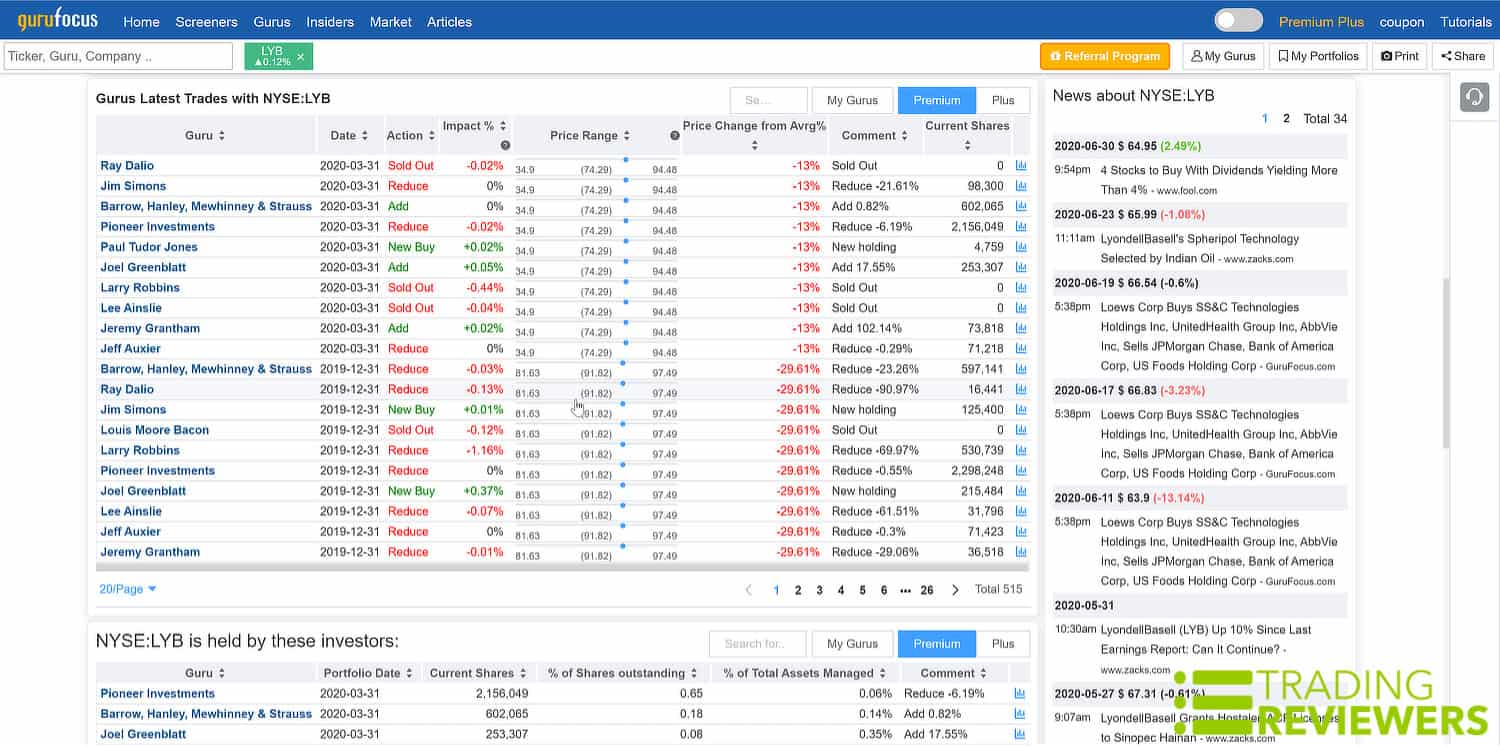

Personalized Guru List

GuruFocus allows you to create a personalized list of famous gurus like Warren Buffet, George Soros, and Carl Icahn. Also, you can set email alerts that let you know when one of the investors you follow makes a trade. Additionally, you can track an individual investor or monitor all of your favorite gurus with an aggregated portfolio.

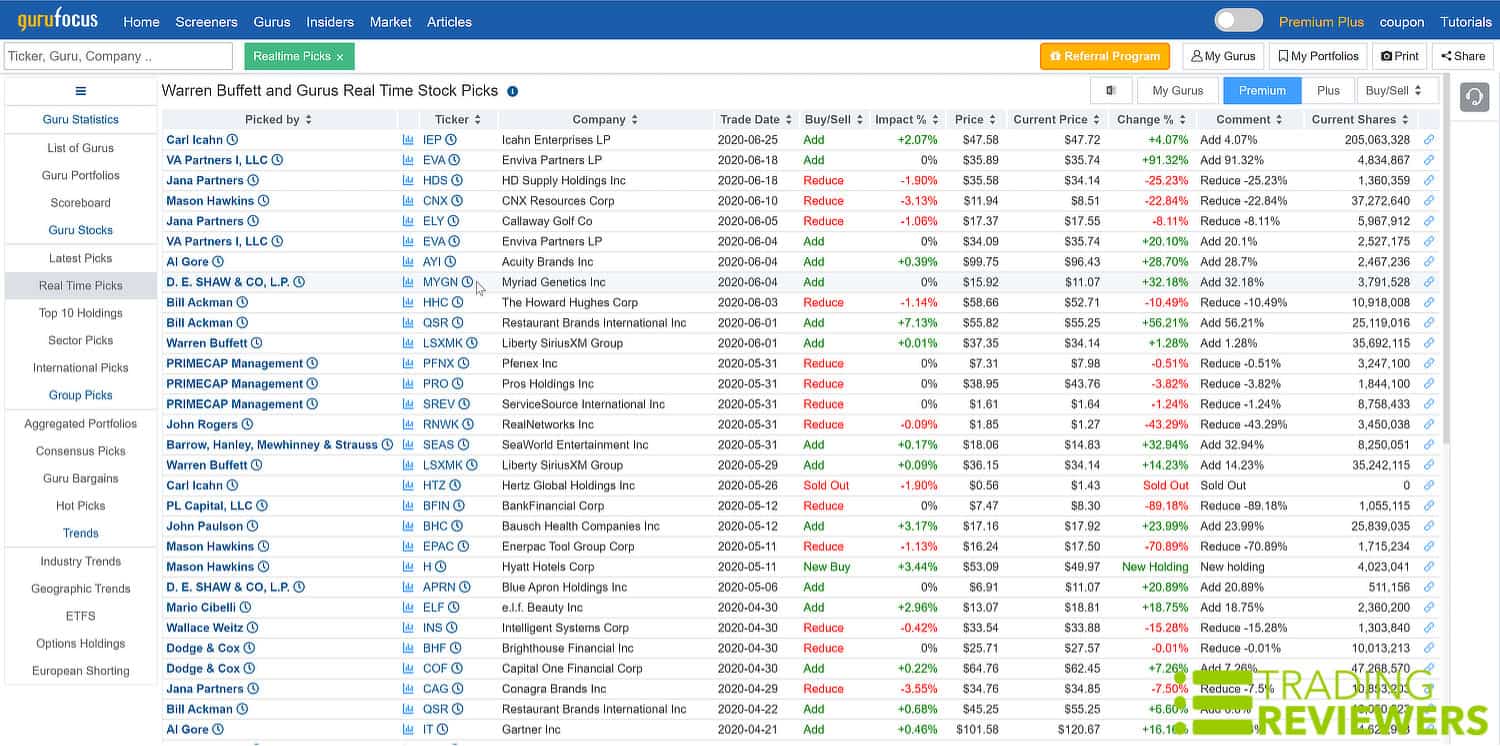

Real-Time Guru Trades

Real-time Guru Trades lets investors monitor current guru trades on a personalized or prescreened list. From one console, you can track all real-time guru trade types, or you can use the filters to view different buy/sell options such as New Buy, Add only, All Sells, Sold Out, and Reduce.

Warnings Signs/Good Signs

The Warning Signs/Good Signs feature increases your ability to evaluate your stocks and trades. Ranging from medium to severe, the signs appear in the Warning Signs summary box. The software uses propriety formulas to monitor and send warning signs of any notable shifts in the company’s fundamental metrics. To reduce your chances of owning downward trending securities, this feature gives you one of 32 different warnings and a full explanation of the warning. Also, using the same metrics, this feature provides good signs.

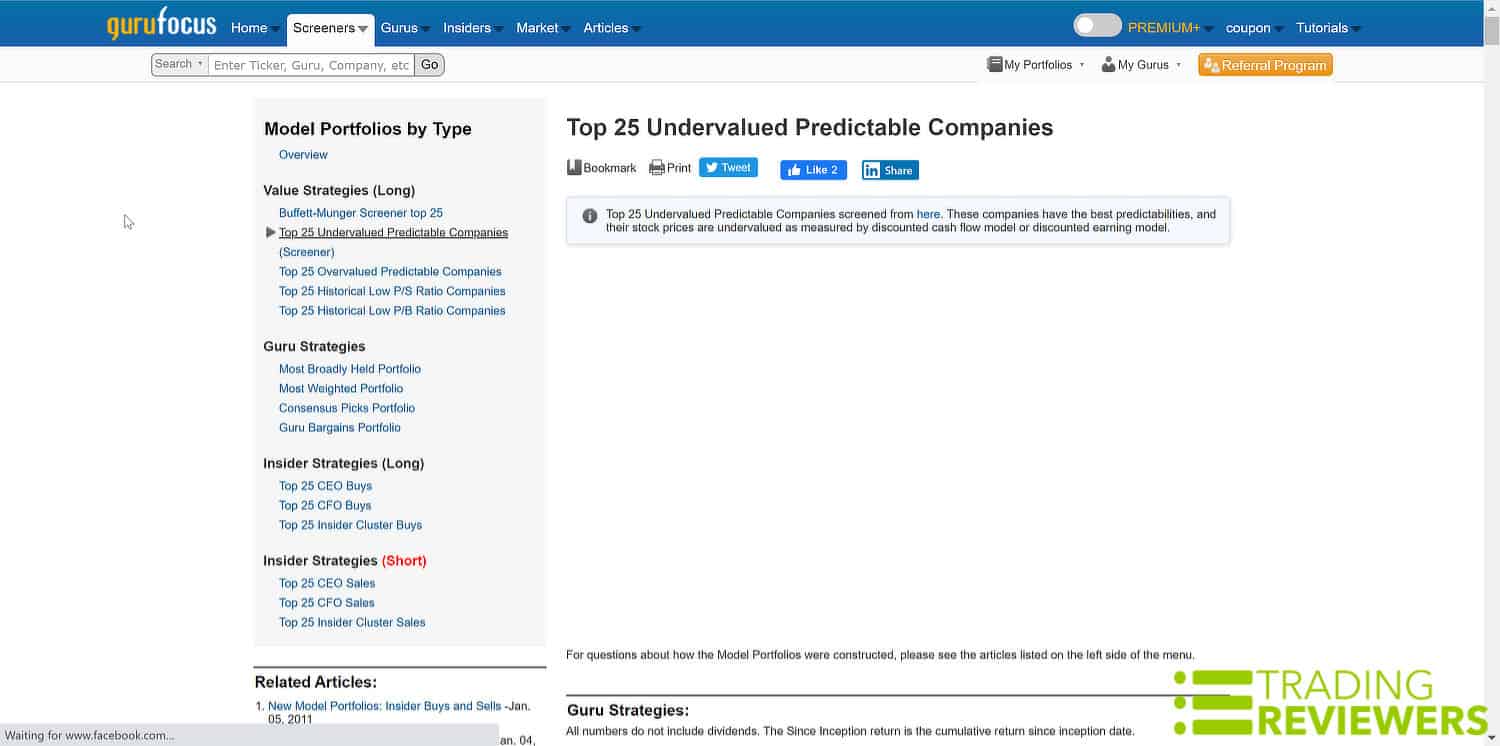

Value Strategies

Since 2009, the Value Strategies model portfolios have consistently outperformed the S&P 500. GuruFocus allows you to use and review these model portfolios. The strategies are:

- Buffet-Munger Screener Top 25

- Top 25 Predictable Companies

- Top 25 Historical Low P/S Ratio Companies

- Top 25 Historically Low P/B Ratio Companies

If you believe that undervalued stocks will continue their history of beating the market average, these strategies should appeal to you.

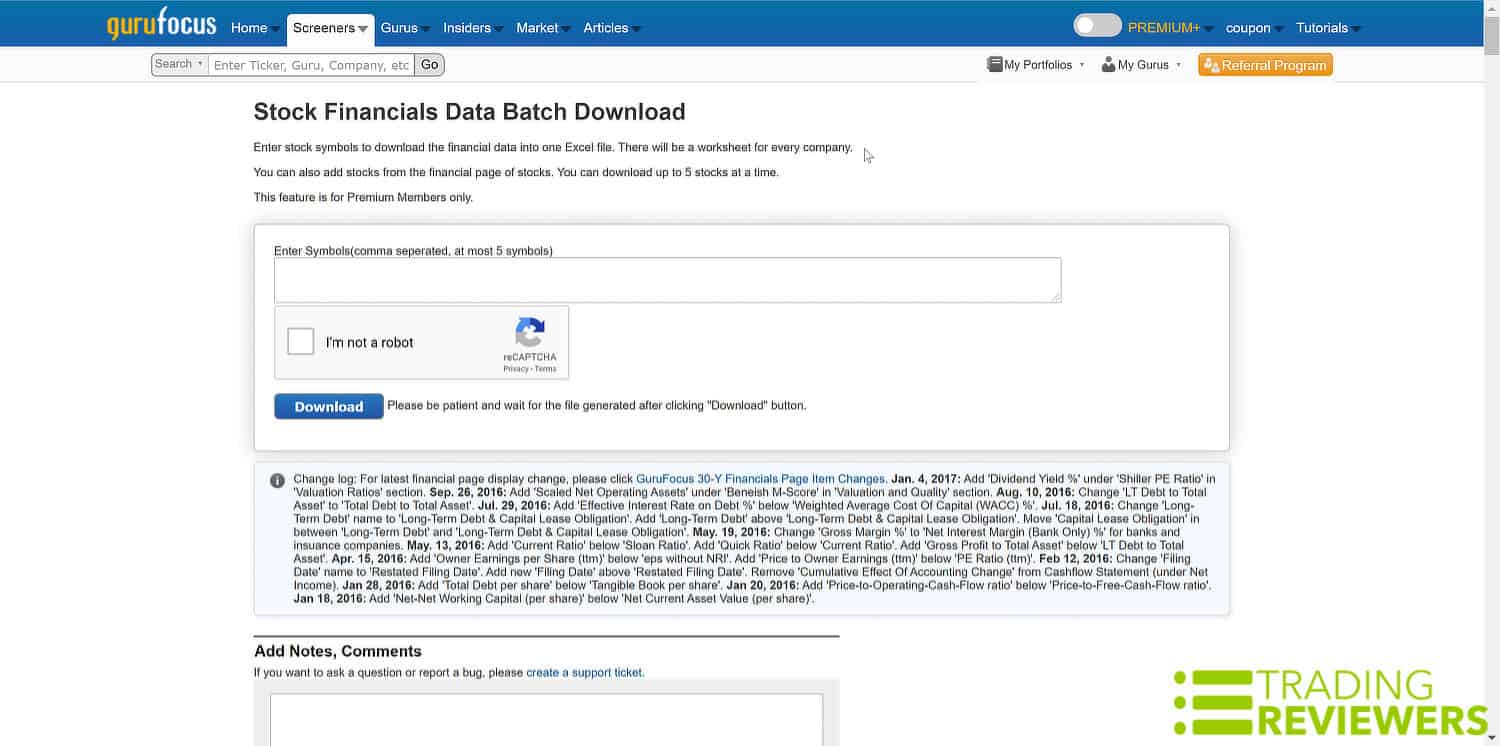

Excel/CSV Downloads

By locating the XLS and CSV download button on GuruFocus’ site, you can easily download:

- Institution and company financial data

- Guru portfolio

- Historical data

In the screener’s section, there are 9 different downloads and tools including Guru portfolios, insider data, stock PDFs, and mobile app tools. The batch download tool allows you to download up to 20 years of historical financial data.

GuruFocus App

When you’re on the move, the Guru Focus app helps keep you tethered to your investing environment. You can stay current with the latest financial news and your trade activity. Amazingly, this mobile app provides you with many of the features and functions that the website platform offers like guru and insider trades, portfolio tracking and management, research tools, and the DCF calculator.

Discussion Forum

Also included in the GuruFocus members’ area is an investment forum where users can ask questions and exchange ideas. Although this adds a nice community aspect to the platform, the discussion forum is not very active and we found a good number of the posts to be off-topic spam replies.

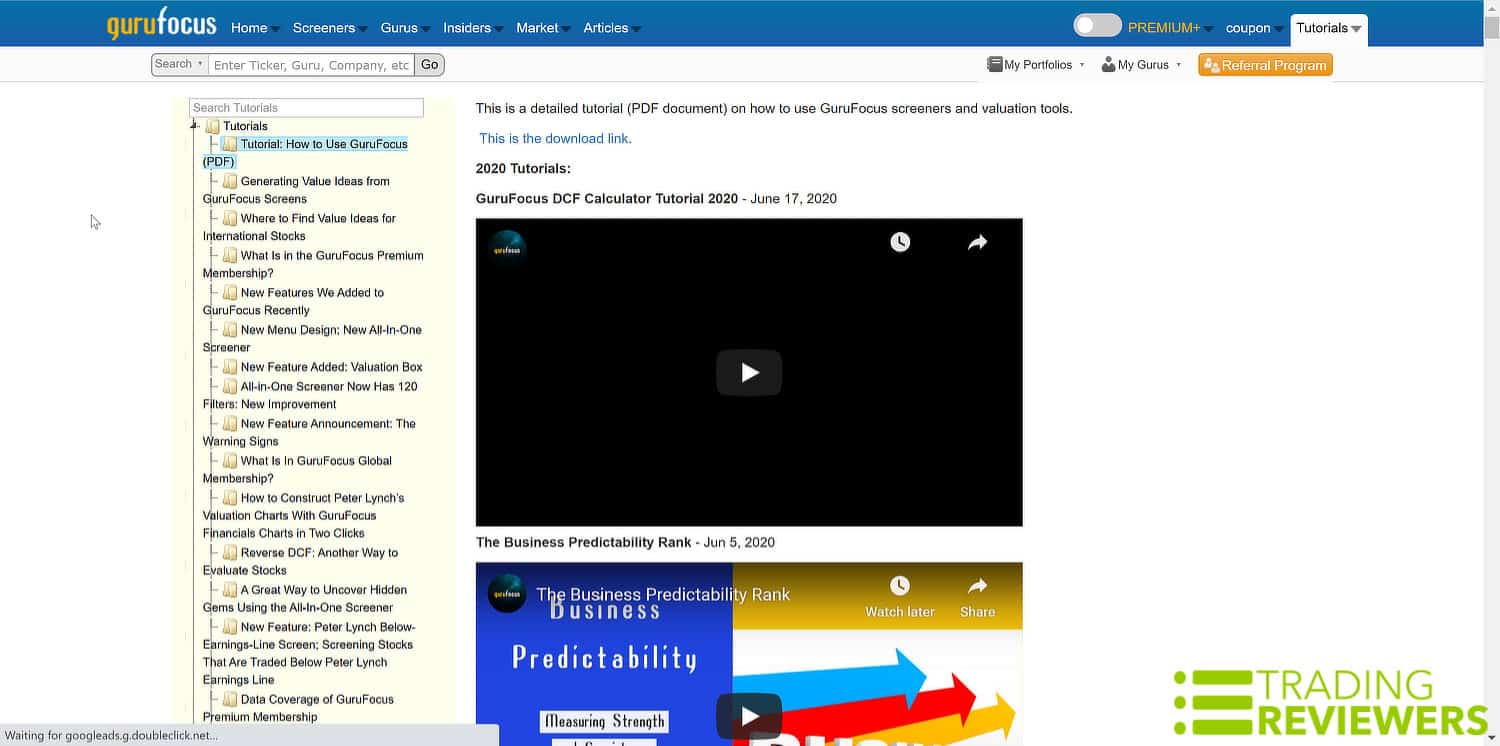

Tutorials

GuruFocus’ tutorials are an excellent reference and educational resource. Provided is a seemingly inexhaustible collection of how-to videos and reviews on guru portfolio strategies, features, tools, and investment advice specifically for value investors. Some of the video and article titles include:

- How to Visualize Financial Trends with Interactive Charts

- How to Construct Peter Lynch’s Valuation Charts with GuruFocus Charts in Two Clicks

- Travel Companies Showing High Growth Material

- New Feature Announcement: The Warning Signs

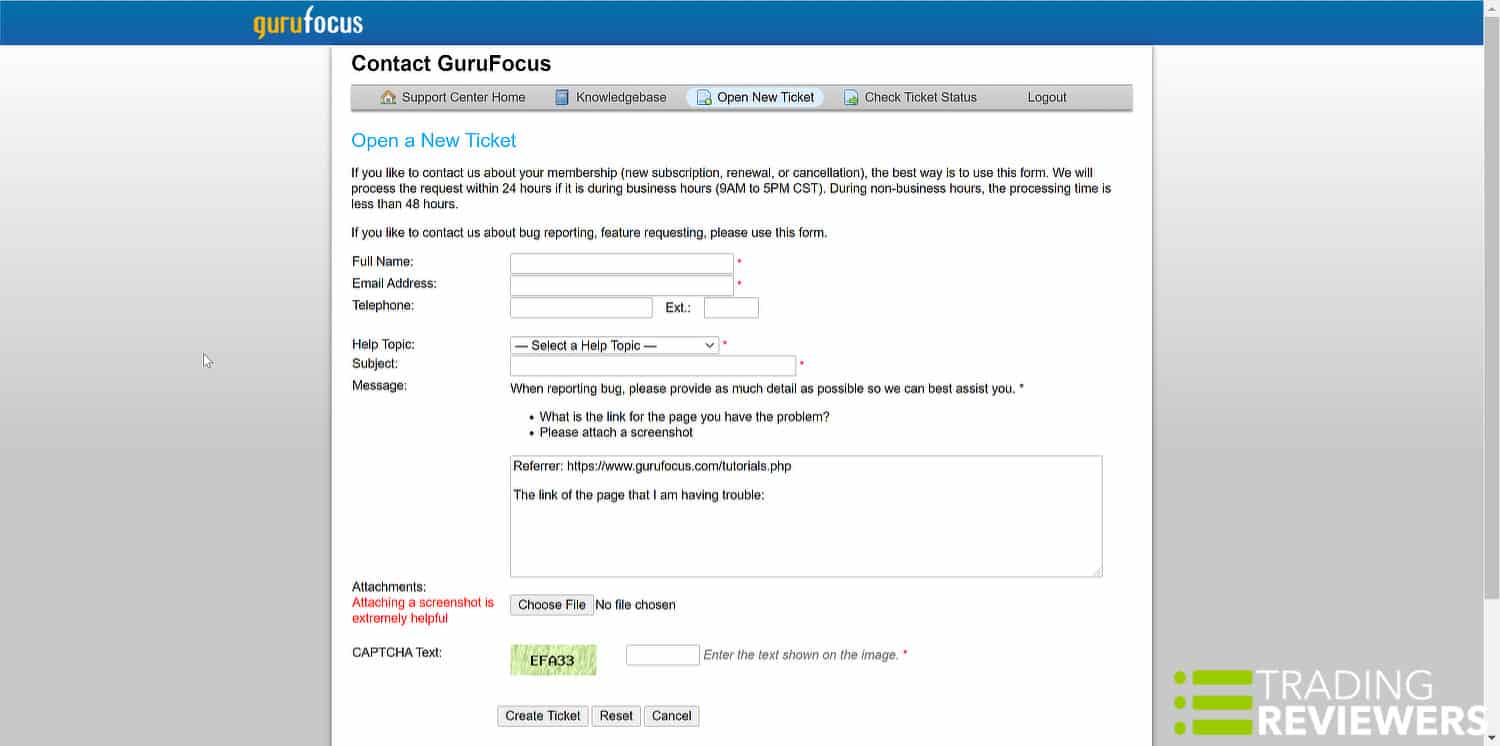

Top-Shelf Customer Support

Like many online financial and business platforms, GuruFocus runs a database-driven customer service approach. If you can’t solve your problem through the FAQ search box, you can open up a customer support ticket and an actual customer service representative will contact you via email.

Reader Reviews

Unbelievably valuable…

I have been using Gurufocus for 10 years now and find it unbelievably valuable in my investing journey. The stock research pages are very comprehensive and quickly gives me a well-rounded view of the stock. It is for more advanced investors as the amount of information is very deep and a newbie can get lost. Frankly, I have become addicted to the site (it’s a good addiction as it has helped make me quite wealthy). It has one of the best stock screeners on the web and very quick feedback and service from the company.

Top…

Top research and support tool.

Submit a Review

Have you tried GuruFocus? If so, please let other investors know what you think about it.

How Much Does GuruFocus Cost?

With the basic membership, you can have free access to the resources on the site, but the great research tools and most advanced features will not be available. The premium membership costs $449/year for the U.S. market, and foreign market data is an additional $399 for each region. Also, you get a $100 GuruFocus membership discount for each region that you add.

Premium investors have carte blanche on the platform, but there are some restrictions on backtesting (3 years), customized data series (3), and Excel downloads (20,000/month). Premium Plus members get unlimited international data, Excel downloads, and data series for $849/year.

GuruFocus Walkthrough [VIDEO]

FAQs

The premium membership cost of $449/year breaks down to $37.42/month. Being able to benefit from the due diligence and expertise of guru investing is worth the cost in our opinion and the included research tools make it easy to pinpoint the most promising undervalued companies.

The screener lists get updates almost every day. International regions may take up to 48 hours.

This answer depends on what type of investor you are. Day traders won't get excited about GuruFocus's emphasis on a long-term, value investing strategy. By the same token, many GuruFocus members wouldn't like the fact that FINVIZ Elite doesn't have model portfolios and trading picks from the best investors. Basically, FINVIZ Elite tends to attract the do-it-yourself type day trader and investor, while GuruFocus attracts long term, value-driven investors.

For premium members, the backtesting feature looks back 3 years. Premium Plus members have 14 years of backtesting historical data available.

Information concerning all stock picks is typically updated within 24 hours.

Pros and Cons

Pros

Cons

- Free 7-day trial available

- Excellent training ground for investors who want to master value investing

- Affordable subscription pricing

- Real-time guru and insider trades form a strong base for building and maintaining your portfolio

- Interactive charts are great for visual analysis of stock performance

- Model and guru portfolios are good for beginning investors and investors who are not overly comfortable with fundamentals

- 30-day money-back guarantee

- Not for everyone, with a narrow focus of one investment philosophy

- Could be better organized and some features and tools are difficult to find

- Forum isn't very active and has a fair amount of spammy, off-topic posts

Best for?

There’s no doubt that GuruFocus rivals FINVIZ in features, data, and tools, but if you don’t buy into value investing, GuruFocus is not a research platform that we’d recommend. This platform is best for long-term, value-driven investors who are looking to minimize risk by tracking renowned investors. So, if that’s the type of investor you are, you’ll love what GuruFocus has to offer.