CHECK PRICE OR BUY NOW

JOIN THE DISCUSSION

Overview

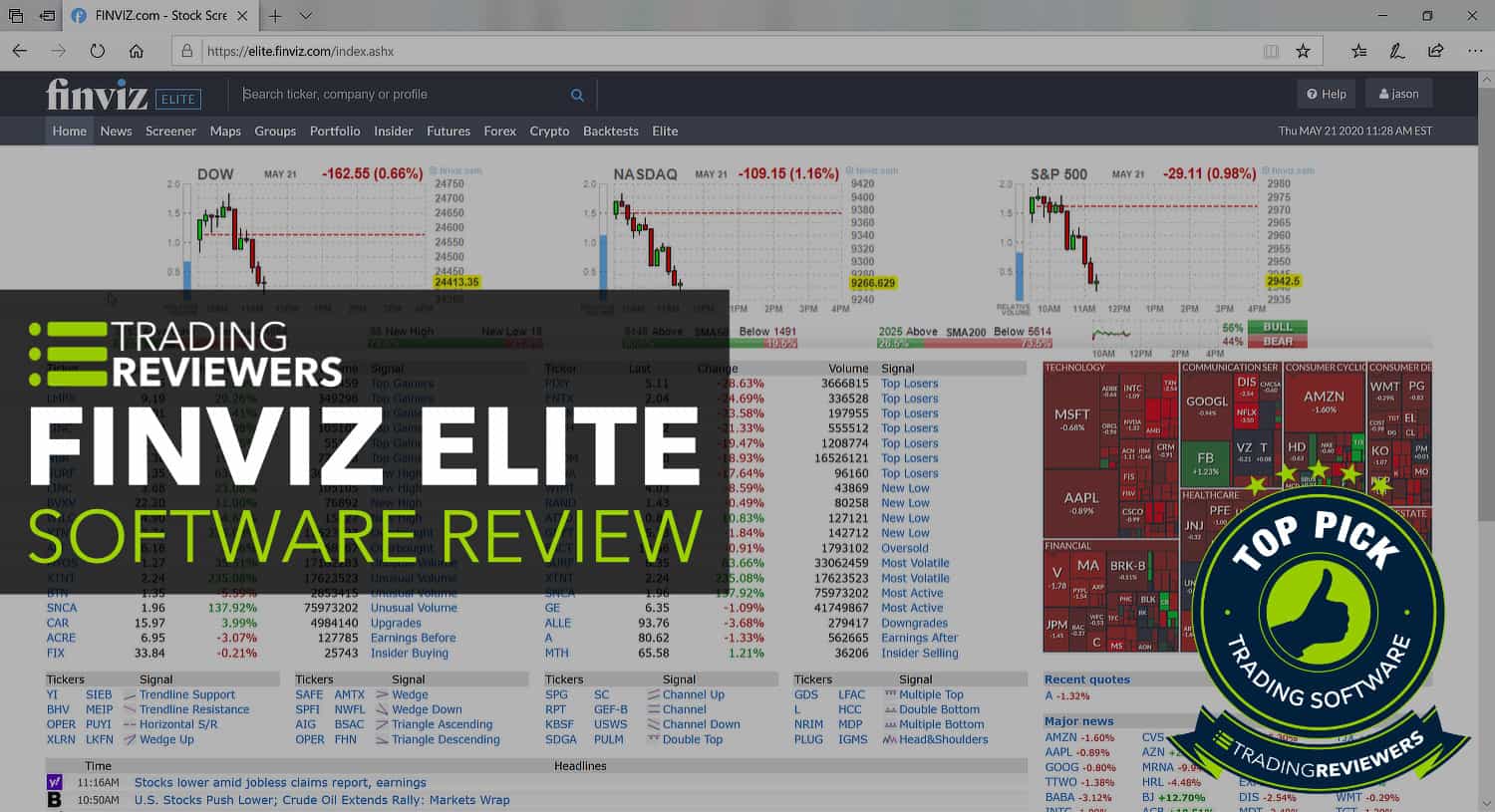

Whether you are a day trader, swing trader, or long-term investor, time is a precious commodity. Many good trading opportunities can quickly vanish while you waste time manually scanning through charts and tables in search of stocks that meet your requirements. With its ability to rapidly scan mountains of data and find stocks worth trading, there’s no doubt that the FINVIZ stock screener can help you become a better trader. However, do you really need all of the extra features that the premium FINVIZ Elite account provides?

There are many powerful screening and research tools included with the company’s free versions, but in this FINVIZ Elite screener review we’ll take an in-depth look at their paid subscription and see why it’s a better choice for serious traders who want to find stocks fast.

Platform Details

| Founder | Juraj Duris |

| Founded | 2007 |

| Platform | Browser-based |

| Included | Stock screener, advanced charts, premarket and real-time data, backtesting, stock fundamentals, maps, analyst ratings, insider buys and sells, alerts, correlations |

| Subscriptions | Monthly, annual |

| Price | Click here |

| Coupon Code | No discount code currently available |

What is FINVIZ?

FINVIZ is a powerful stock screening platform that was developed in 2007 by angel investor, Juraj Duris. FINVIZ Elite is the premium edition of the FINVIZ Free and Registered plans. Unlike some stock screeners, it’s extremely easy to use and allows traders to use both technical and fundamental data to analyze stocks.

For easy navigation, the FINVIZ Elite platform features a tab configuration and it offers several exclusive features:

- Real-time data: Allows you to stay on top of a rapidly changing stock market

- Pre-market data: Helps you spot potential moves before everyone else

- Technical studies and advanced charts: Help you to study and review moves in the market

- Diversification: Allows you to diversify risk by using the correlation feature

- Data export, customized filters, and statistical view: Make the FINVIZ Elite stock screener a far more powerful and useful research tool

- Historical data and additional technical indicators: Let traders validate their stock trading strategies on a professional-level

- Alerts: Notify you of sudden changes in the stock market and events concerning your positions

What's Included with FINVIZ Elite

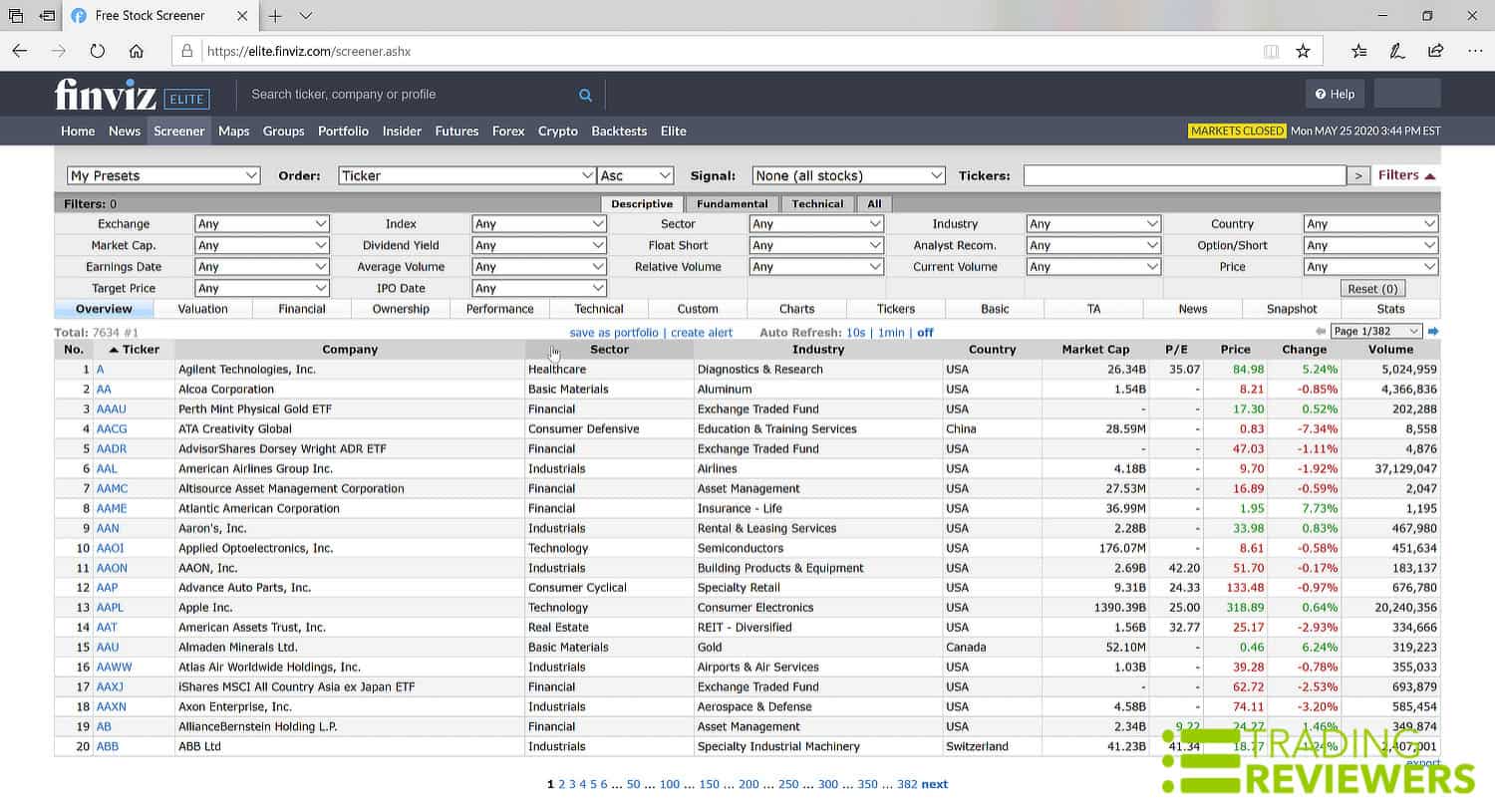

FINVIZ Elite Stock Screener

On the FINVIZ Elite stock screener homepage, there are three types of analysis tabs: Descriptive, Technical, and Fundamental. The All tab shows you a combined view of all available scanning tools. To help you narrow your search, this stock screener has filters, located just below the main tabs and they help you narrow your search parameters. For example, under the Descriptive tab, the first column of FINVIZ screener filters include Exchange, Market Cap, Earnings Date, and Target Price. You can drastically refine your stock scan results with the built-in filter options and can even save custom screener presets for future use. To reduce the number of stocks even further, you can use any of the other 13 built-in filter options such as Short Float, Sector, Industry, and Price.

Here is a complete list of the screening parameters provided for Descriptive, Fundamental, and Technical chart scans:

Descriptive

- Exchange

- Market capitalization

- Earnings date

- Target price

- Index

- Dividend yield

- Average volume

- IPO date

- Sector

- Float short

- Relative volume

- Industry

- Analyst recommendation

- Current volume

- Country

- Option/short

- Price

Fundamental

- P/E

- Price/cash

- EPS growth next 5 years

- Return on equity

- Debt/equity

- Insider ownership

- Forward P/E

- Price/free cash flow

- Sales growth past 5 years

- Return on investment

- Gross margin

- Insider transactions

- PEG

- EPS growth this year

- EPS growth quarter over quarter

- Current ratio

- Operating margin

- Institutional ownership

- P/S

- EPS growth next year

- Sales growth quarter over quarter

- Quick ratio

- Net profit margin

- Institutional transactions

- P/B

- EPS growth past 5 years

- Return on assets

- LT debt/equity

- Payout ratio

Technical

- Performance

- 20-day simple moving average

- 20-day high/low

- Beta

- Performance 2

- 50-day SMA

- 50-day high/low

- Average True Range (ATR)

- Volatility

- 200-day SMA

- 52-week high/low

- RSI (14)

- Change

- Pattern

- Gap

- Change from open

- Candlestick pattern (Doji, Hammer, custom candlestick patterns, etc.)

At this point, the FINVIZ Elite screener may not appear to be any different from the FINVIZ Free and Registered membership plans. However, the company’s premium stock screener has additional custom options that are only available with a paid subscription plan. One of those options is in the price range filter. FINVIZ Elite provides customizable price ranges while FINVIZ free users have fixed price options. This customization option can save you a lot of time.

Also, the FINVIZ Elite screener has a great custom feature in the industry filter. The stock screeners that FINVIZ provides for free only allow one industry option at a time. FINVIZ Elite subscribers, however, have access to a custom box with multiple industry group options. Screener results from this type of scan can indicate whether an industry sector is underperforming or overperforming.

To top it off, FINVIZ Elite offers some other valuable extras to serious traders:

- Statistics View (last view tab to the right): Pie and bar charts that provide a statistical breakdown of sectors, countries, and industries

- Data Export: Allows you to export your data into an Excel spreadsheet, opening up many possibilities for using that data set creatively such as in reports or for personal records

- Connection to advanced charts

Advanced Charts

FINVIZ Free and Registered users have access to some impressive charting tools, but they miss out on some exceptional advanced charts. Under the Screener tab, you can see the chart options by clicking on the Chart Viewing tab and opening up one of the stock charts. The chart types offered are candlestick charts, advanced, line, interactive, and performance. As part of the free plan, users have access to the first three chart types while FINVIZ Elite subscribers can use all five chart types as well as intraday charts, hover charts, overlays, and indicators. Regardless of your trading style or time frame, these are an important thing to have and another reason to consider upgrading to a paid FINVIZ account.

With FINVIZ Elite’s interactive charts, traders and investors can use the crosshair cursor to pinpoint exact data points. This cursor feature and the suite of drawing tools make the interactive charts feature more effective for technical analysis. Plus, you can use the crosshairs to check a stock’s Relative Strength Index, an indicator that we find helpful for identifying when a stock is overbought or oversold.

Lastly, the FINVIZ Elite plan offers performance comparison charts that allow you to compare a stock’s performance to the Standard & Poor 500 ($SPY). When you’re done configuring your charts, you can save everything to your portfolio.

Premarket and Real-time Data

Traders and investors rely on timely stock market information to make sound decisions. FINVIZ Elite delivers the following real-time and pre-market data:

- Sector heat maps

- Bull/bear indicators

- Top gainers and top losers

- Charts and stock quotes

- News headlines (news sources include PR Newswire, Investors.com, Yahoo Finance, Zacks, Reuters, Bloomberg, Barrons, Financial Times, InvestorPlace, GlobeNewswire, Insider Monkey, Simply Wall St., Motley Fool, Investors Business Daily, MarketWatch, TheStreet.com, Investopedia, and more)

- Insider trading

- Alerts and notifications on price, insider transactions, and news

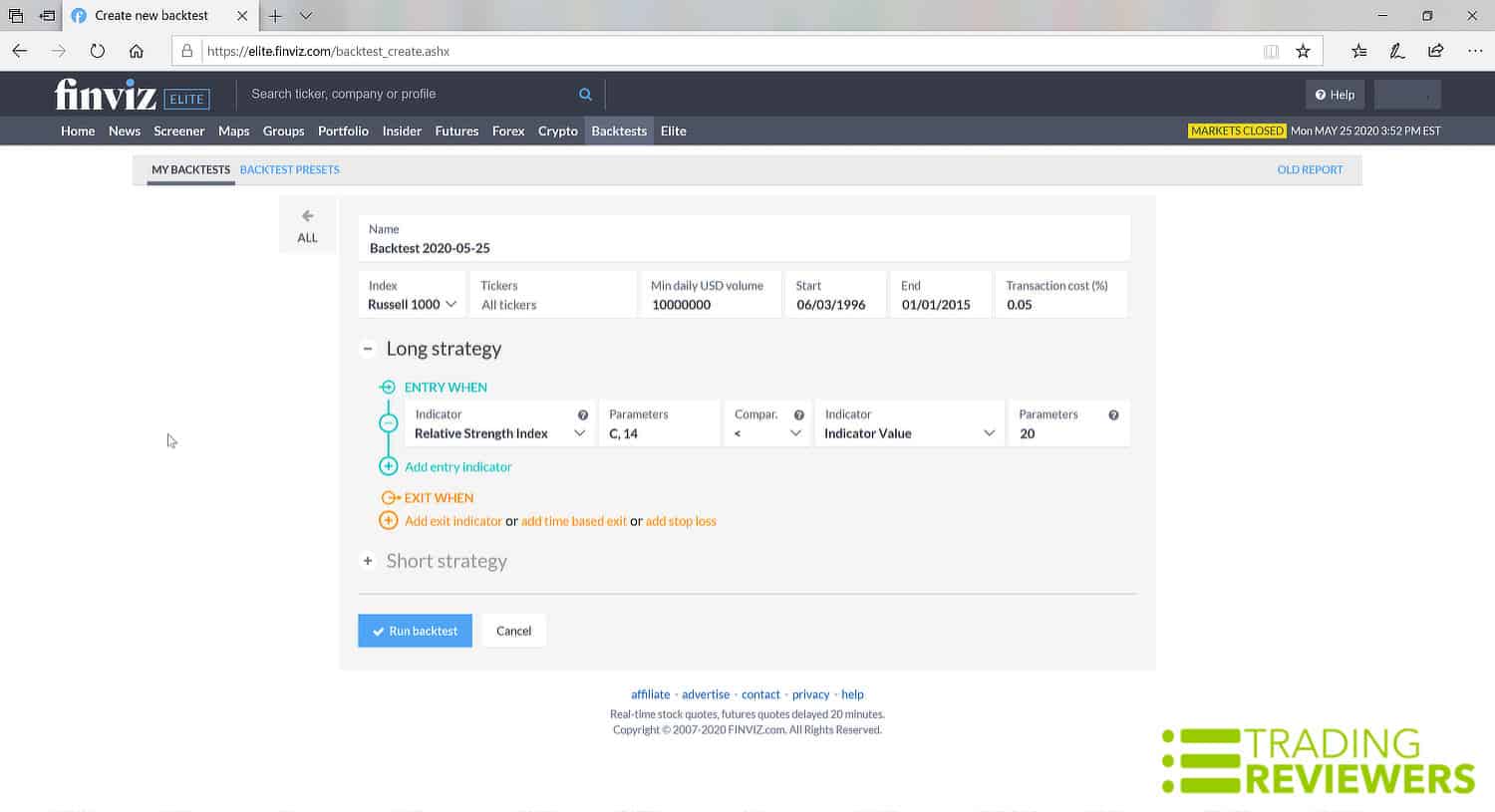

Backtesting

The FINVIZ Elite backtesting feature provides 16 years of historical data to help you test your stock trading strategies before you use them in real market conditions. Surprisingly, it’s very easy to use. All you do is enter your entry and exit points along with your choice of the two SPY benchmark options: the S&P 500 ETF ($SPY) and S&P 500 Equal-Weight Index ($SPW). The backtesting can show you how your trade strategy would have performed against the benchmark for a specified period in the past. Also, you can backtest 100 technical indicators one at a time or in multiple sets.

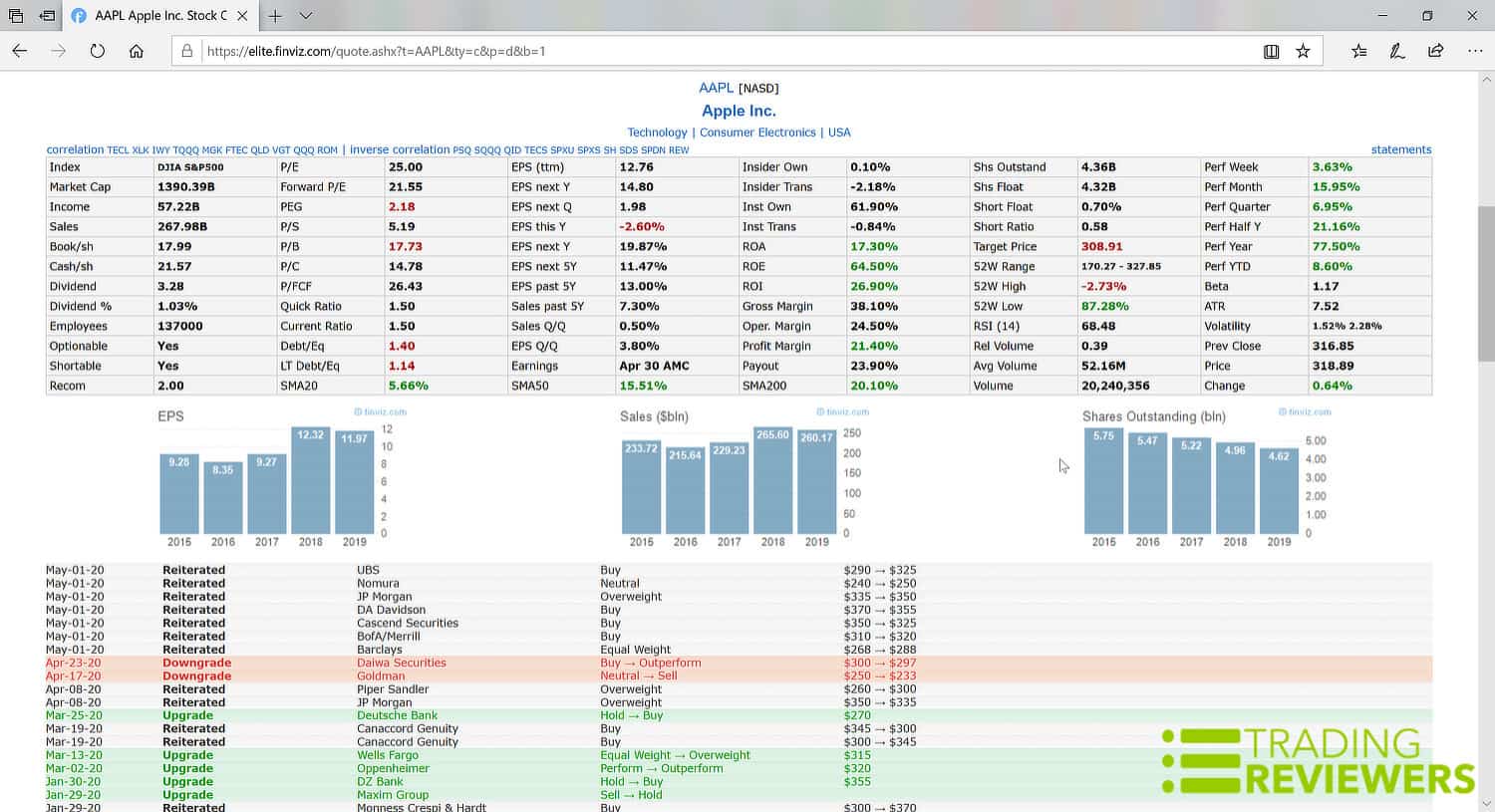

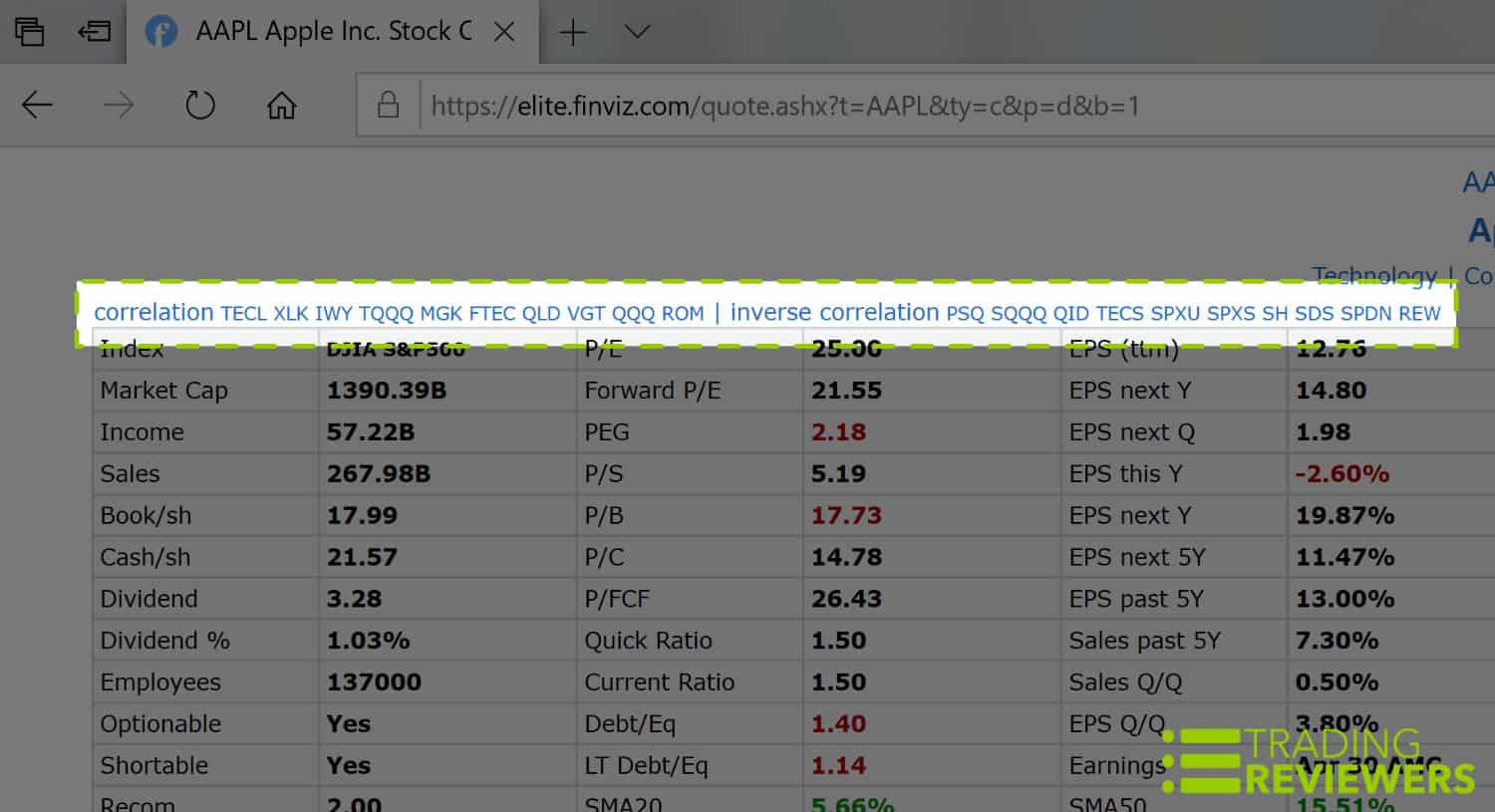

Stock Fundamentals

At first glance, FINVIZ Elite’s fundamentals section appears to be the same as the free stock screeners’. The customizable filters and data tables are identical. However, FINVIZ Elite offers one major perk in this category — diversity. If you want to use fundamentals to load your portfolio with correlating or inversely correlating stocks, FINVIZ Elite’s correlation screener can help. This is how it works:

Under the Fundamentals tab, set your filters to the desired fundamental metric levels for each field. For example, you could pick a P/E ratio under 15, gross margin under 40%, etc.

Click on one of the stock tickers from your scan result

In the upper left-hand corner of the metric table, you’ll find the list of correlating and inversely correlating stocks for that particular equity (later in this review, we’ll cover the benefits of correlation.)

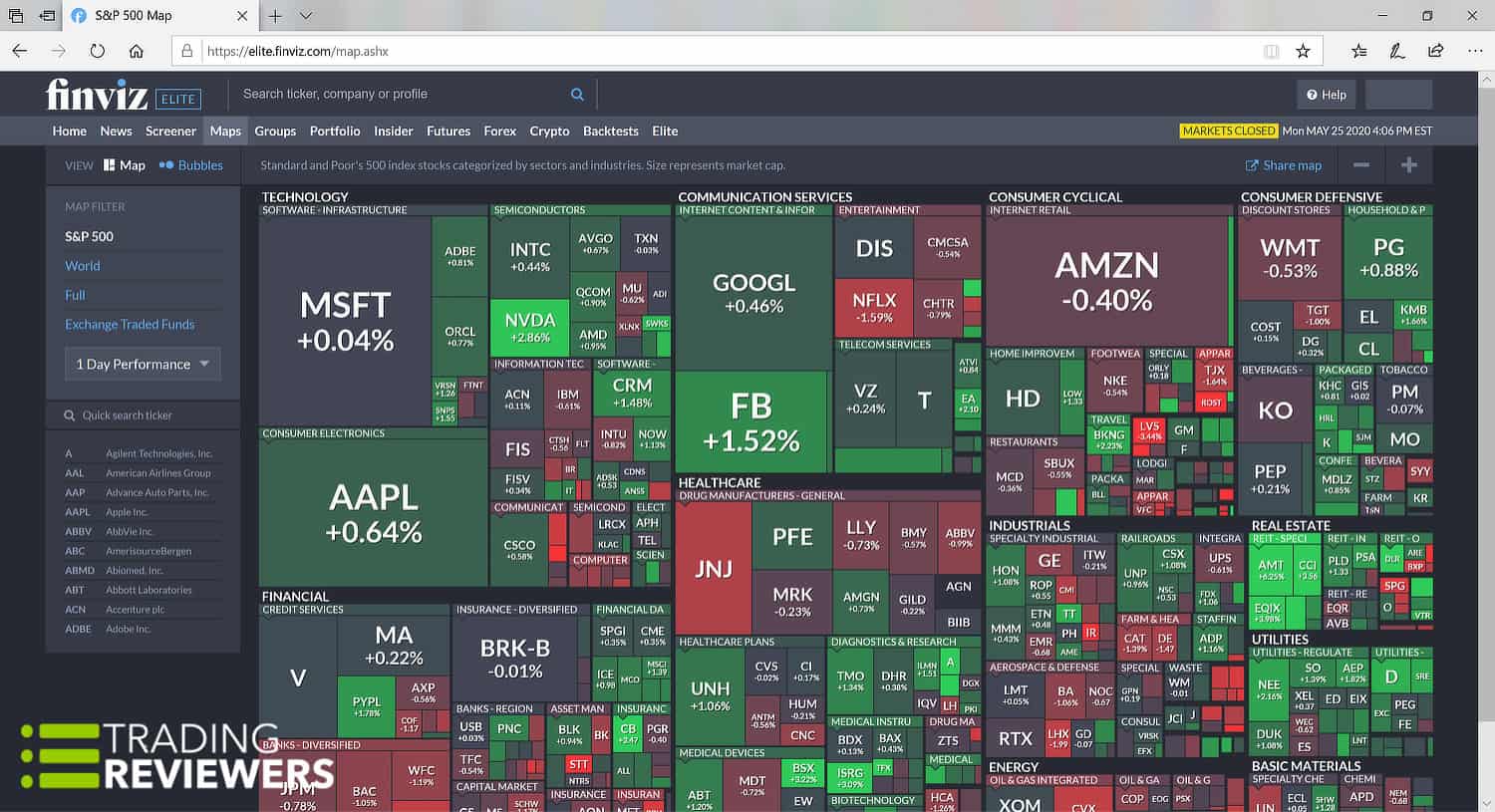

Maps (Heat Maps and Bubbles)

Another thing that we love about FINVIZ is the Maps feature. This page provides a handy visualization tool that allows you to check sector performance at a glance, using the FINVIZ Heat Map and Bubbles. Just choose your preferred map type and FINVIZ instantly provides you with a convenient performance snapshot of what’s moving the markets. There are visualizations for the S&P 500, world markets, all listed U.S. stocks (NYSE, Nasdaq, and Amex), and ETFs.

The following are some of the filter presets that are available from the dropdown menu:

- Performance (1 week to 1 year and YTD)

- Relative volume

- P/E

- PEG

- P/S

- P/B

- Dividend yield

- EPS growth past 5 years

- Float short

- Analyst recommendations

- Earnings day performance

- Earnings date

- …and more.

Analyst Ratings

When it comes to analyst ratings filters, customization can save you a great deal of time as it allows you to get the desired results in a single scan instead of several. FINVIZ Free and Registered users get nine options, and Elite users can choose any combination of the nine options. For example, for stocks with an analyst rating of hold or higher, you can choose:

- Hold or Better

- Buy

- Buy or Better

- Strong Buy

In this case, FINVIZ Elite’s customizing feature saves you from having to perform three additional searches.

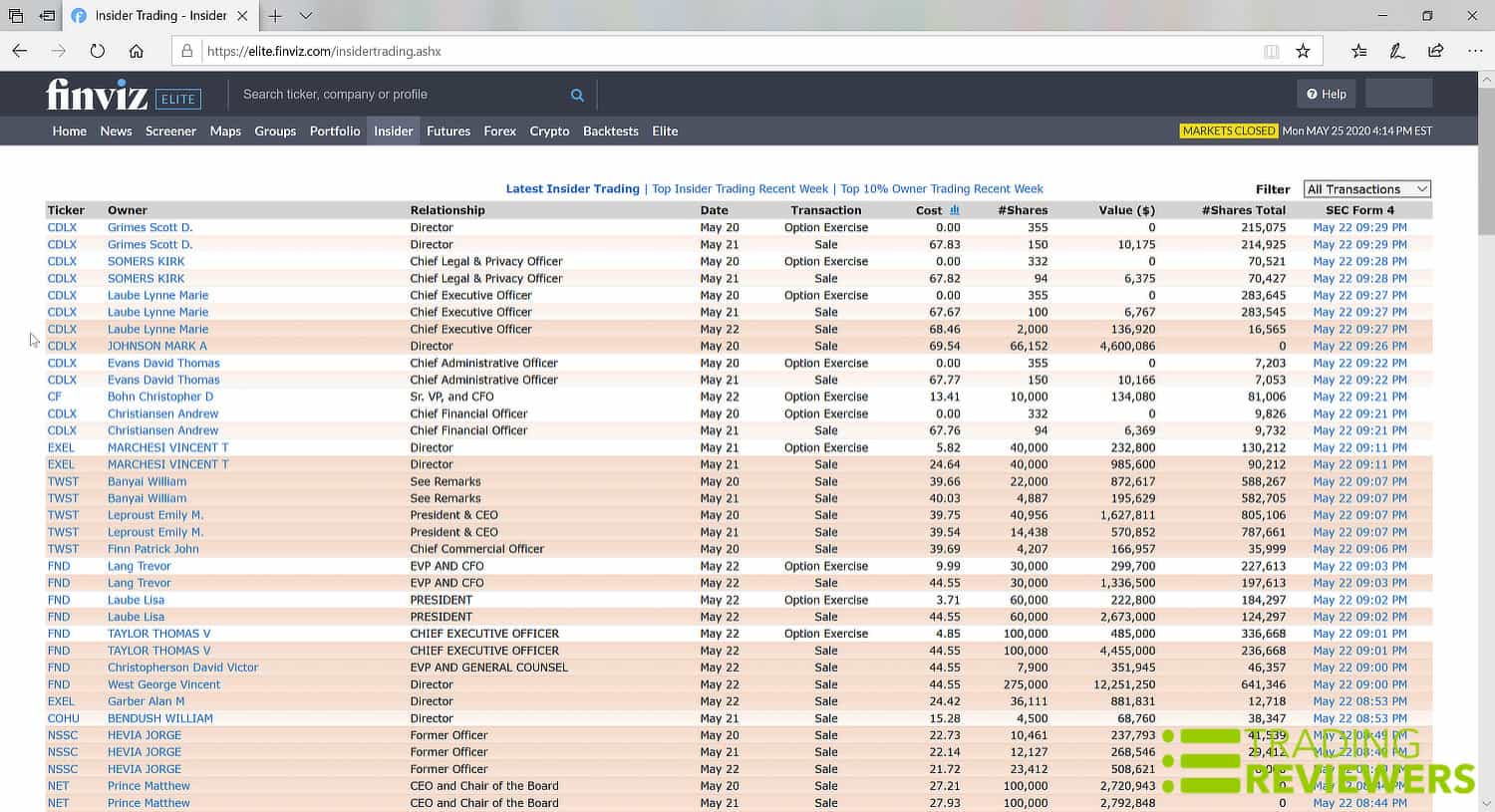

Insider Trading

FINVIZ’s Insiders tab makes it super easy for traders to stay updated on the latest insider filings. The insider trading feeds include the latest insider trading activity, top activity for the most recent week, and the top 10% owner insider trading for the most recent week. Listed for each transaction is the following info:

- Ticker symbols

- Owner

- Relationship

- Date

- Transaction

- Cost

- Number of shares

- Value

- Total number of shares held

- Link to the SEC Form

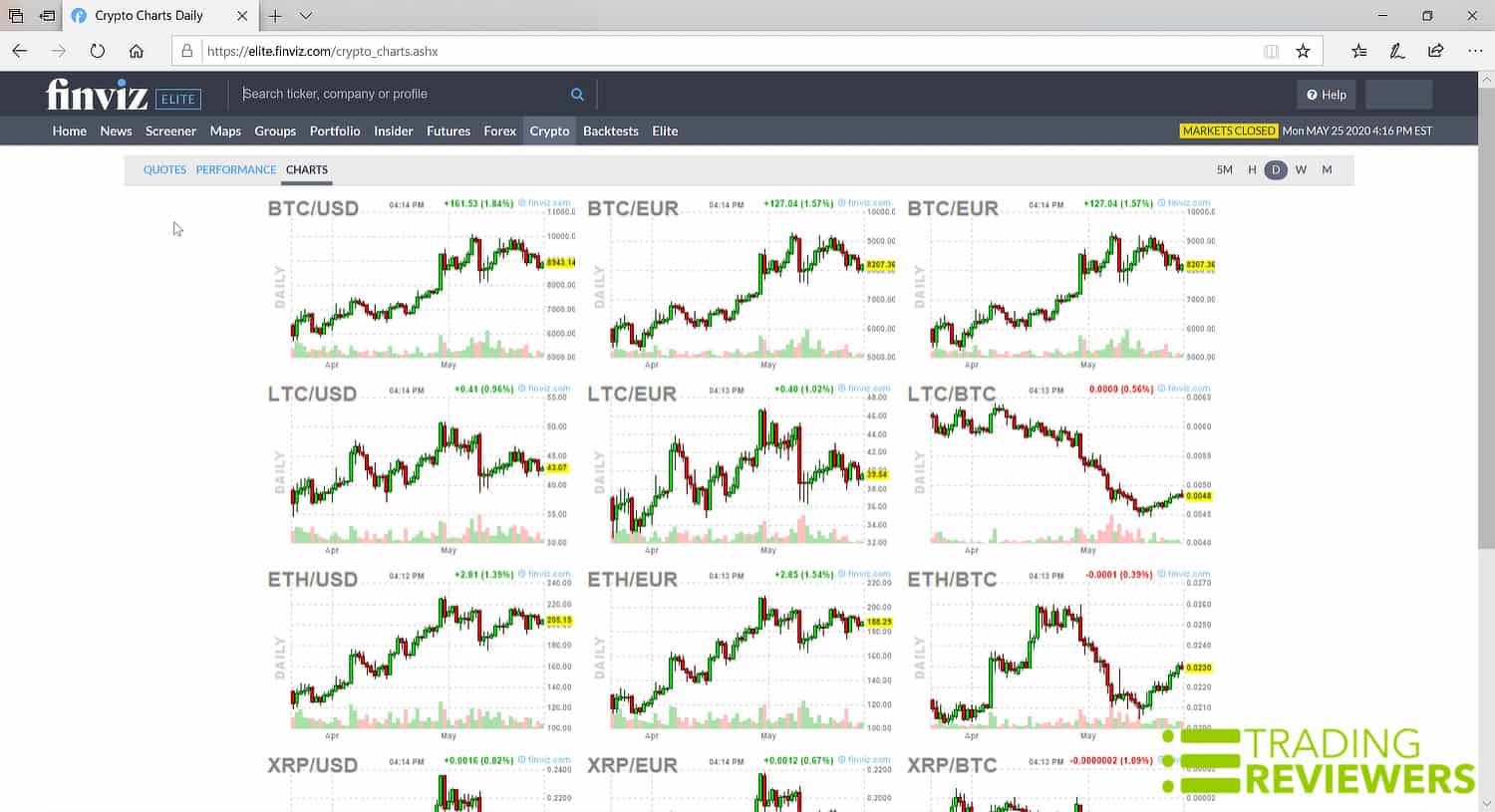

Futures, Forex, and Crypto

FINVIZ Elite also allows you to track futures, Forex, and cryptocurrencies. To access each area on FINVIZ, just click the tab in the top navigation bar and you’ll see a visualized overview for commodities, major currency pairs, live crypto quotes, WTI crude oil, and more.

FINVIZ also allows you to change views. The options include quotes, performance graphs, and charts (daily charts are shown by default, but you can click on each chart and load intraday charts as well as weekly and monthly).

Correlations

Finding stocks with correlating or inversely correlating relationships can be a time consuming and tedious job. Whether you use descriptive, fundamental or technical analysis, FINVIZ Elite’s correlation feature can produce stocks with your desired correlation within seconds. For example, under the Descriptive tab, choose a Market Cap variable and select any stock. You’ll instantly be able to view stocks that share a correlating or inversely correlating relationship with your stock.

Stocks with inverse correlations add diversity to your portfolio. Diversity helps guard against lopsided equity losses. Also, you may choose to reduce volatility in your portfolio by buying stocks with low correlation. Either way, this advanced correlation feature will get the job done.

Customization Options

By adding time-saving versatility and flexibility, the customization feature helps distinguish the premium FINVIZ stock screener from the free versions. Being able to customize almost any filter can be a game changer when it comes to fast, precise stock scans. Also, you can adjust the time frame on the hover charts and change the number of screener rows.

Email Alerts and Notifications

With FINVIZ Elite email alerts and notifications, you’re always on top of things, even when you’re away from your trading desk. This feature allows you to set alerts up for portfolio changes, insider transactions, stock price changes, news, or other variables. More importantly, these features give you flexibility in your trade times. You can put your screened stocks aside until your alerts signal you that the time is right to trade.

While email alerts are nice to have, we still prefer TrendSpider’s notification system. In addition to email alerts, TrendSpider also provides you with SMS text alerts which make a big difference when it comes to speed. Be sure to check out our in-depth TrendSpider review if you’re interested in learning more about our go-to software for stock setup alerts.

Reader Reviews

There are no reviews yet. Be the first one to write one.

Submit a Review

Have you used FINVIZ Elite before? If so, please let other traders know what you think about it.

How to Use FINVIZ Elite [VIDEO]

Pricing: How Much is FINVIZ Elite?

FINVIZ Elite vs. Trade Ideas vs. TradingView: Comparison Table

| SERVICE | FINVIZ Elite | Trade Ideas | TradingView |

| PRICE | $299.50 annually or $39.50 monthly | $2,268 a year or $228 per month | $719.40 annually or $59.95 monthly |

| FEATURES | Real-time and pre-market data, upgraded charts, customization, correlation, alerts, notifications, backtesting, 16 years of historical data, 100 tech indicators, and portfolio | Real-time and pre-market data, 20 simultaneous charts, AI (artificial intelligence) technology, streaming trade ideas, simulated trading, historical data, tech indicators, 500 price alerts, backtesting, portfolio, and advanced charting | Extended trade hours, customizable charts, alerts, backtesting, historical data, 100 tech indicators, enhanced watchlist, earnings calendars, brokerage integration, and webhook notifications |

FINVIZ FAQs

Great question. For traders who are serious about increasing their trading capabilities with FINVIZ's top-of-the-line scanning functionality and other market research tools, we feel that the FINVIZ Elite plan is easily worth the reasonable $24.95/month price. Also, if for some reason you don't like the platform, you can get a full refund.

FINVIZ Elite fuels its features and tools with real-time data. This includes heat maps, charts, top insider trading, price action, and news feeds.

Yes. Starting at 9:00 am, FINVIZ Elite performs pre-market scans.

The FINVIZ Elite software comes pre-loaded with an array of leading indicators such as the Relative Strength Index (RSI), moving averages, Triangular Moving Index with Time Exit, Money Flow Index, Williams %R, and Aaron Oscillator with Time exit.

The Elite screener's backtesting functionality utilizes 16 years of historical data, allowing you to generate reliable backtests that span a large number of years and market environments.

Unlike many of its competitors, FINVIZ Elite doesn't have a free trial option. However, you can find some good video tours of the premium screener FINVIZ offers on YouTube.

Yes, FINVIZ makes it easy to get a refund if you're unsatisfied with your membership. You simply need to cancel your subscription during the monthly period and then contact customer service, providing them with the Paypal transaction ID.

Pros and Cons

Pros

Cons

- The filters save hours of work and help you build better watch lists

- Very easy to use

- Browser-based software provides cross-platform compatibility

- Data feed with breaking news from today's top news providers

- Terrific maps and interactive charts help you visualize market dynamics

- Real-time market data

- Makes it easy for traders to spot insider buying and insider sales

- Powerful screener platform is useful for beginners, intermediate, and pros

- Useful for day traders, swing trading, and long-term investing alike

- Screens perform fundamental and technical analysis to find the best stocks

- Affordably priced

- 30-day money-back guarantee is great for added peace of mind

- Responsive customer support

- Does not support SMS alerts

- No mobile app

- No free trial

Best for?

FINVIZ Elite is best for investors and traders who have a desire to make more timely and well-informed trades. At such a reasonable price, anyone can have access to professional level stock research tools and this easy-to-use platform gives you the ability to gauge the pulse of the entire stock market. We also love how easy it is to review the performance of entire sectors, industries, money exchanges, countries, and individual companies. Lastly, with the company’s 100% money-back guarantee, there’s zero risk if you decide to upgrade your subscription from FINVIZ’s free accounts to Elite.